Under the proposed changes while the Insurance Commission as a BSP unit may issue rulings circulars orders and instructions all decisions except otherwise specified that were made by the insurance regulator shall be appealable to the governor of the BSP The BSP governor like IC officials are all appointed. Based on this new ruling general insurance players are obligated to provide cover to all insurance seekers without excessive loading and cross selling of other classes of insurance to mitigate the risk.

Overview Shariah Advisory Council

Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959.

Insurance new bank negara ruling to. The circular requires insurers takaful operators and their agents to advise consumers during the pre-contractual stage or renewal of motor insurance takaful cover on the present market value of motor vehicles the importance of insuring the vehicle at the appropriate market value and the effect of over-insurance and under-insurance when a claim is made. Although general insurance players could still load the policies albeit at a more reasonable amount and not 200-300 as previously charged by the MMIP for the so-called high-risk displaced. Pertimbang dos booster untuk penerima Sinovac kata bekas menteri kesihatan.

Stories from the best and worst districts BBC News. The central bank recently released comprehensive. New SOPs soon for.

KUALA LUMPUR Sept 30 Bank Negara Malaysia BNM regrets the Malaysia Competition Commissions MyCC decision to penalise General Insurance Association of Malaysia Piam and its 22 members for infringing Section 4 of the Competition Act 2010. The role of Bank Negara Malaysia is to promote monetary and financial stability. In a memorandum sent to BNM NCCC a division under the Federation of Malaysian Consumers Associations said insurance companies were increasing premiums at such a rapid rate that consumers were unable to pay at short.

Bank Negara Malaysia is governed by the Central Bank of Malaysia Act 2009. This is aimed at providing a conducive environment for the sustainable growth of the Malaysian economy. Insurer AXA hit by ransomware after dropping support for ransom payments.

Revised Tax Audit Framework for Finance and Insurance Stamp duty exemption - Bank Negaras Special Relief Fund for SMEs Operational Guideline 42020 - Monthly Tax Deduction under the Income Tax Deduction from Remuneration Rules 1994. Unhappy with a bank or other financial institution. Motorists share struggles dealing with auto insurers Bank Negara.

New NGO to help unfairly treated insurance claimants. Regulate steep hike in insurance premiums Bank Negara told Samuel Chua. Based on this new ruling general insurance players are obligated to provide cover to all insurance seekers without excessive loading and cross selling of other classes of insurance to mitigate the risk.

The Shariah Advisory Council SAC of Bank Negara Malaysia at its 213th meeting on 27 April 2021 has ruled that the method to measure qard interest-free loan transaction between shareholders fund and takaful fund under MFRS 17 Insurance Contracts and MFRS 9 Financial Instruments requirements is allowed. Although general insurance players could still load the policies albeit at a more reasonable amount and not 200-300 as previously charged by the MMIP for the so-called high-risk displaced. Below is how you can make a complaint against institutions regulated by Bank Negara Malaysia such as a banking institution insurance company takaful operator or a non-bank institution that issues credit cards or charge cards.

Higher cost to implement Malaysias new compliance rulings08 Jan 2020. Want to file a complaint against a financial institution but dont know how. Chubb launches MY Smart Car Insurance for low mileage drivers in Malaysia.

Although general insurance players could still load the policies albeit at a more reasonable amount and not 200-300 as previously charged by the MMIP for the so-called high-risk displaced. 2 Taxavvy Issue 49-2020 In order to encourage the use of online payments the Inland Revenue Board IRB has in its media statement dated 26. How British Muslims retirement funds rest on a knife edge Arab News.

Although general insurance players could still load the policies albeit at a more reasonable amount and not 200-300 as previously charged by the MMIP for the so-called high-risk displaced. Liberty Insurance expects a sharp V-shaped recovery for motor insurance. If you are not satisfied with the decision given by your institution.

A new circular from the central bank that took effect last Friday will pile more pressure on an already hard-hit. Write to the Complaints Unit of your institution. Based on this new ruling general insurance players are obligated to provide cover to all insurance seekers without excessive loading and cross selling of other classes of insurance to mitigate the risk.

Based on this new ruling general insurance players are obligated to provide cover to all insurance seekers without excessive loading and cross selling of other classes of insurance to mitigate the risk. In January Bank Negara released a policy document that set several new requirements that investment-linked insurance providers must adhere to from 1 July 2019 onwards. Egypts sukuk popular among debt investors but extra burden on citizens.

The National Consumer Complaints Centre NCCC has urged Bank Negara Malaysia BNM to regulate the steep increase in insurance premiums. Bank Negara Malaysias BNM reporting institutions especially insurance operators Lembaga Tabung Haji TH and money services will incur higher operating cost to comply with the central banks money laundering rulings. In a statement today BNM said on September 14.

If you have or are planning to purchase an investment-linked product ILP insurance policy then you should take note of the new regulations by Bank Negara that will come into effect from 1 July 2019. First of all you should know that you absolutely have the right to lodge a complaint if you are not satisfied or cannot come to a mutual understanding with banks and insurance companies regulated by Bank Negara Malaysia BNM. Education News from World.

Currently the Insurance Commission is under the Department of Finance.

Statutory Requirements Bank Negara Malaysia

Higher Cost To Implement Malaysia S New Compliance Rulings

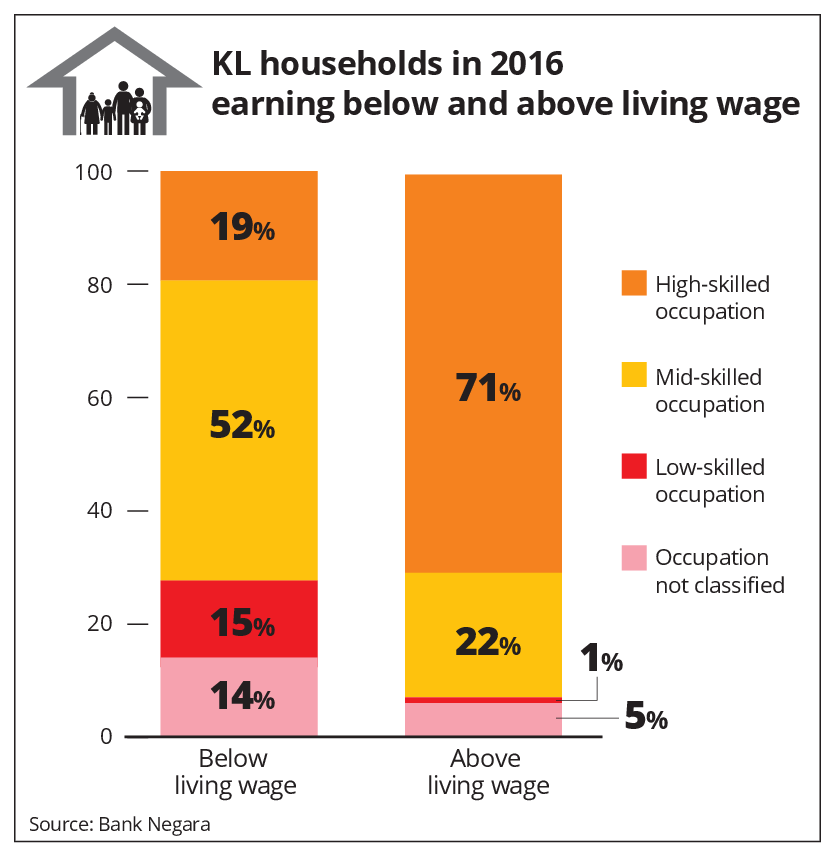

Wages Too Low Says Bank Negara The Star

Complaint Redress Bank Negara Malaysia

Wages Too Low Says Bank Negara The Star

Foreign Banks Shaken By Malaysia S Move To Halt Currency Slide Offshore Bank Banking Offshore

Islamic Financial Services Act 2013 Bank Negara Malaysia

Newsbreak Bank Negara Extends Timeline For Fire Insurance Detariffication The Edge Markets

Card Payments Continue To Rise In Malaysia Amid Covid 19 Reveals Globaldata Globaldata

Bank Negara Appoints Aznan Abdul Aziz As Assistant Governor The Star

Complaint Redress Bank Negara Malaysia

Statutory Requirements Bank Negara Malaysia

Pdf An Analysis Of Malaah Based Resolutions Issued By Bank Negara Malaysia

Overview Shariah Advisory Council

Digital Onboarding Bank Negara Malaysia S Central Bank Releases Updated E Kyc Policy Document Effective Immediately

Bank Negara S Ruling On Fhc May Alter Banking Landscape The Star

Types Of Payment Systems Bank Negara Malaysia

Pdf Analysis On The Development Of Legislations Governing Shariah Advisory Council Of Bank Negara Malaysia