After-hours stock trading as the name suggests starts after the stock markets have. After hours trading used to be the sole province of big investors with lots of expertise andlots of money and composed of traders with lots of experience.

Thanks Wallstcheatsheet Com Well Explained Cryptotrading Cryptocurrency Cryptocurrencies Crypto Bitcoin Crypto Trading Cryptocurrency Crypto Currencies

While the availability of after-hours trading offers retail investors the opportunity to benefit from the market there are risks associated with it and here are some of them.

Can retail investors trade after hours. After that year it became a widely used tool among retail investors. Those trading stocks after hours typically do so between 4. Some firms only allow investors to view quotes from the one trading system the firm uses for after-hours trading.

Just because the average investor has come on board doesnt mean that these folks have gone away. Here is where having and studiously executing an opportunistic trading plan keeps you out of trouble and makes you money. After hours and premarket trading takes place only through ECNs.

In the US the regular stock market hours are between 930 am. As a result of this reduced trading. Angel said those small trades are probably retail investors.

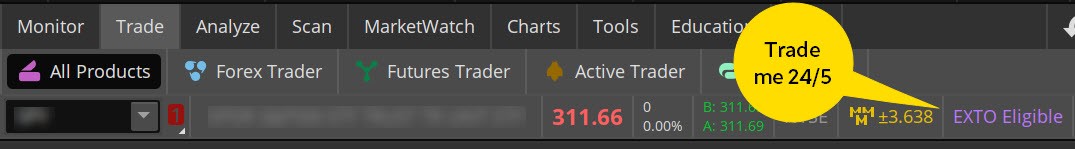

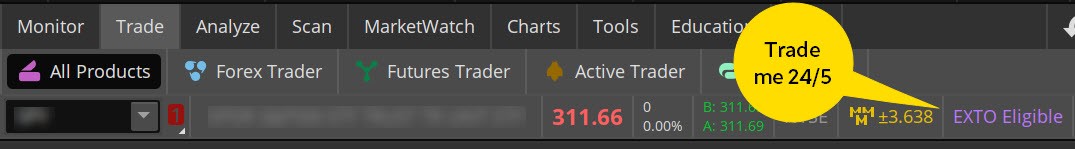

Well even admit that theres an added advantage to placing trades. After an amendment to the SECs Exchange Act Rule 15c2-11 in September companies that trade on the OTC Market will be held to stricter disclosure standards that. Now many brokers such as Fidelity Charles Schwab and TD Ameritrade offer after-hours trading.

But remember that just because you can. Pre-market trading in stocks occurs from 4 am. While after-hours trading presents investing opportunities there are also the following risks for those who want to participate.

During the regular trading day investors can buy or sell stocks on the New York Stock Exchange and other exchanges. Typically after-hours trading occurs in stocks with major news or. We understand that some investors find after-hours convenient.

The main exchanges in the United States NASDAQ and NYSE hold standard trading sessions that start at 930 am. You can trade in after-hours or extended hours but the markets are less liquid and execution price is riskier because of wide quotes. Can you trade SPY options after.

The stock market opens. The following are situations where retail traders affect market prices. And these days its easy to find an online discount broker that offers after-hours trading.

After hours trading is simply the buying and selling of shares following the close of the regular stock market session. Most of us cant invest full-time. Up until the 1990s the after-hours market was restricted from retail traders.

Because fewer shares are being traded. If we dont work we wont have funds to invest. Check with your broker to see whether your firms system will permit you to access other quotes on other ECNs.

In fact some stocks dont trade at all in the after-hours market. We cant tell who made those trades. Furthermore when theres an overwhelming sentiment in the market the aggregated retail orders may be large enough to move the market.

To 8 pm3 Many retail brokers offer to trade during these sessions but may limit the types of orders that can be used. Given that our strategy revolves around proper asset allocation we dont trade in the after-hours market and we see no reason to start. Retail traders can target small exotic and unregulated markets.

EST and after-hours trading on a day with a normal session takes place from 4 pm. And end at 400 pm. We have no pressure to trade and can wait on the sidelines for good opportunities.

But then two huge trades came in for 300000 Facebook shares a piece. Trading Stocks After Hours. Generally fewer shares are traded during the after-hours session because most traders have closed for the day.

After hours trading refers to the time outside regular trading hours when an investor can buy and sell securities. Inability to See or Act Upon Quotes. Big Price Swings in After Hours Trading.

Who can trade after hours and pre market. They can also trade via digital markets called electronic communication networks or ECNs. Prior to trading with these brokers read any disclosure documents they prepare for you so you understand the risks.

Most of the volume comes from institutional traders rather than retail investors. Today many brokers offer clients.

:max_bytes(150000):strip_icc()/GettyImages-1146062956-e5b54f002b5f4231b1a7225f4a1c452a.jpg)

After Hours Trading Does It Affect Stock Prices

Forex Line Indicator And Trading System 90 Accurate Profitable Strategy Mt4 Forex Indicators Trading Strategy Trading

Fidelity Extended Hours Trading Pre Market After Hours 2021

What Is After Hours Trading And How Can I Start

Forex Trading Sessions And Best Times To Trade Forex Trading Trading Forex

A Major Forex Trading Advantage Is That The Market Is Open 24 Hours A Day 5 Day Forex Forex Trading Forex Training Forex

After Hours Trading Or After Hours Thinking About Tr Ticker Tape

:max_bytes(150000):strip_icc()/professional-profession-chart-font-diagram-multimedia-1163690-pxhere.com1-f4d24f07af8c427699a8c18019ba0012.jpg)

How The Nasdaq Pre Market Works

Pin By Lucas White On Finance Forex Education Online Trading Learn Forex Trading

Anatomy Of The Forex Market Infographic America Anatomy Australia Brazil Canada Denmark For Forex Trading Infographic Marketing Trading Strategies

Fidelity Extended Hours Trading Pre Market After Hours 2021

Longest Pre Market Extended After Hours Trading Brokers 2021

If You Are A Novice This Will Be A Problem For Sure Therefore There Are Many Brokers That Simplify Options Trading F Trend Trading Day Trading Forex Brokers

How To Trade Pre Market Post Market And Out Of Hours Ig Uk

Apple Looks Ready To Turn Bullish Stock Options Trading Stock Analysis Option Trading

:max_bytes(150000):strip_icc()/PIXNIO-278671-4377x32831-1377f20b22674d16882feeff57e23817.jpg)

After Hours Trading Does It Affect Stock Prices

:max_bytes(150000):strip_icc()/GettyImages-1055247044-3e1fc0004e2b4e2bba9d961c3ca6d57d.jpg)

After Hours Trading Does It Affect Stock Prices

Trading Strategies There Are Many Trading Strategies Available Which Can Be Forex Trading Trading Strategies Options Trading Strategies