Singapores three domestic systemically important banks D-SIBs will have to maintain a net stable funding ratio of 100 per cent by Jan 1. The notice also sets out requirements specific to locally-incorporated domestic systemically important banks D-SIBs in Singapore such as a minimum level of credit loss allowances and the setting up of regulatory loss allowance reserves.

Germany In Imf Staff Country Reports Volume 2016 Issue 191 2016

In October 2012 the Basel Committee on Banking Supervision finalised its D-SIB framework which involves a set of.

Domestic systemically important banks (d-sibs) singapore. On 25 June 2014 the Monetary Authority of Singapore the MAS issued a consultation paper proposing a framework to identify domestic systemically important banks D-SIBs in Singapore. A starting point for the development of principles for the assessment of D-SIBs is a requirement that all national authorities should undertake an assessment of the degree to which banks are systemically important in a domestic context. Strengthening Resilience In April 2015 MAS issued a framework for identifying and supervising domestic systemically important banks D-SIBs in Singapore and the inaugural list of D-SIBs.

The framework for identifying and supervising domestic systemically important banks D-SIBs in Singapore covers all licensed banks in Singapore. This consultation paper sets out the proposals for the D-SIB framework including an outline of the methodology to be employed to assess the systemic importance of banks in Singapore and a range of policy. D-SIBs are defined as banks that are assessed to have a significant impact on the stability of the financial system and proper functioning of the broader economy.

Singapore is one of Maybank Groups largest overseas operations. Known as domestic systemically important banks D-Sibs the seven banks that include Citibank Maybank Standard Chartered and HSBC. DBS OCBC Bank United Overseas Bank Citibank Standard Chartered Maybank and HSBC.

I MAS proposes a framework to identify domestic systemically important banks D-SIBs in Singapore and address the risks they pose. It also unveiled its inaugural list of such banks. The Monetary Authority of Singapore the MAS has developed a framework for identifying and supervising domestic systemically important banks D-SIBs.

The Monetary Authority of Singapore MAS issued a consultation paper in June 2014 which sets out proposals for a framework to identify domestic systemically important banks D-SIBs in Singapore. The Australian Prudential Regulation Authority APRA has today released an information paper on its framework for dealing with domestic systemically important banks D-SIBs in Australia. Information on MAS risk-based supervision of financial institutions including how MAS assesses the impact of financial institutions the use of the Comprehensive Risk Assessment Framework and Techniques CRAFT to assess their risks and framework for identifying and supervising domestic systemically important banks D-SIBs in Singapore.

Authority of Singapore MAS has identified seven banks in Singapore as Domestic Systemically Important Banks D-SIBs in 2015 and required the D-SIBs to be compliant with BCBS 239 by 20194. The Monetary Authority of Singapore MAS published its framework for identifying and supervising domestic systemically important banks D-SIBs in the country as well as the inaugural list of D-SIBs. Singapore May 28 2015.

THE Monetary Authority of Singapore MAS on Thursday published its framework for identifying and supervising domestic systemically important banks D-SIBs in Singapore. Since the opening of our first branch at South Bridge Road in 1960 we have established a significant presence in the retail wholesale and global banking markets. Monday 23 December 2013.

Maybank was identified as one of the domestic systemically important banks D-SIBs in 2015. Other D-SIBs in Singapore with headquarters offshore. The other APAC countries do not currently require banks to.

Named banks have a significant impact on the stability of the financial system says the MAS The Monetary Authority of Singapore has identified seven systemically important domestic banks which will have to locally incorporate their retail operations and meet higher capital requirements. D-SIBs are banks that can have a significant impact on the stability of the financial system and the proper functioning of the broader economy. In assessing a banks systemic importance factors which are considered include size interconnectedness to the financial system substitutability of the institution and its overall complexity.

The rationale for focusing on the domestic context is outlined in paragraph 17 below.

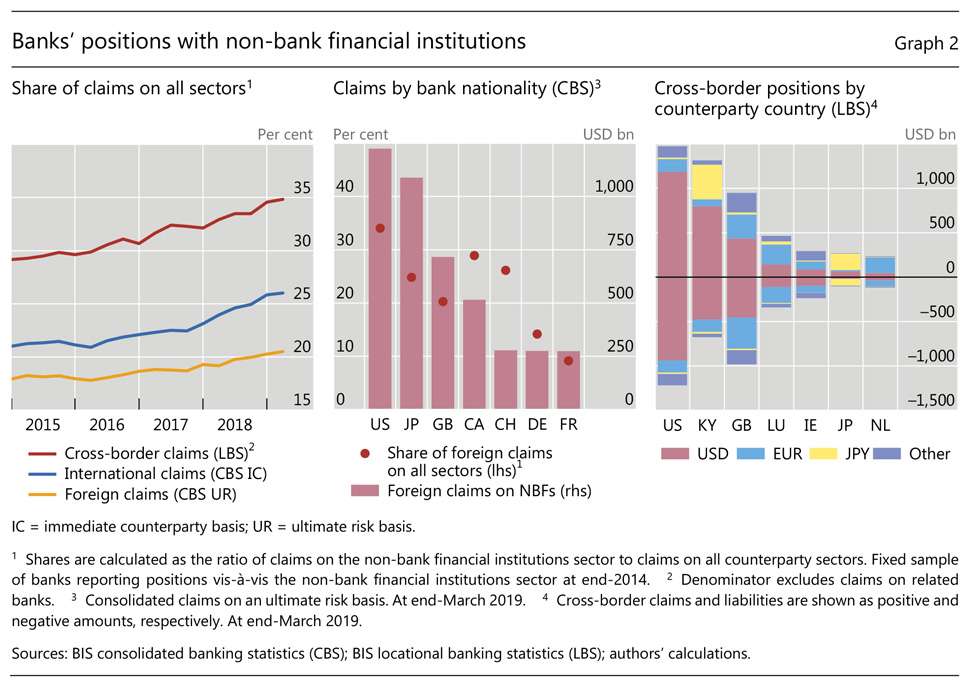

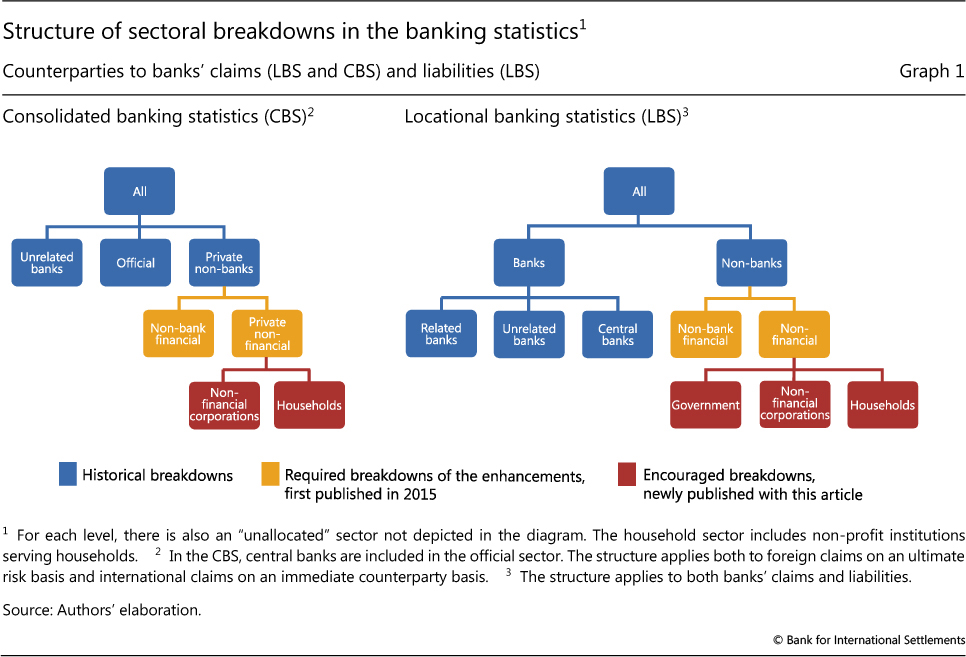

Non Bank Counterparties In International Banking

Financial Stability Review May 2018

Market The Week Ahead Nasdaq Trade Strategy Nasdaq Nasdaq Futures Strategies

Too Big To Fail Measures Remedies And Consequences For Efficiency And Stability Barth 2017 Financial Markets Institutions Amp Instruments Wiley Online Library

Post Crisis Changes In Global Bank Business Models A New Taxonomy In Imf Working Papers Volume 2019 Issue 295 2019

Https Www Bis Org Publ Bcbs233 Pdf

Australia In Imf Staff Country Reports Volume 2019 Issue 051 2019

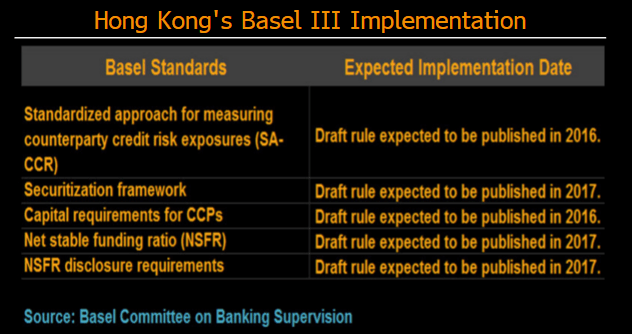

Basel Iii Implementation In North Asia 2016 Outlook Bloomberg Professional Services

Financial Stability Review November 2018

Too Big To Fail Measures Remedies And Consequences For Efficiency And Stability Barth 2017 Financial Markets Institutions Amp Instruments Wiley Online Library

Https Www Bis Org Publ Work922 Pdf

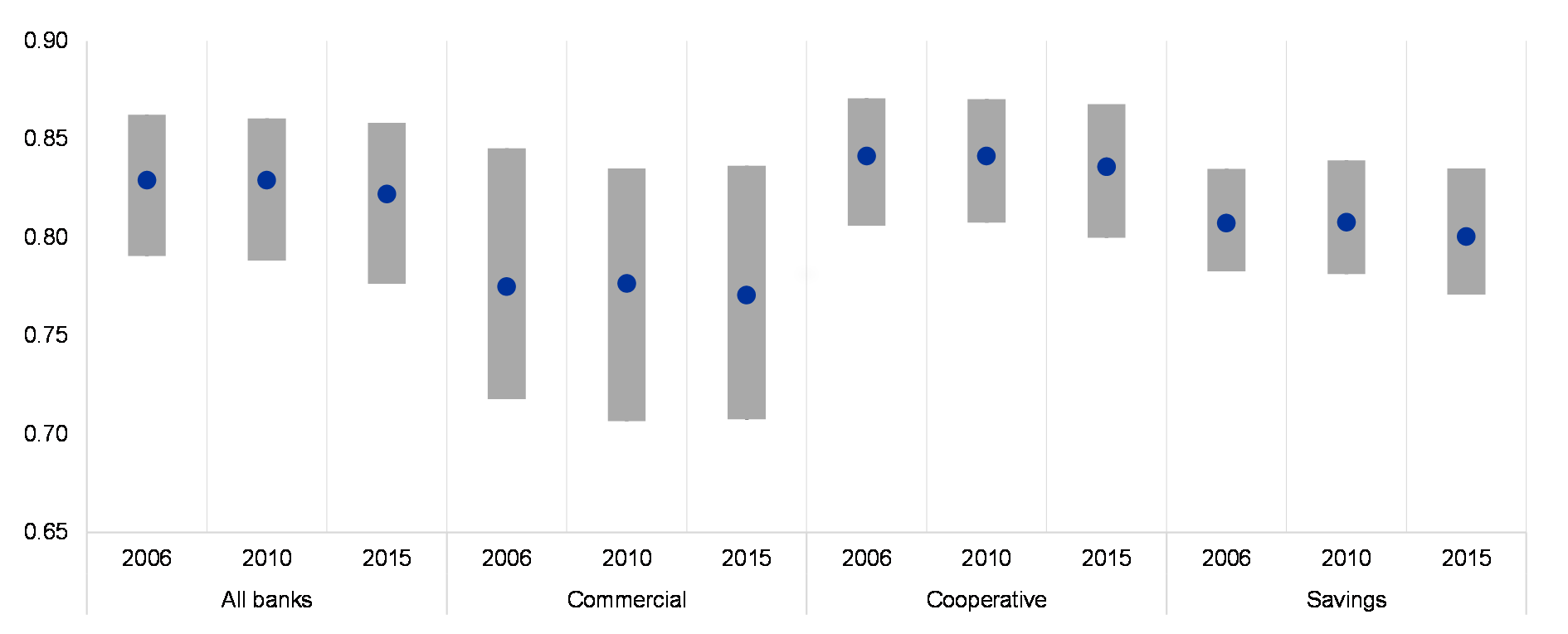

Where Have All The Profits Gone European Bank Profitability Over The Financial Cycle In Imf Working Papers Volume 2018 Issue 099 2018

Pdf Weighting On Systemic Important Banking Sib In Indonesia The Official Versus Pca Approaches

Too Big To Fail Measures Remedies And Consequences For Efficiency And Stability Barth 2017 Financial Markets Institutions Amp Instruments Wiley Online Library

Singapore Banks D Sib Announced Singapore Stock Market News Stock Market Dbs Bank Marketing

Https Www Clearstream Com Resource Blob 2136594 Bad163a2089711d273a9bc9397d39c3d En Pillar3 Cbl Discl Rep 19 Data Pdf

Chapter 13 Reinforcing Financial Stability In Realizing Indonesia S Economic Potential