Optional Reserve Calculation Section 8. Dale Marshall A statutory reserve may be kept on deposit with the Federal Reserve Bank.

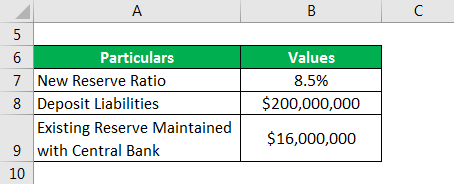

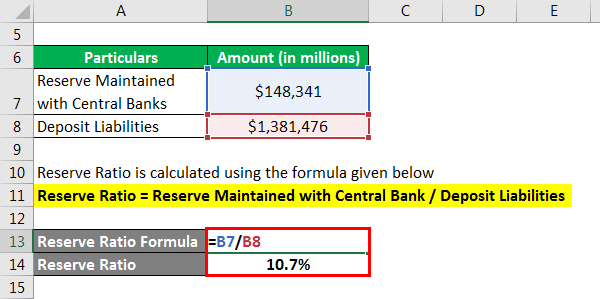

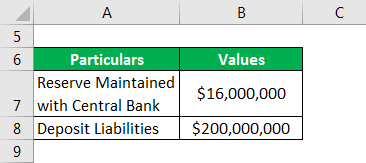

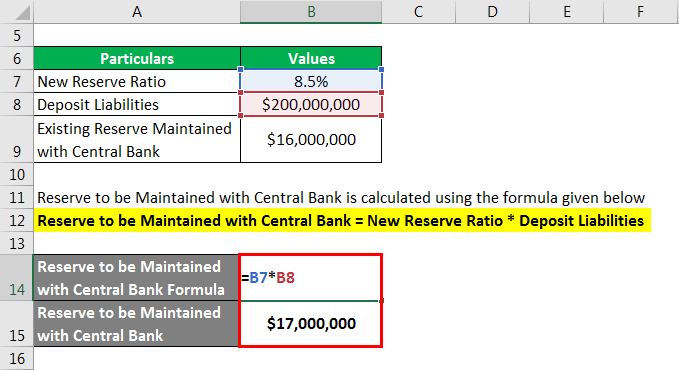

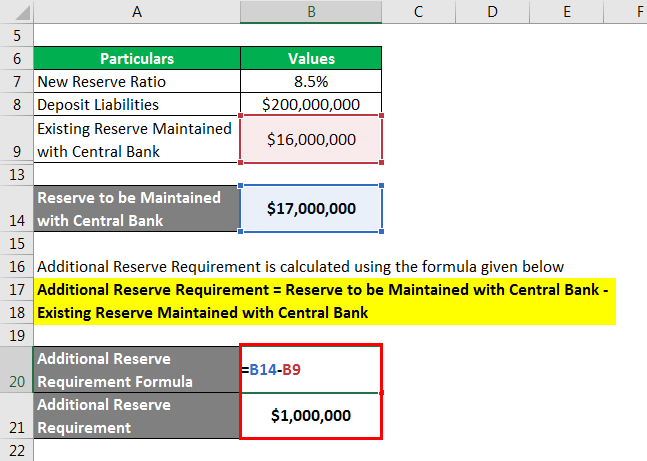

Reserve Ratio Formula Calculator Example With Excel Template

10510 10511 -.

/dotdash_final_Cash_Reserves_Dec_2020-01-be14cdc169de4288af1aa6ea495ec0ef.jpg)

What is statutory minimum reserve. According to Regulation XXX the minimum reserves during the secondary guarantee period are the greater of the basic reserves for the secondary guarantee plus the deficiency reserve if any for the secondary guarantees and the minimum reserves required by other rules or regulations governing universal life plans. These are called minimum reserves. The following content explains the Boards authority to impose reserve requirements and how reserve requirements were administered prior to the change in reserve.

They are mandated under. Euro area banks are required to hold a certain amount of funds as reserves in their current accounts at their national central bank. Section II summarizes the minimum reserve requirements that apply to a product or type of product including which products or categories of products are subject to principle-based valuation requirements and documentation.

This action eliminated reserve requirements for all depository institutions. The nations central bank sets the percentage rate. Minimum contributions to reserves vary based on the Reserve Study or a statutory formula based on number of common area components.

A banks minimum reserve requirement is set for six-week periods called maintenance periods. A statutory reserve is an amount of cash a financial institution such as a bank credit union or insurance company must keep on hand to meet the obligations incurred by virtue of accepting deposits and premium paymentsThe statutory reserves required of banks and credit unions are generally set by the. The minimum reserve is generally determined by the central bank to be no less than a specified percentage of the amount of deposit liabilities the commercial bank owes to its customers.

City banks are usually required to maintain higher account balance. Condominium disclosure statement must include the current balance in reserves and the most recent reserve study. As announced on March 15 2020 the Board reduced reserve requirement ratios to zero percent effective March 26 2020.

1 It is a percentage of the banks deposits. A statutory reserve is an amount of money set aside by a financial institution such as a bank or insurance firm in order to meet unmatured obligations. Reserve requirements in the Valuation Manual.

A statutory reserve is an amount of money set aside by a financial institution such as a bank or insurance firm in order to meet unmatured obligations. It is a component of the balance sheet for an insurance firm and can be in the form of anything easily convertible to cash such as marketable securities. It is a component of the balance sheet for an insurance firm and can be in the form of anything easily convertible to cash such as marketable securities.

Statutory Financial Statements Audited Form 1A4 Statutory Balance Sheet Form 2A5 - Statutory Income Statement Form 8 Statutory Statements of Capital Surplus Notes to the Statutory Financial Statements Auditors Report Loss Reserve Certificate Actuarial Certificate if. Minimum Reserve System refers to. Reserve CalculationValuation Net Premium Exceeding the Gross Premium Charged Section 9.

Statutory minimum paid-in capital is between 1 to 26 million and minimum surplus is between 1 to 28 million. Minimum Reserve Max Net Premium Reserve Deterministic Reserve Stochastic Reserve Principle-based reserves reflect company-specific products and experience under a wide range of future economic conditions with a minimum regulatory floor. A bank that is found in any city that also has a Federal Reserve bank or Federal Reserve branch office.

Minimum Reserve NPR Max0 MaxDR SR-NPR-DDPA. As minimum reserve requirements are. Reserve CalculationIndeterminate Premium Plans Section 10.

Minimum Standard for Accident and Health Insurance Contracts Section 11. Minimum Reserves Section 7. 1 Refer to Valuation Manual for further details.

To the extent that the laws of a particular state differ from the NAIC model practices described in this practice note may not be appropriate for actuarial practice in that state. The reserve requirement is the total amount of funds a bank must have on hand each night. In the United States the Federal Reserve Board of Governors controls the reserve requirement for.

Both statutory minimum paidin capital statutory minimum surplus are 25 million. Also is General reserve a statutory. Statutory reserves are the minimum amounts of cash and readily marketable securities that insurance companies must hold.

Minimum Reserve Standards for Individual and Group Health Insurance Contracts and by reference the NAIC Health Reserve Guidance Manual. 70001-70005 Life disability.

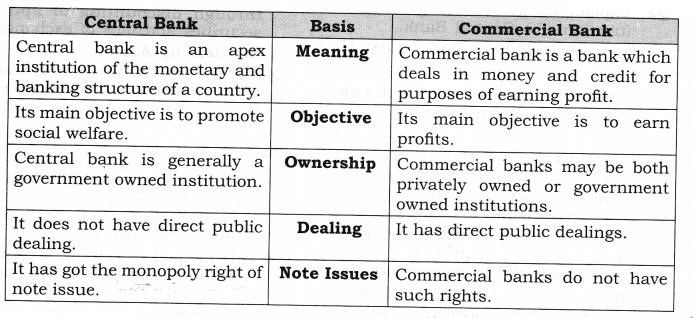

What Is Statutory Liquidity Ratio Slr

Ncert Solutions For Class 12 Macro Economics Banking Learn Cbse

Reserve Ratio Formula Calculator Example With Excel Template

Ncert Solutions For Class 12 Macro Economics Banking Learn Cbse

/dotdash_Final_Tier_1_Leverage_Ratio_Definition_Nov_2020-01-4741405e9a8f49b79939f1a51fc3de54.jpg)

Tier 1 Leverage Ratio Definition

Reserve Ratio Formula Calculator Example With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Tier_1_Leverage_Ratio_Definition_Nov_2020-01-4741405e9a8f49b79939f1a51fc3de54.jpg)

Tier 1 Leverage Ratio Definition

Reserve Ratio Formula Calculator Example With Excel Template

Https Www Nvb Nl Media 2923 Aml Ctf Sanctions Guidance Pdf

Reserve Ratio Formula Calculator Example With Excel Template

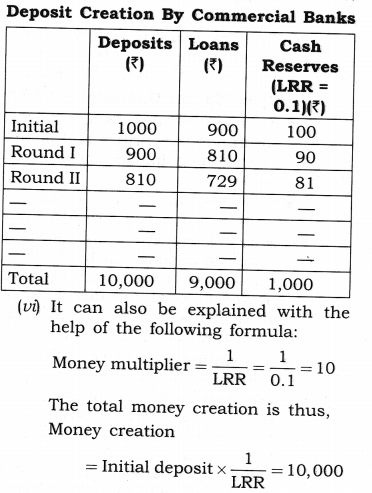

Creating Money Boundless Economics

Reserve Ratio Formula Calculator Example With Excel Template

/dotdash_final_Cash_Reserves_Dec_2020-01-be14cdc169de4288af1aa6ea495ec0ef.jpg)

/dotdash_final_Cash_Reserves_Dec_2020-01-be14cdc169de4288af1aa6ea495ec0ef.jpg)

/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)

/dotdash_final_Deposit_Multiplier_Dec_2020-01-12355ee057a74ef1887bb1066444b606.jpg)

:max_bytes(150000):strip_icc()/dotdash_final_Cash_Reserves_Dec_2020-01-be14cdc169de4288af1aa6ea495ec0ef.jpg)