Refinancing your student loans from variable rate debt to fixed rate. Variable Rate Home Loans.

Common Costs To Consider When Repricing Or Refinancing A Home Loan Home Loans Loan The Borrowers

We are deliberately incentivising customers to.

Is it viable to opt for fixed rate loan. One of the main advantages of this is cash-flow certainty. Richie Boucher was making a big push at the time to get people to opt for one of the banks fixed rate products. In some instances such rates are not subject to adjustments for a few months or even years.

The starting interest rates of variable-rate loans are likely to be lower than the fixed-rate ones. When a loan is fixed for its entire term it. All kinds of charges beyond your control will increase the amount every month.

People with fixed budgets can get a clear idea of their EMI obligations if they opt for a fixed-interest-rate loan. Both fixed-rate and variable-rate loans come with their own merits and demerits depending on the interest rate environment. In case you decide to alter or pay off your fixed home loan you will be required to pay for additional break fees and penalties.

Federal loans always have fixed interest rates while private student loans often give you a choice between a fixed rate and a variable rate. A variable rate as its name already indicates is the rate that may either rise or drop during the period of the. A fixed interest rate home loan is a home loan with the option to lock in or fix your interest rate for a set period of time usually between one and five years.

In the current market where you have to be careful of your cash flow it is advisable to opt for a fixed rate for three to five years since you can be certain of your monthly mortgage instalments. Depending on the loan term and expected interest environment borrowers can opt to take either a fixed-rate or variable-rate loan. The biggest disadvantage of such a setting is that the fixed-interest-rate loans are anywhere between 1 to 25 higher than floating-interest-rate loans.

Benefits of variable rate loans. You can enjoy a low rate and may never have to face an increase. A customer who is totally risk averse can opt for a fixed rate loan as the rate of interest here is not subject to any change at all and remains fixed throughout the tenure of the loan irrespective of any fluctuations in the interest rates in the economy or the institutions internal policies.

A fixed-rate mortgage means that the payments are unchanging. While its used as a loan purchase tool its also a viable refinancing option that shortens your term and helps save interest costs. A fixed-rate loan has an interest rate that doesnt change throughout the life of the loan.

Currently all federal loans are based on fixed rate interest but private lenders allow you to choose between the twoThis is owing to the change inJuly 2006 whenfederal student loans moved away from variable rates and opted for only fixed interest rate loans. Fixed Interest Rate A fixed interest rate is the most straightforward. It can change every year or even within a few months.

Whether a fixed-rate loan is better for you will depend on the interest rate environment when the loan is taken out and on the duration of the loan. Fixed Rate Home Loan HDFC provides home loans for the construction purchase of homes Fresh Resale. You may be able to get approval for a larger loan if you opt for an ARM over a fixed rate mortgage.

Still this might be a viable option if you choose to pay an additional fee. As you compare loan options note whether or not loans feature fixed rates. Some people view this as a positive since a better economy usually means a lower interest rate for them.

Home loans provide borrowers with several interest rate options. Lower Starting Interest Rate. That said there are options available to OPT international students.

Fixed rates provide the least amount of risk but may be higher than the other interest rate options. For longer-term loans a disadvantage is that the borrower might be making payments on a fixed-interest loan at a higher interest rate than the prevailing market rate. Because the rate remains the same for the entire term the monthly loan payment shouldnt change resulting in a relatively low-risk loan.

Opt for that always rather than the variable-rate mortgage. Both FHA loans and mortgages from big banks are viable options for people on OPT who need a home loan but these options are not without their difficulties for visa holders. 20-year fixed mortgages have more affordable monthly payments than 15-year and 10-year fixed-rate loans.

We live our lives surrounded by ample low-rate finance schemes amidst numerous loan. By knowing exactly what your repayments will be youll be able to plan ahead and budget for the future. An ARM is also a viable option if you want to go big when you are buying your home.

If you have a 20-year real estate loan with a fixed rate you will pay that interest rate and payment for the life of the loan. Youll be required to have a social security number which not all immigrants have. A variable rate loan can be an excellent choice because of the following advantages.

The 20-year fixed rate mortgage is a viable option for homebuyers who cannot afford a 15-year fixed term. You can refinance federal student loans variable rate student loans or both.

The State Bank Of India Can Offer Various Types Of Housing Loan You Should Check Your Requirement According To That Select One A Home Loans Types Of Loans Loan

Common Costs To Consider When Repricing Or Refinancing A Home Loan Home Loans Loan The Borrowers

What Are The Penalties For Breaking My Mortgage Early

What Is A Hecm Loan See If You Qualify For A Hecm Loan Inside

Borrowing Money To Invest Objective Financial Partners

Variable Vs Fixed Mortgage The Ultimate Guide For 2021

What Is A Va Loan Forbes Advisor

How Do Home Improvement Loans Work Build Cautiously Loanry

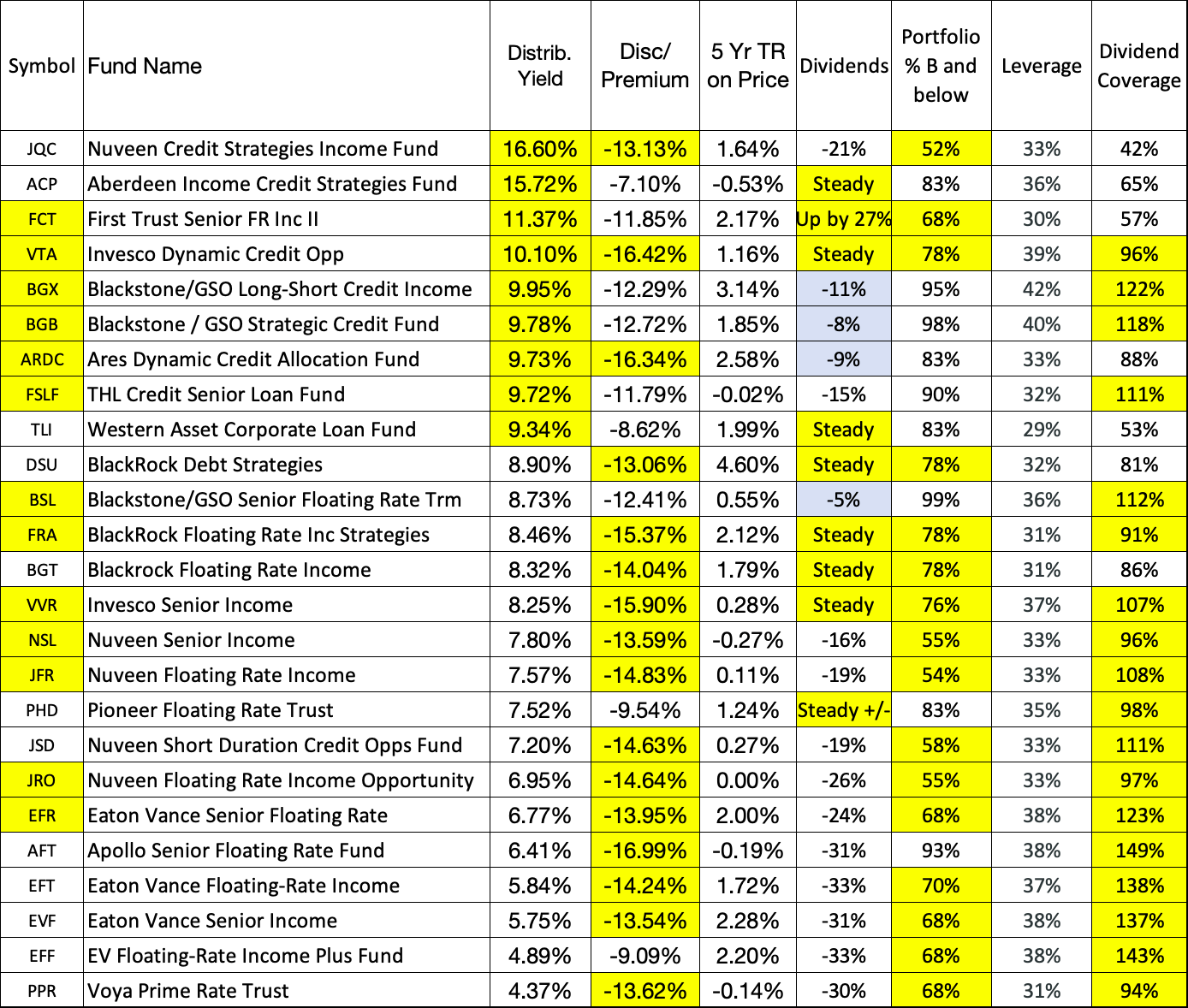

Senior Loans Hunkering Down At The Top Of The Capital Structure Seeking Alpha

10 Ways To Pay Off Your Mortgage Early Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

How Much Will It Cost To Break My Mortgage With Rbc Ratehub Ca

Fha Mortgage Rates Best Fha Home Loan Rates Programs

Variable Vs Fixed Mortgage The Ultimate Guide For 2021

The 30 Year Fix Pt 1 The Curious Case Of The 30 Year Fixed Rate Mortgage In America

10 Things The Bank Will Ask When You Need A Business Loan

How Much Will It Cost To Break My Mortgage With Rbc Ratehub Ca

Are Variable Rate Loans The Right Option For Your Business

/GettyImages-1163111044_20002-acdec818c4214a7c91871836f9be0032.png)

When Are Personal Loans A Good Idea

6 Reasons Real Estate Investors Get Rejected For A Mortgage One American Mortgage