Recipients of grants ARE taxable by the State of New Hampshire. A health care provider that is described in section 501 c of the Code generally is exempt from federal income taxation under section 501 a.

Yes the value of leave donated in exchange for amounts paid before January 1 2021 to organizations that aid victims of COVID-19 is excludable from an employees income for California income tax purposes.

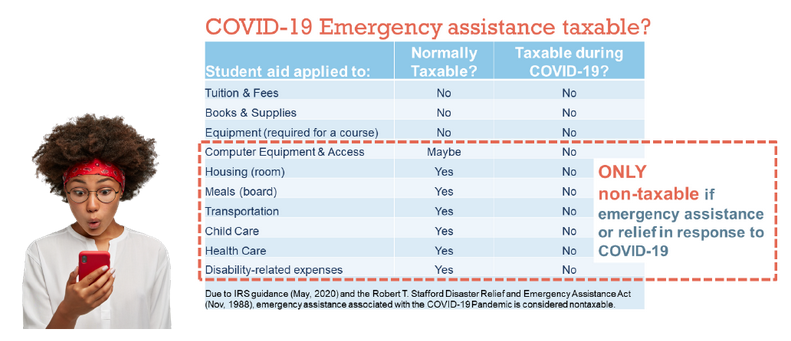

Is covid 19 relief fund taxable. As explained below need-based grants to households likely fall under the general welfare exclusion and are therefore not taxable whereas grants to. The Taxability of COVID-19 Financial Relief Funds. It is not taxable income it is essentially a credit Wilson said.

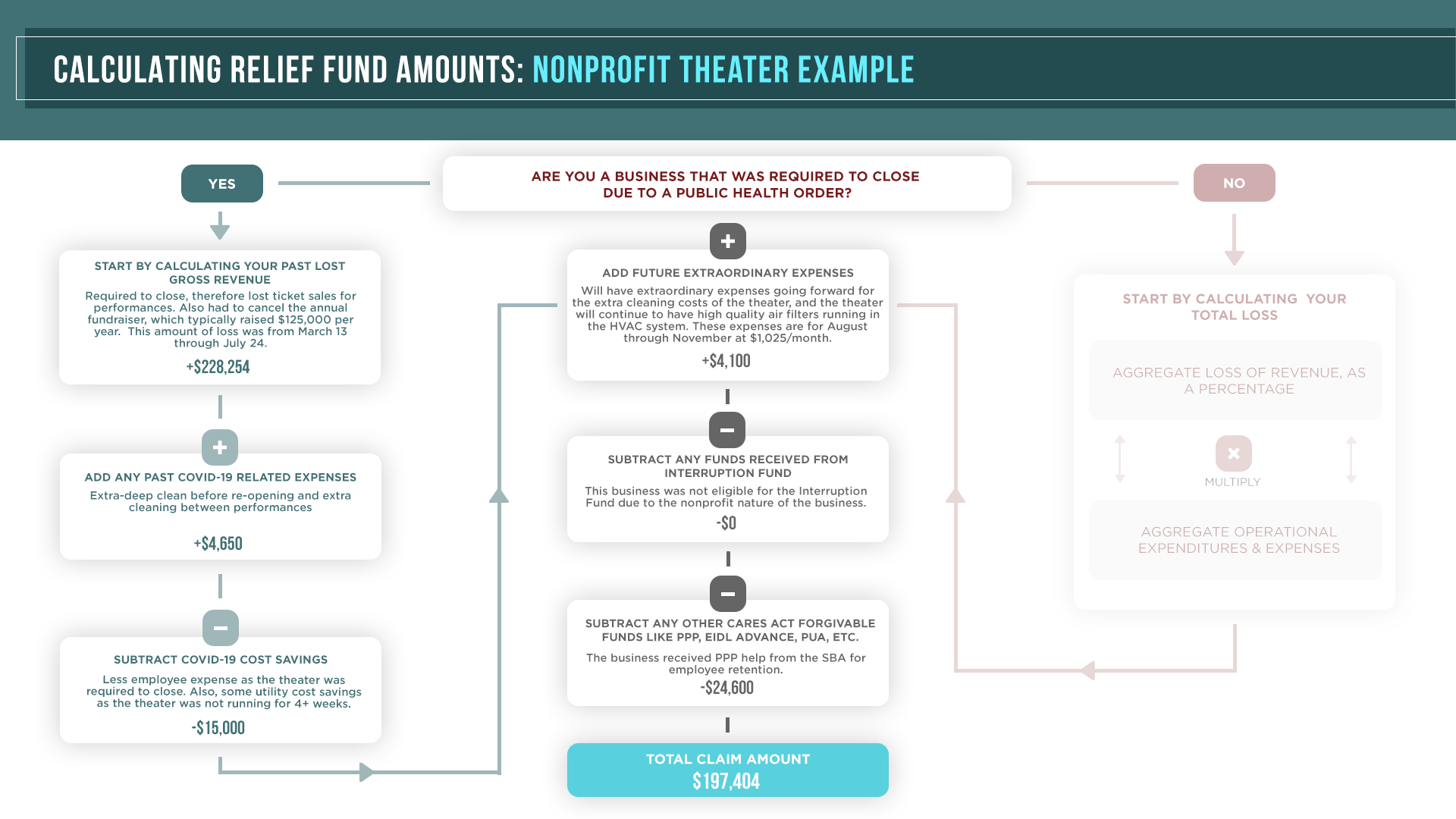

EIDL advances are not taxable and expenses paid with such advances are tax-deductible. The CARES Act provides that payments from the Fund may only be used to cover costs that Are necessary expenditures incurred due to the public health emergency with respect to COVID19. Federal state and local governments have provided or are providing a variety of measures to help individuals and businesses get through the economic challenges presented by.

Nonetheless a payment received by a tax-exempt health care provider from the Provider Relief Fund may be subject to tax under section 511 if the payment reimburses the provider for. Treasury has made payments from the Fund to States and eligible units of local government. So if you were able to get the stimulus check last year or early this year for the second round you already.

COVID-19-related grants to businesses do not qualify as tax-free under the general welfare exclusion and are generally taxable including state and local grants made under the. The District of Columbia and U. As explained below need-based grants to households likely fall under the general welfare exclusion and are therefore not taxable whereas grants to small businesses are likely not covered by this exclusion and would be taxable.

For a sole trader or partnership preparing accounts on the cash basis this income will be taxable in the 202021 tax year and the income tax payable by 31 January 2022. Electing employees may not claim a charitable deduction for the value of the donated leave. The rules have been set and the New Hampshire Department of Revenue Administration NHDRA is helping taxpayers understand the tax implications.

The relief is delivered as no payroll tax payable for the quarter April to June 2020. COVID-19-related grants to businesses do not qualify as tax-free under the general welfare exclusion and are generally taxable including state and local grants made under the CARES Act Coronavirus Relief Fund. COVID-19 Support Measures and Tax Guidance In light of the global COVID-19 outbreak a series of support measures have been introduced to help businesses and individuals to ease their cash flow.

Is my stimulus check taxable income. Most claimants will not therefore have received their grant until after 5 April 2020. During this period of uncertainty IRAS continues to.

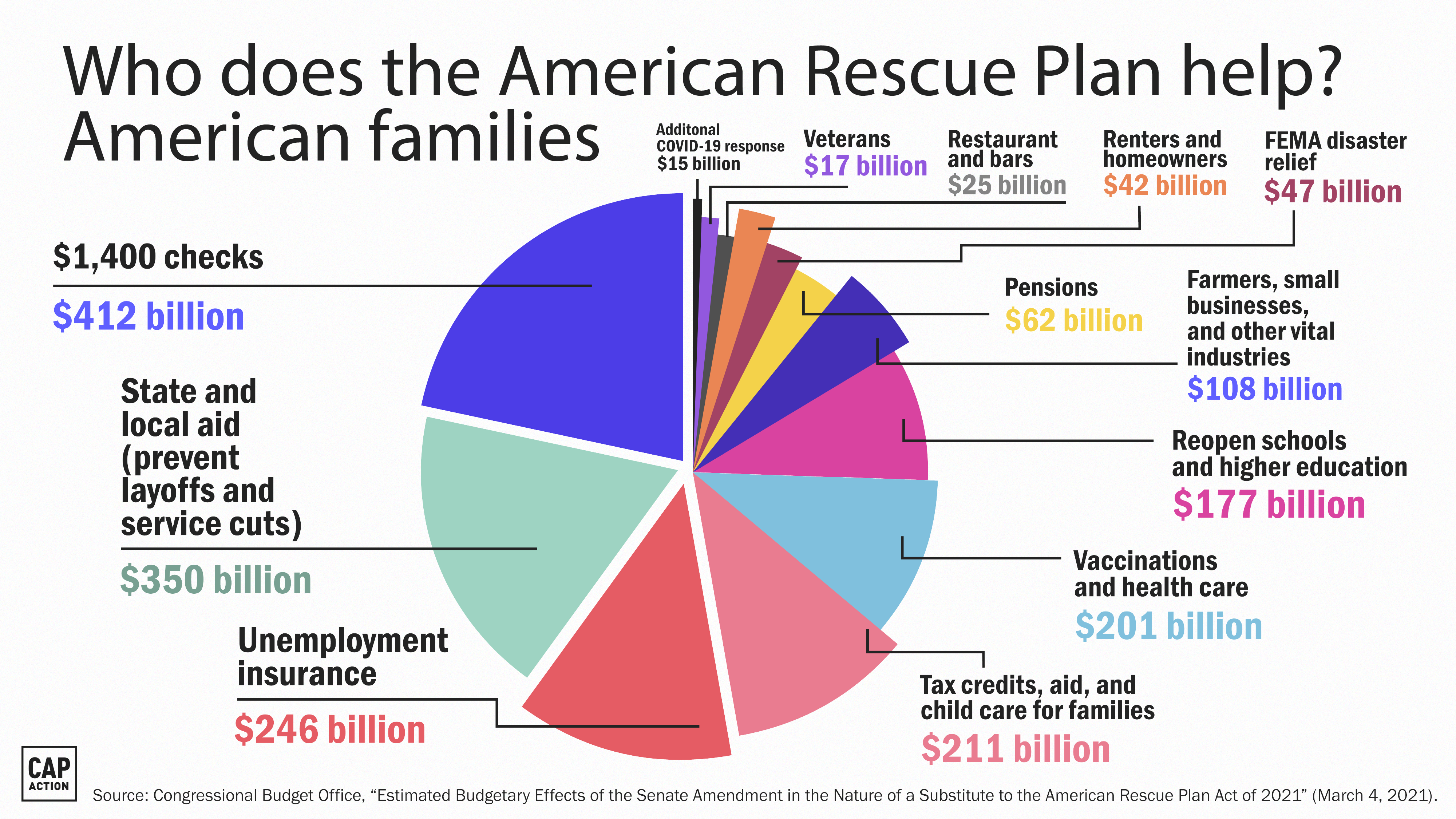

The CARES Act established the 150 billion Coronavirus Relief Fund. The state government introduces payroll tax relief for all small businesses to help them cope with the impacts of COVID-19. Income Tax Treatment of COVID-19-Related Payouts to Businesses and Individuals The following payouts are not taxable either because a specific exemption has been granted to exempt the payouts from tax or the payouts are not income in nature.

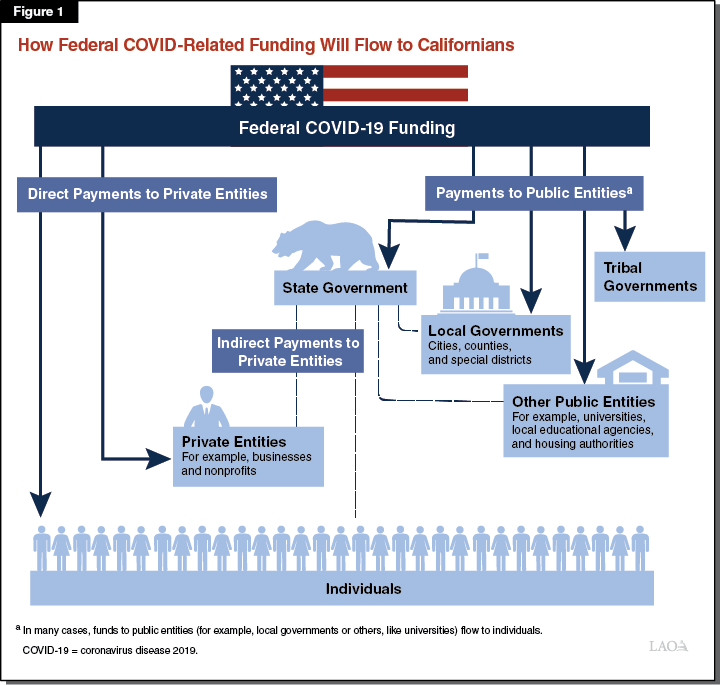

Burning questions about the second COVID-19 stimulus Last Updated. Were not accounted for in the budget most recently approved as of March 27 2020 the date of enactment of the CARES Act for the State or government. Through the Coronavirus Relief Fund the CARES Act provides for payments to State Local and Tribal governments navigating the impact of the COVID-19 outbreak.

Will it reduce my tax return.

Https Www Cbpp Org Sites Default Files Atoms Files Policybasics Wheredofederaltaxrevscomefrom 08 20 12 Pdf

A Year Into Crisis Billionaires Could Pay For 2 3 Of Biden S Covid Relief Bill With Their Pandemic Profits Americans For Tax Fairness

Https Www Cciarts Org Library Docs Grantmakers Relief Funding Of Individuals During A Qualified Disaster Pdf

United States Tax Developments In Response To Covid 19 Kpmg Global

How Cares Act Eases Retirement Account Rules Forbes Advisor

Relief Fund Wyoming Business Relief Program

The Big Questions About Scholarship Taxability Scholarship America

Cares Act Provider Relief For Covid 19 Practicing Dpms Apma

Emergency Services Fund Covid 19 Relief Grants United Way Of St Clair County

Federal Covid 19 Provider Relief Funds Following The Money Urban Institute

Covid 19 Related Government Grants Taxable Or Not

Http Www Tax Ri Gov Rionpause Documents Publication 2020 06 New Grant Program 11 25 20 Pdf

Temporarily Relocating To An Out Of State Secondary Home Due To Covid 19 You May Be Subject To Double Taxation On The Same Income Prager Metis

Federal Covid 19 Provider Relief Funds Following The Money Urban Institute

Federal Covid 19 Related Funding To California

Taxation Of Annuities Ameriprise Financial

Https Www Maine Gov Revenue Sites Maine Gov Revenue Files Inline Files Ta Oct2020 Vol30 Iss19 Pdf