Recalculate your net worth targets. How We Invest In Inflation.

Reduce weighting in higher-yielding securities.

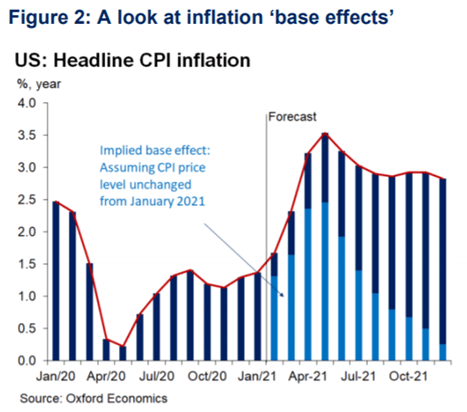

How to invest in high inflation environment. Investments to avoid amid inflation Because an interest rate hike by the Fed might be in store experts recommend that you dont tie up too much of your money now in any long-term bonds or. Consider reducing overall exposure to risk assets especially after a huge bull run since 2009. Real estate is actually the ultimate hard asset and often sees its greatest price appreciation during periods of high inflation.

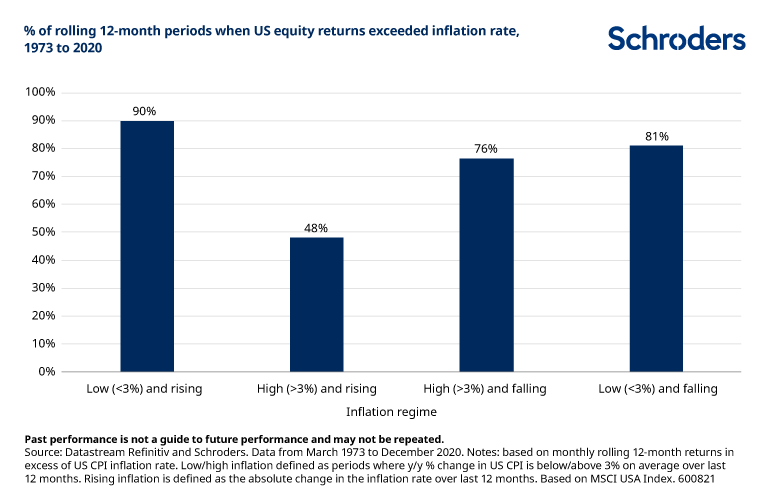

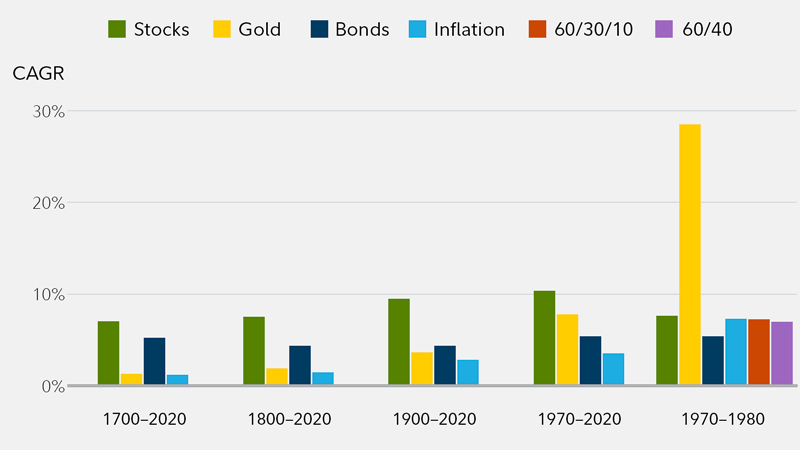

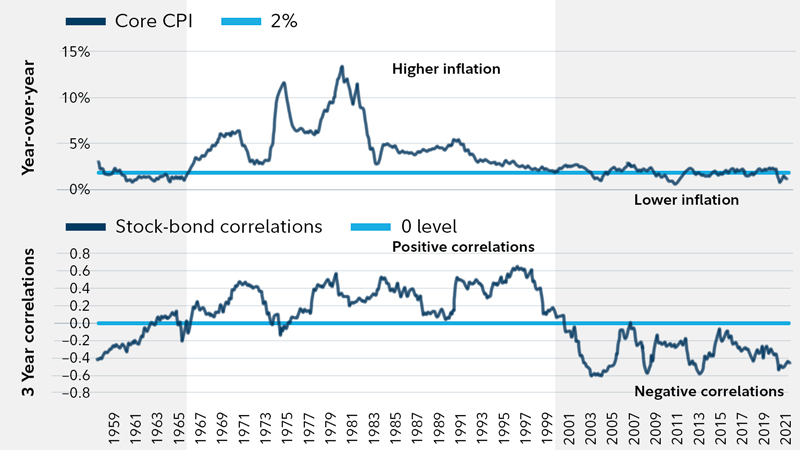

The most negatively correlated asset pairs with respect to changes in rates and inflation include banks and real estate who often are on opposite sides of the same transactions utilities and. But their high valuations high price-to-earnings ratio will revert downward. Stocks historically perform well during normal inflationary times.

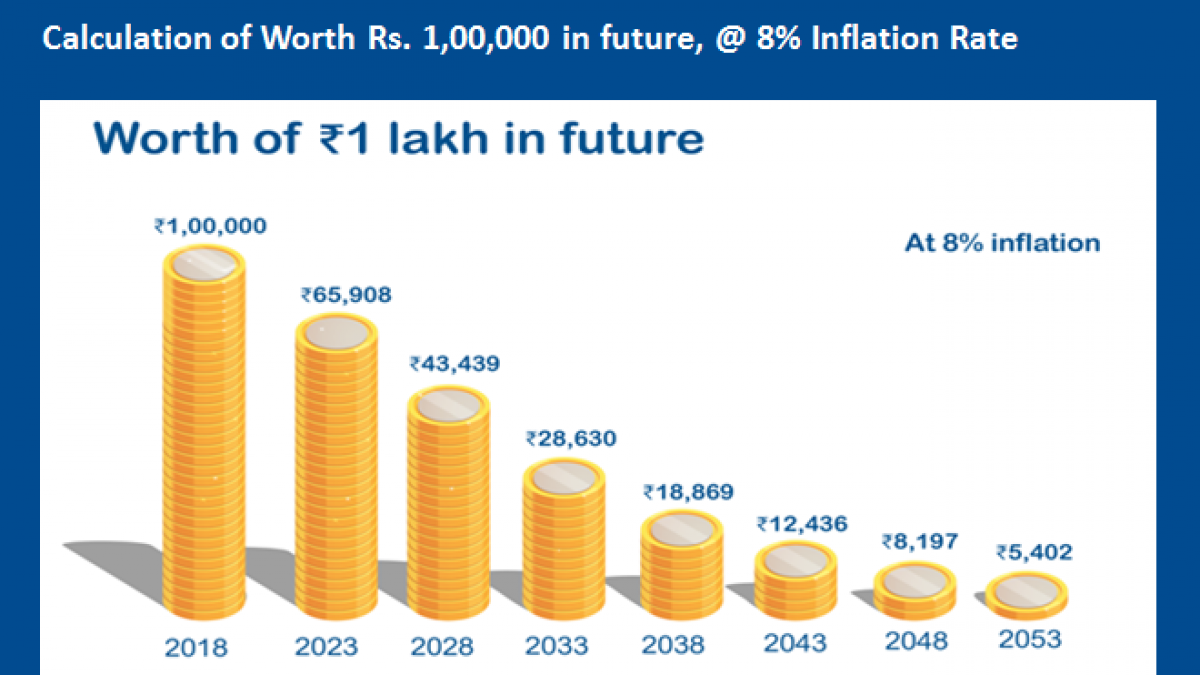

More specifically theyre inflation-protected bonds whose principal rises when there is inflation. The principal value of TIPS is tied to changes in. That dynamic holds over long periods of time though it can fall apart in the short term if.

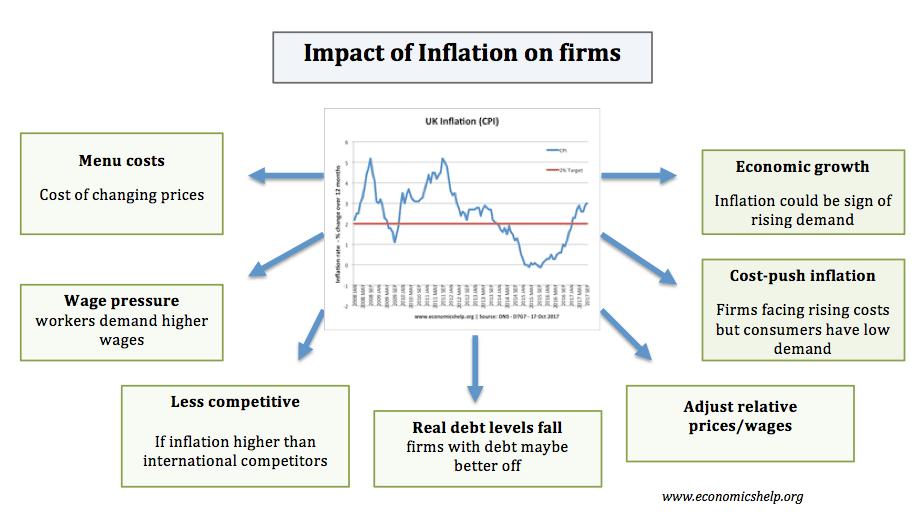

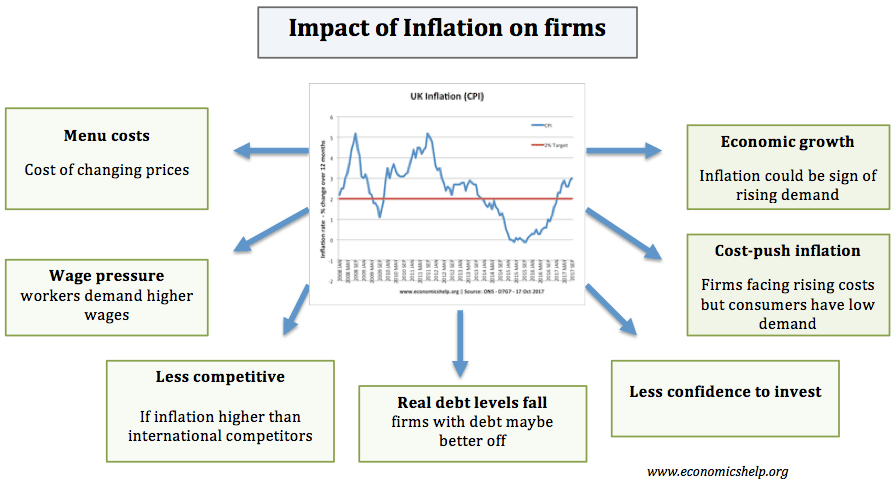

In other words a business that can cope well with high inflation must have 1 pricing power and 2 the ability to increase its sales volume by a large amount without the need for significant additional capital investments. So when investing during inflationary. Over the long term real estate is also usually an excellent investment response to inflation.

Investing for inflation involves picking assets that appreciate are tangible or pay variable interest. Reassess holdings in debt-heavy valuation-rich growth companies. The timing of inflationary periods is often consistent with a strong economy.

Equity investing is an effective inflation hedge because the stock market tends to outpace inflation. 2 days agoA 30-year investing veteran shares why investors should be skeptical of central banks and how to prepare for a period of permanent inflation. If we are entering into an inflationary environment today it is happening when.

Good inflation-hedging investments include stocks TIPS and tangibles like gold or. This is especially true because as rents rise people become increasingly interested in owning as a way of getting the tax benefits that help offset the general level of inflation. Treasury inflation-protected securities or TIPS are investments that account for inflation.

Treasury Inflation-Protected Securities are the most straightforward way to protect against a potential increase in inflation says Arnott.

Which Equity Sectors Can Combat Higher Inflation Cityam Cityam

Warren Buffett Explains How To Invest In Stocks When Inflation Rises

What Are The Effects Of A Rise In The Inflation Rate Economics Help

How To Hedge Against Inflation 5 Best Investments

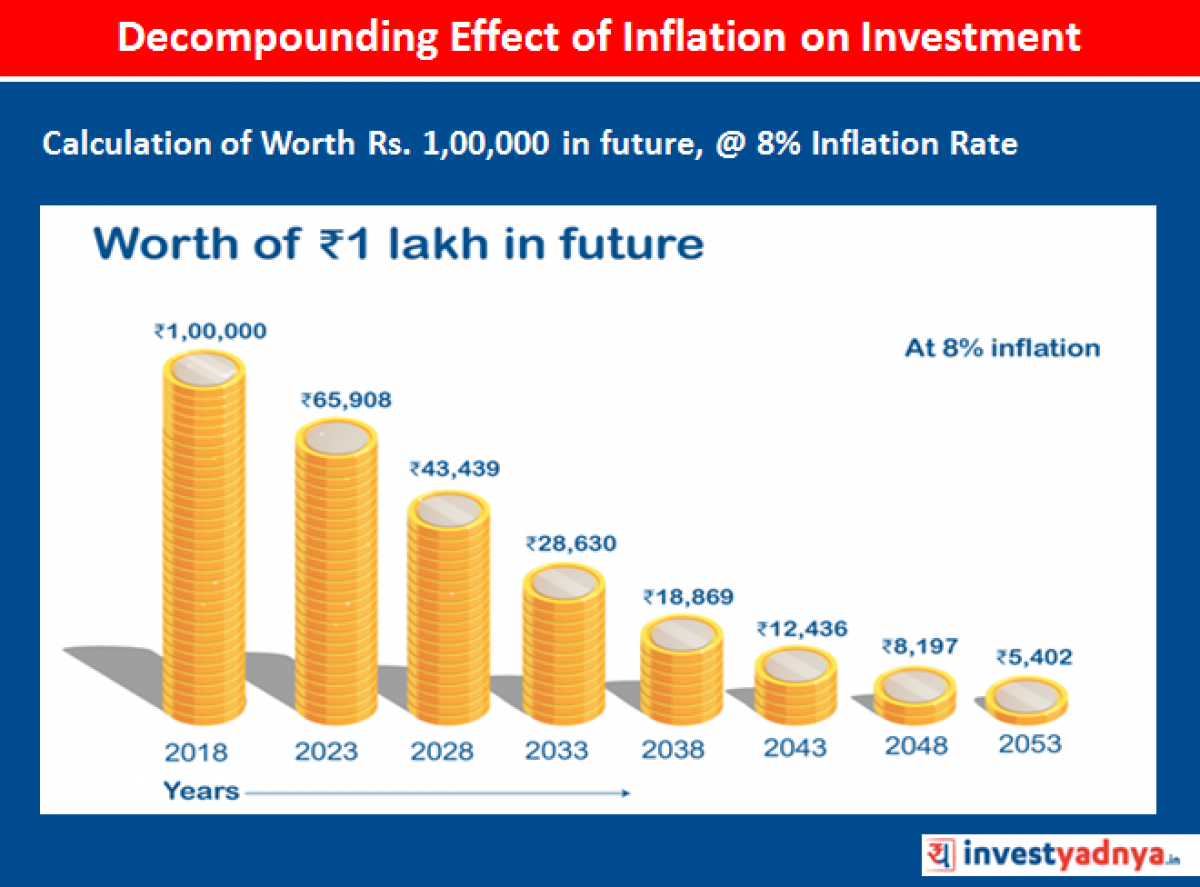

Effect Of Inflation On Investment Yadnya Investment Academy

How Does Inflation Affect Firms Economics Help

How To Invest Smartly When Inflation Picks Up

Effect Of Inflation On Investment Yadnya Investment Academy

How To Invest Smartly When Inflation Picks Up

Effects Of Inflation On Investments

Effect Of Inflation On Investment Yadnya Investment Academy

How To Protect Your Money From Inflation Portfolio Plan Fidelity

6 Sectors Which Benefit From High Inflation Fairmont Equities

/GettyImages-157311703-d5072cb293f44aa4a59c274e56fbd963.jpg)

Inflation S Impact On Stock Returns

Yes Rising Inflation Is Bad For Stocks Seeking Alpha

How To Invest If Inflation Surges

How To Protect Your Money From Inflation Portfolio Plan Fidelity

/dotdash_INV-final-Inflation-Trade-May-2021-01-fd06eca0c9f2471f9555cd138890ab0e.jpg)