Ministry of MSME MoMSME has decided that a new scheme viz. A copy of the salient features and operational guidelines for implementation of the Scheme released by the Ministry of MSMEs is enclosed.

Union Bank Of India Sanctions 14000 Accounts Under Eclgs Scheme Aims To Solve Liquidity Problems Union Bank Bank Of India Solving

Purpose of the Interest Subvention Scheme for MSME.

Interest subvention scheme for msme 2018. Government of India Ministry of Micro Small and Medium Enterprises MSMEs had announced the Interest Subvention Scheme for MSMEs 2018 on November 2 2018 for Scheduled Commercial Banks. We have decided to extend the interest subvention scheme for MSMEs Gadkari said in response to a question without divulging further. Ministry of MSME MoMSME has decided that a new scheme viz.

Salient Features of the Scheme. Scope purpose and eligibility to avail benifit under interest subvention scheme 2018 for MSME. Salient Features of the Scheme 21 Purpose Scope and Duration.

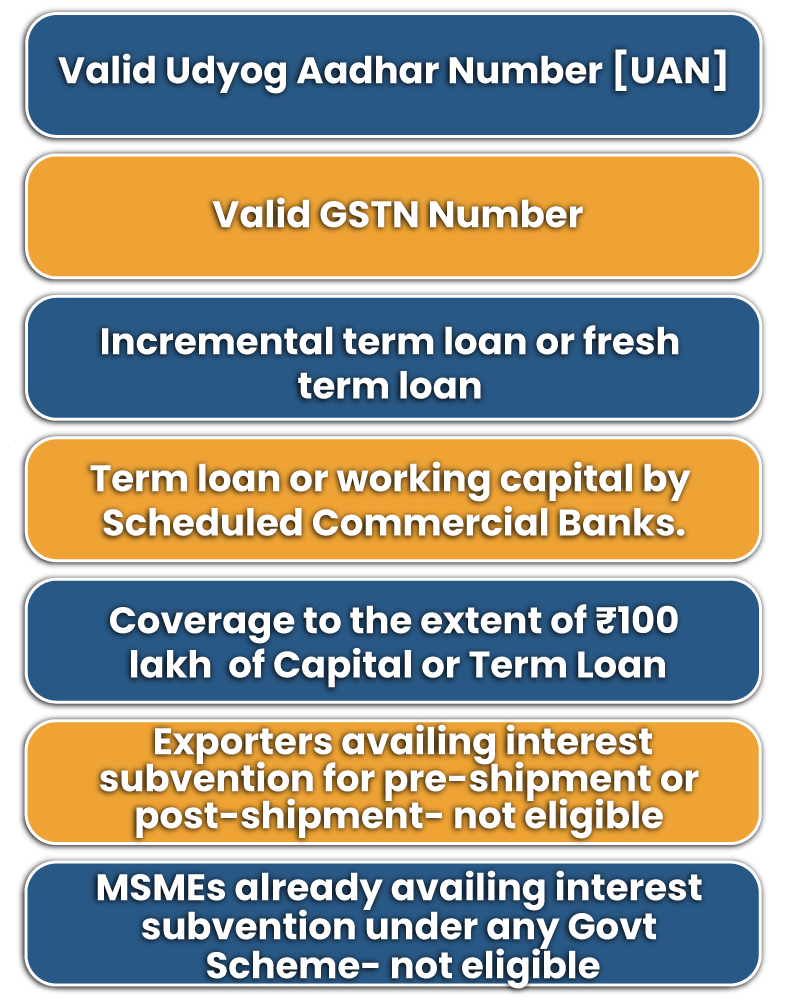

The Interest Subvention Scheme for Incremental credit to MSMEs 2018 which offers 2 per cent interest subvention for all GST registered MSMEs on. Interest Subvention Scheme for Incremental credit to MSMEs 2018 will be implemented over 2018-19 and 2019-20. Interest Subvention Scheme for Incremental credit to MSMEs 2018 will be implemented over 2018-19 and 2019-20.

Interest subvention for allGSTregistered MSMEson freshor incremental loans. The purpose of introducing this Scheme for MSME is to encourage for increasing productivity for manufacturing and service enterprises and availing of incentives to MSMEs. Interest Subvention Scheme for Incremental credit to MSMEs 2018 will be implemented over 2018-19 and 2019-20.

Government of India Ministry of Micro Small and Medium Enterprises MSMEs had announced the Interest Subvention Scheme for MSMEs 2018 on November 2 2018 for Scheduled Commercial Banks. As part of access to credit Prime Minister announced 2 interest subvention for all GST registered MSMEs on fresh or incremental loans. Under this scheme GST registered MSMEs can avail a 2 subvention on the interest rate of a.

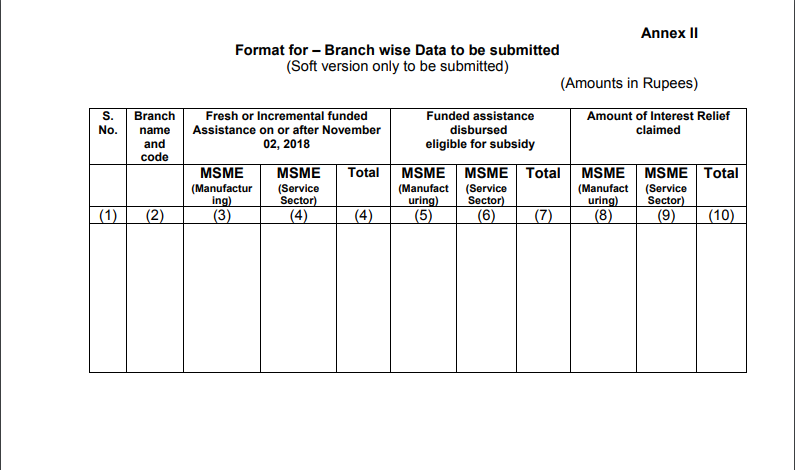

Operational guidelines for eligible institutions for smooth implementation of Interest Subvention Scheme for MSME 2018 along with FAQs. The Interest Subvention Scheme for Incremental credit to MSMEs 2018 which offers 2 per cent interest subvention for all GST registered MSMEs on fresh or incremental loans was in effect till March 31 2020. The Ministry of Micro Small and Medium Enterprises MSME Government of India on November 2 2018 has announced Interest Subvention Scheme for MSMEs.

Ministry of MSME hasdecided that a new scheme viz. As part of access to credit Prime Minister announced 2 interest subvention for all GST registered MSMEs on fresh or incremental loans. The scheme for MSME Interest Subvention Scheme for Incremental credit to MSMEs 2018 has to be implemented from 2018-19 and 2019-20 as has been decided by The Ministry of MSME.

2 interest subvention for all GST registered MSMEs on fresh or incremental loans. Government of India has since decided to. Interest Subvention Schemefor Incremental credit to MSMEs2018 will be implemented over 2018-19 and 2019-20 with an allocation of Rs975crare.

The scheme earlier called Interest Subvention Scheme was announced by the government in November 2018 for all exports of MSME and 416 tariff lines. A copy of the salient features and operational guidelines for implementation of the Scheme released by the Ministry of MSMEs is enclosed. Revision in Interest Rates under Fixed Deposit SchemeFDS.

Government of India has since decided to include Co-operative Banks also as Eligible Lending Institutions effective from March 3 2020. On 2nd November 2018 the Ministry of Micro Small and Medium Enterprises MSMEs that falls under the Government of India announced the Interest Subvention Scheme for MSMEs. 13 Zeilen Interest Subvention Scheme for Incremental Credit to Micro Small and Medium EnterprisesMSMEs 2018.

Salient Features of the Scheme. Government of India Ministry of Micro Small and Medium Enterprises MSMEs had announced the Interest Subvention Scheme for MSMEs 2018 on November 2 2018 for Scheduled Commercial Banks. Interest Subvention Scheme for MSMEs.

Small Industries Development Bank of India SIDBI is the single national level nodal implementation agency for the scheme. Salient Features of the Scheme. Interest Subvention Scheme for Incremental credit to MSMEs 2018 will be implemented over 2018-19 and 2019-20.

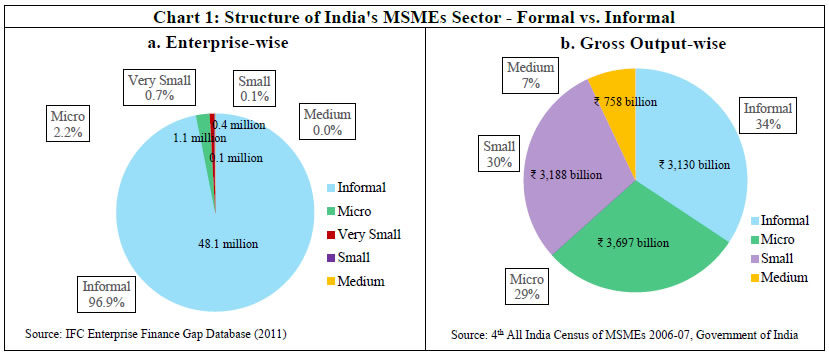

Ministry of MSME MoMSME has decided that a new scheme viz. 2 Interest Subvention Scheme for MSMEs 2018 Objectives Encouraging both manufacturing and service enterprises to increase productivity and provide incentives to MSMEs for on-boarding on GST platform which helps in formalization of economy while reducing the cost of credit. The scheme covers mostly labour intensive and employment generating sectors like processed agriculturefood items handicrafts readymade garments glass and glassware medical and scientific instruments and auto.

Reserve Bank Of India Mint Street Memos

Interest Subvention Scheme For Msme Co Operative Banks Enterslice

Msme Dept Launches Champion State Control Room To Assist Msmes Small And Medium Enterprises Product Launch Champion

Interest Subvention Scheme For Msme Corpbiz Advisors

India S Statistical Office Released New Data Eepc India

Fssai Registration Food License Indiafilings Com Food License Food Filing Taxes

Banks Asked To Provide Bill Discounting Facility To Msmes Against Payments Due From Large Corporates Facility Bills Large

Private Limited Company Indiafilings Com Private Limited Company Limited Company Company

Interest Subsidy For Msme Sector Incentive Pre And Post Encouragement

Interest Subvention Scheme For Msmes 2019 Indiafilings

Dc Msme To Engage Cpses For Establishing 20 Technology Centres Across India Small And Medium Enterprises Technology India

Interest Subvention Scheme For Msme Corpbiz Advisors

Msme Benefits And Aatmanirbhar Bharat

Interest Subvention Scheme For Msmes 2019 Indiafilings

Rbi Included Cooperative Banks In Interest Subvention Scheme For Msme