RBI releases 2020 list of Domestic Systemically Important Banks D-SIBs SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the. As D-SIBs on August 31 2015 and August 25 2016 respectively.

Https Www Ijcb Org Journal Ijcb20q4a3 Pdf

Non Performing Loans NPLs will rise most for banks in India.

Domestic systemically important banks 2020. These buffers aim to address the potential negative effects that these institutions may have on the international or domestic. List of D-SIBs by RBI 2020 SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs. O-SIIs are institutions that due to their systemic importance are more likely to create risks to financial stability.

Domestic Systemically Important Banks 6 of 14 Issued on. The too big to fail is a phrase used to describe a bank or company thats so entwined in the economy that its failure would be catastrophic. State-owned SBI along with private sector lenders ICICI Bank and HDFC Bank are declared as Domestic Systemically Important Banks D-SIBs or institutions which are too big to fail as on March 31 2020.

The Chinese governments final assessment framework for domestic systemically important banks D-SIB has adopted a broader approach than we had anticipated based on earlier draft consultations and we now believe at least 20 of the 30 large banks under consideration will fall into the D-SIB category says Fitch Ratings. It means these banks are too big to fail. The State Bank of Pakistan has today announced the designation of D-SIBs for the year 2020 under the Framework for Domestic Systemically Important Banks D-SIBs that was introduced in April 2018.

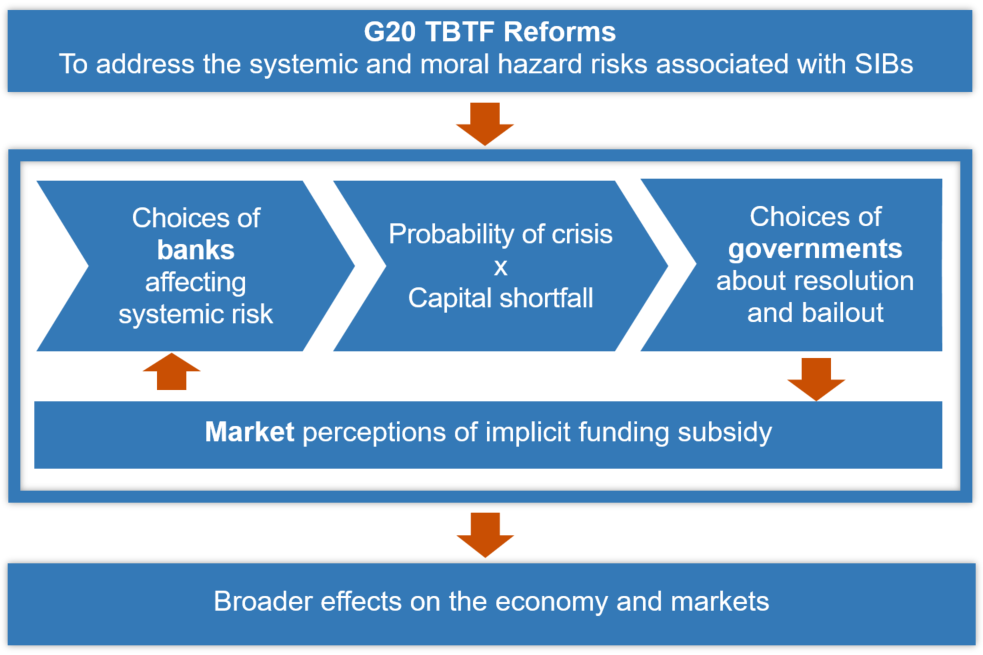

Whilst maximizing private benefits through rational decisions these. In maximising their private benefits individual financial institutions. The State Bank of Pakistan has today announced the designation of D-SIBs for the year 2020 under the Framework for Domestic Systemically Important Banks.

It specifies the methodology for. The list of institutions included in this section follows the EBA Guidelines on the criteria for the assessment of Other Systemically Important Institutions O-SIIs - pursuant to Article 131 3 of Directive 201336EU. Compared with the list of G-SIBs published in 2019 the number of banks identified as G-SIBs remains 30.

The 2020 list of global systemically important banks G-SIBs uses end-2019 data and an assessment methodology designed by the Basel Committee on Banking Supervision BCBS. A merger or significant restructuring exercise by financial institutions. RBI releases 2020 list of Domestic Systemically Important Banks D-SIBs January 19 2021 admin SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs.

The Reserve Bank of India RBI has retained State Bank of India ICICI Bank and HDFC Bank as domestic systemically important banks D-SIBs for 2020. Based on the above indicators 5 commercial banks are identified as D-SIBs namely Bangkok Bank Krung Thai Bank Bank of Ayudhya Kasikornbank and the Siam Commercial Bank. The Reserve Bank had announced State Bank of India and ICICI Bank Ltd.

Expeditiously the G-SIFI framework to domestic systemically important banks D-SIBs. NPAs to rise most for India and Thailand funds infusion is key. The rationale for adopting additional policy measures for G-SIBs was based on the negative externalities ie adverse side effects created by systemically important banks which current regulatory policies do not fully address.

5 February 2020 G 94 The list of D-SIBs will be reviewed on an annual basis. September 03 2020. Fitch Ratings-ShanghaiHong Kong-07 December 2020.

The framework introduced by State Bank is consistent with the international standards and practices and takes into account the local dynamics. RBI releases 2020 list of Domestic Systemically Important Banks D-SIBs SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs. The rationale for adopting additional policy measures for G-SIBs was based on the negative externalities ie adverse side effects created by systemically important banks which current regulatory policies do not fully address.

Global systemically important institutions G-SIIs and subject to national discretion other systemically important institutions O-SIIs must fulfil supplementary requirements concerning the amount of Common Equity Tier 1 capital they must hold as a buffer. In maximising their private benefits. Expeditiously the G-SIFI framework to domestic systemically important banks D-SIBs3 2.

The additional Common Equity Tier 1 CET1 requirement for D-SIBs was phased-in from April 1 2016 and became fully effective from April 1 2019. The Bank may also review the list as and when deemed necessary if there are major structural changes in the banking system eg. The additional Common Equity Tier 1 CET1 requirement for D-SIBs was phased-in from April 1 2016 and became fully.

Pdf Weighting On Systemic Important Banking Sib In Indonesia The Official Versus Pca Approaches

Hdfc Bank Not Among Domestic Systemically Important Banks Examrace

Hdfc Bank Too Big To Fail Why This Crucial Tag Stamped On Just 3 Banks In India Read All About It The Financial Express

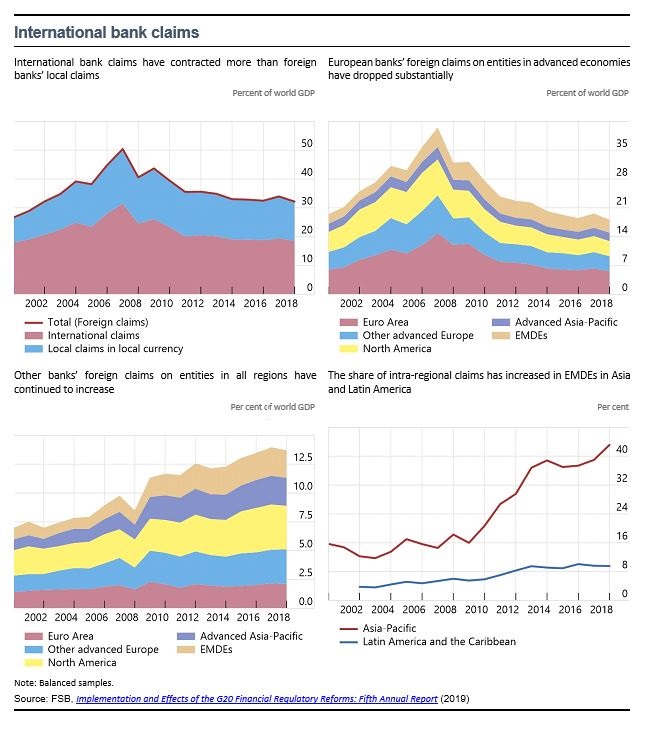

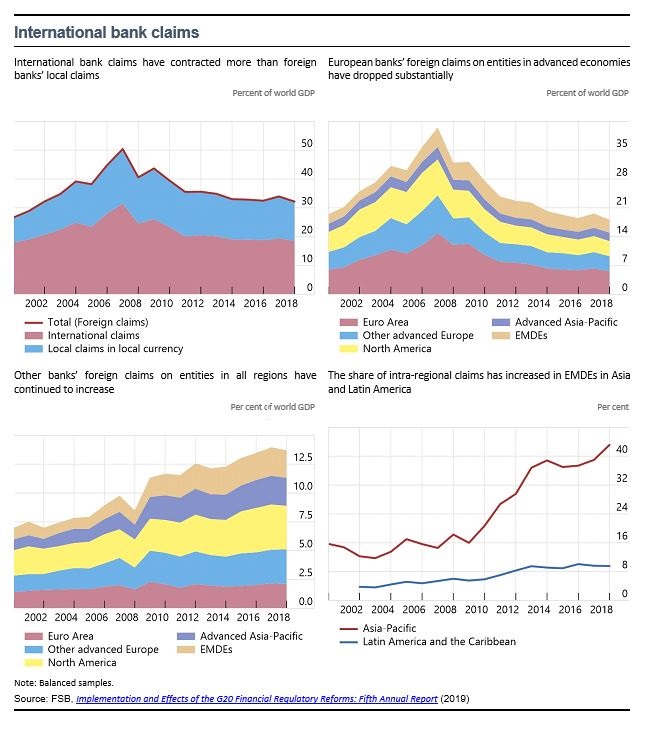

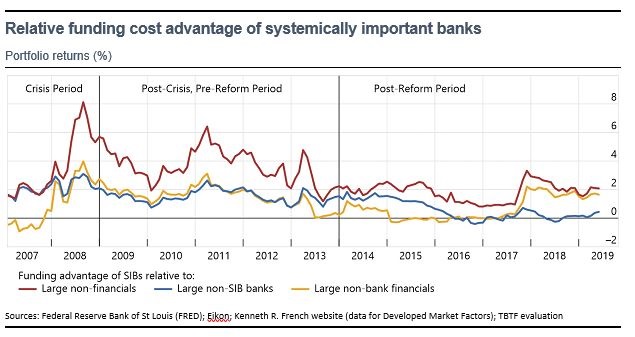

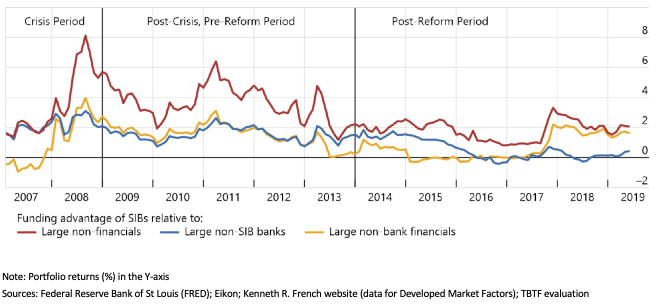

Implications Of The Too Big To Fail Reforms For Global Banking Deutsche Bundesbank

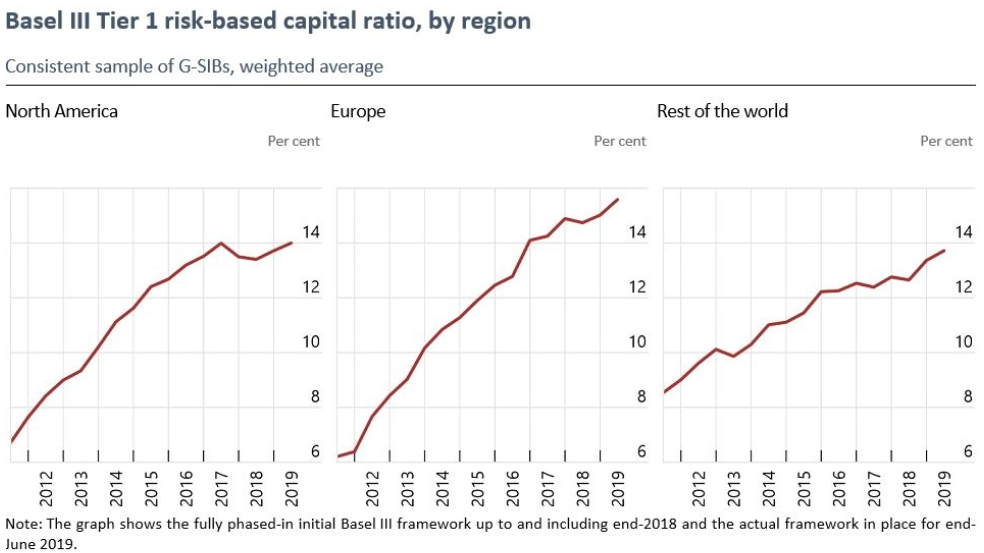

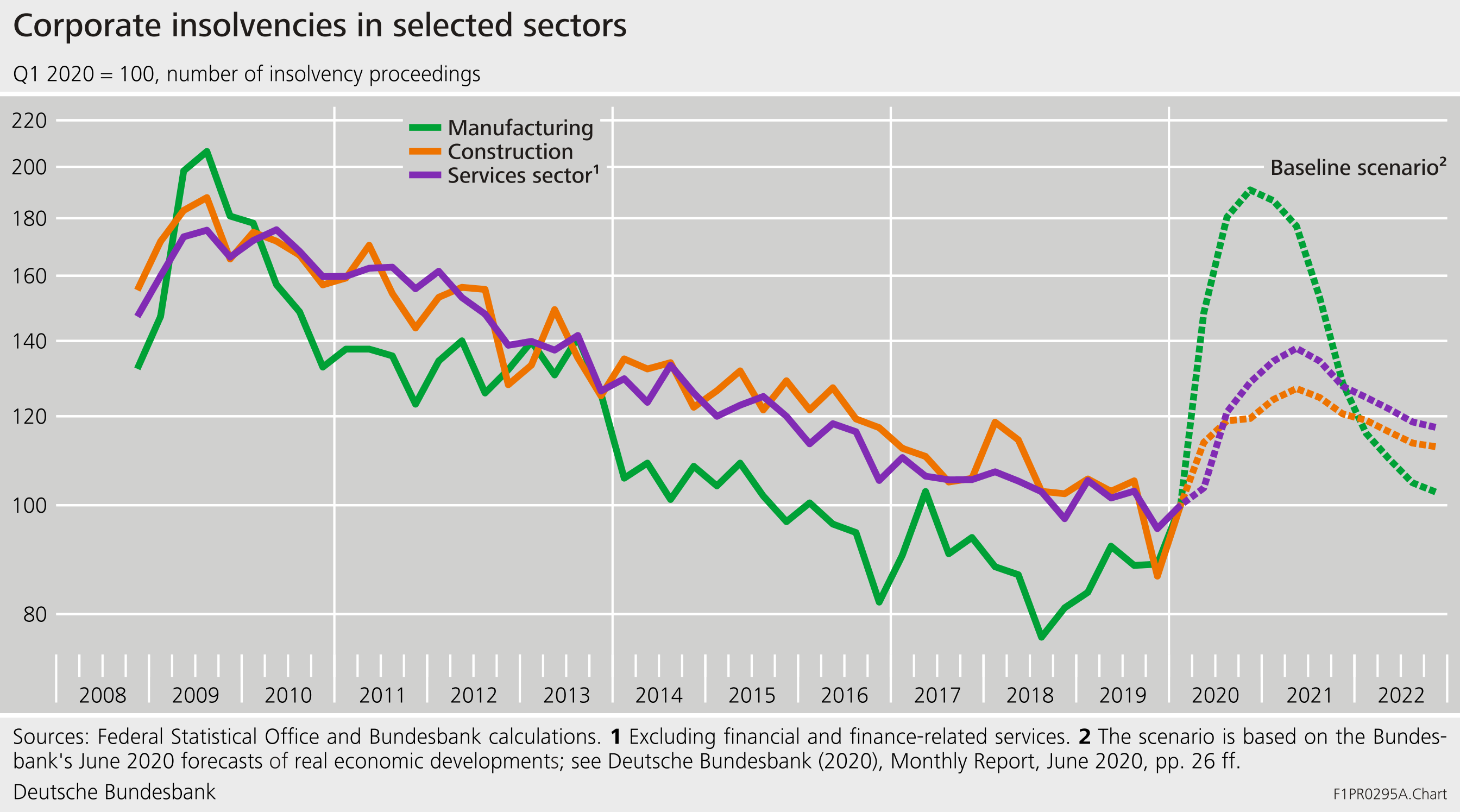

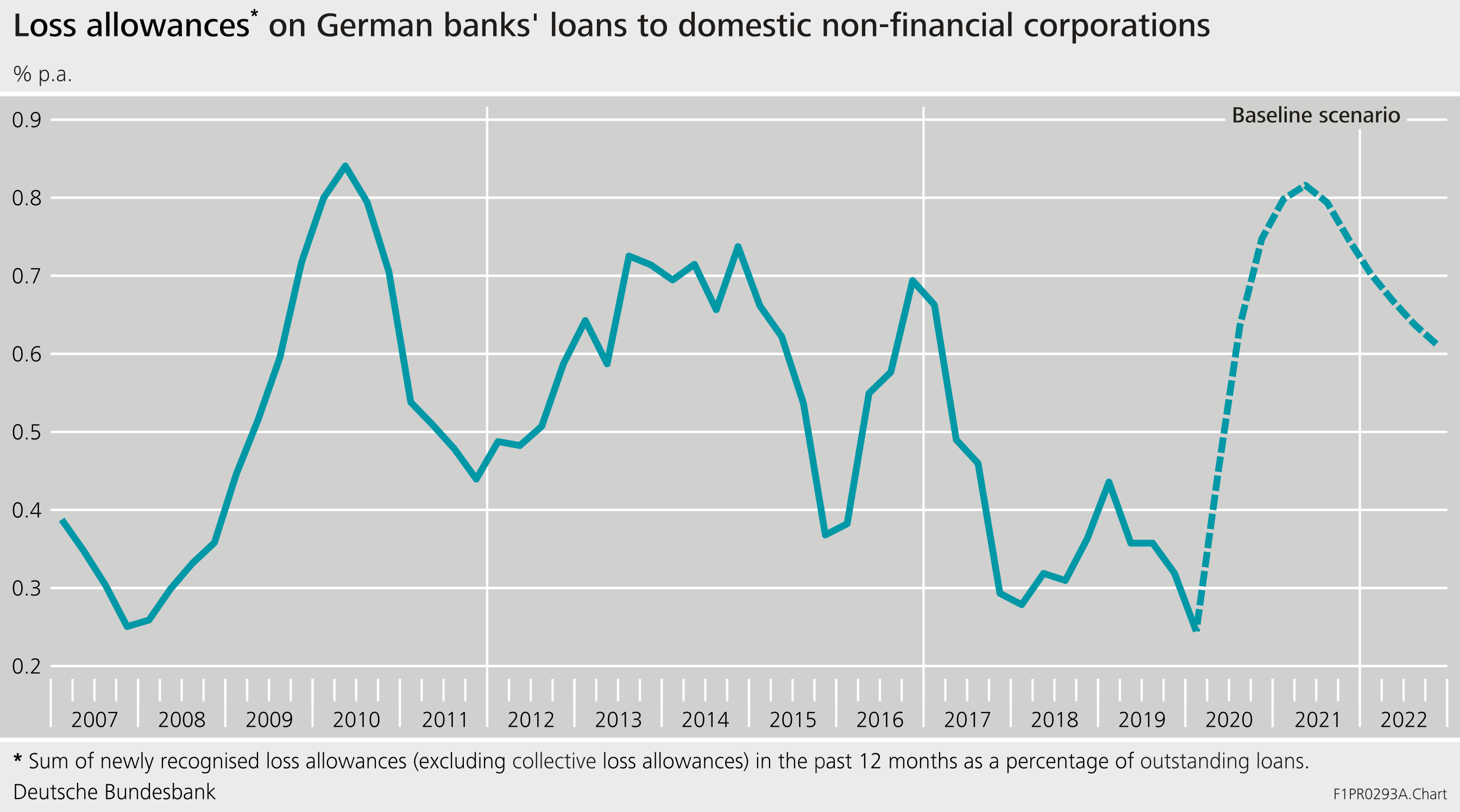

Financial Stability And Too Big To Fail After The Covid 19 Pandemic Deutsche Bundesbank

Macroprudential Policy Measures

Financial Stability And Too Big To Fail After The Covid 19 Pandemic Deutsche Bundesbank

Sbi Icici Bank Hdfc Bank Remains In The 2020 List Of D Sibs

Finance Malaysia Blogspot What Is Domestic Systemically Important Banks D Sib

Implications Of The Too Big To Fail Reforms For Global Banking Deutsche Bundesbank

Https Www Bnm Gov My Documents 20124 883228 Policy Document Dsbi Feb2020 Pdf E9ccf184 8530 A328 21fd 23810edddcd9 T 1587360482884

Https Www Ijcb Org Journal Ijcb20q4a3 Pdf

Https Www Ijcb Org Journal Ijcb20q4a3 Pdf

Domestic Systemically Important Banks D Sibs Empower Ias Empower Ias

Financial Stability And Too Big To Fail After The Covid 19 Pandemic Deutsche Bundesbank

Pdf Domestic Systemically Important Banks A Quantitative Analysis For The Chinese Banking System

Identifying Global Systemically Important Financial Institutions Bulletin December Quarter 2014 Rba

Evaluation Of Too Big To Fail Reforms Lessons For The Covid 19 Pandemic Financial Stability Board

Financial Stability And Too Big To Fail After The Covid 19 Pandemic Deutsche Bundesbank