No the payment is not income and taxpayers will not owe tax on it. The stimulus check you receive will not factor into your income-tax liability.

Coronavirus Covid 19 Tax Updates Cares Act Stimulus Relief Forgivable Loans Grants And Faqs Mehdiani Financial Management

The payment will not reduce a taxpayers refund or increase the amount they owe when they file their 2020 or 2021 tax return next year.

Is covid 19 relief taxable. A health care provider that is described in section 501 c of the Code generally is exempt from federal income taxation under section 501 a. If you did not receive one or both of the stimulus payments you need to report the information on your 2020 return to claim the Recovery Rebate Credit. The CARES Act allowed these credits.

To provide relief and support to low-income families healthcare workers and other specified individuals who have supported the national response to COVID-19 and in doing so contracted COVID-19. The state government introduces payroll tax relief for all small businesses to help them cope with the impacts of COVID-19. It is not taxable income it is essentially a credit Wilson said.

Interest relief if you received COVID-19 benefits. Or through commercially available tax filing. The Internal Revenue Service IRS wwwirsgov has.

In the somewhat longer words of the IRS. Nonetheless a payment received by a tax-exempt health care provider from the Provider Relief Fund may be subject to tax under section 511 if the payment reimburses the provider for. So if you were able to get the stimulus check last year or early this year for the second round you already.

Now the tax credit also applies to employers who voluntarily kept paying employees who missed work due to COVID-19. The stimulus check is taxable income Again no. IRS says these COVID-19 relief funds are taxable.

Employee Retention Credit Available for Many Businesses Financially Impacted by COVID-19. Although this support has now concluded business owners who received it should be aware of how it is taxed. The focus of FFCRA though is paid leave.

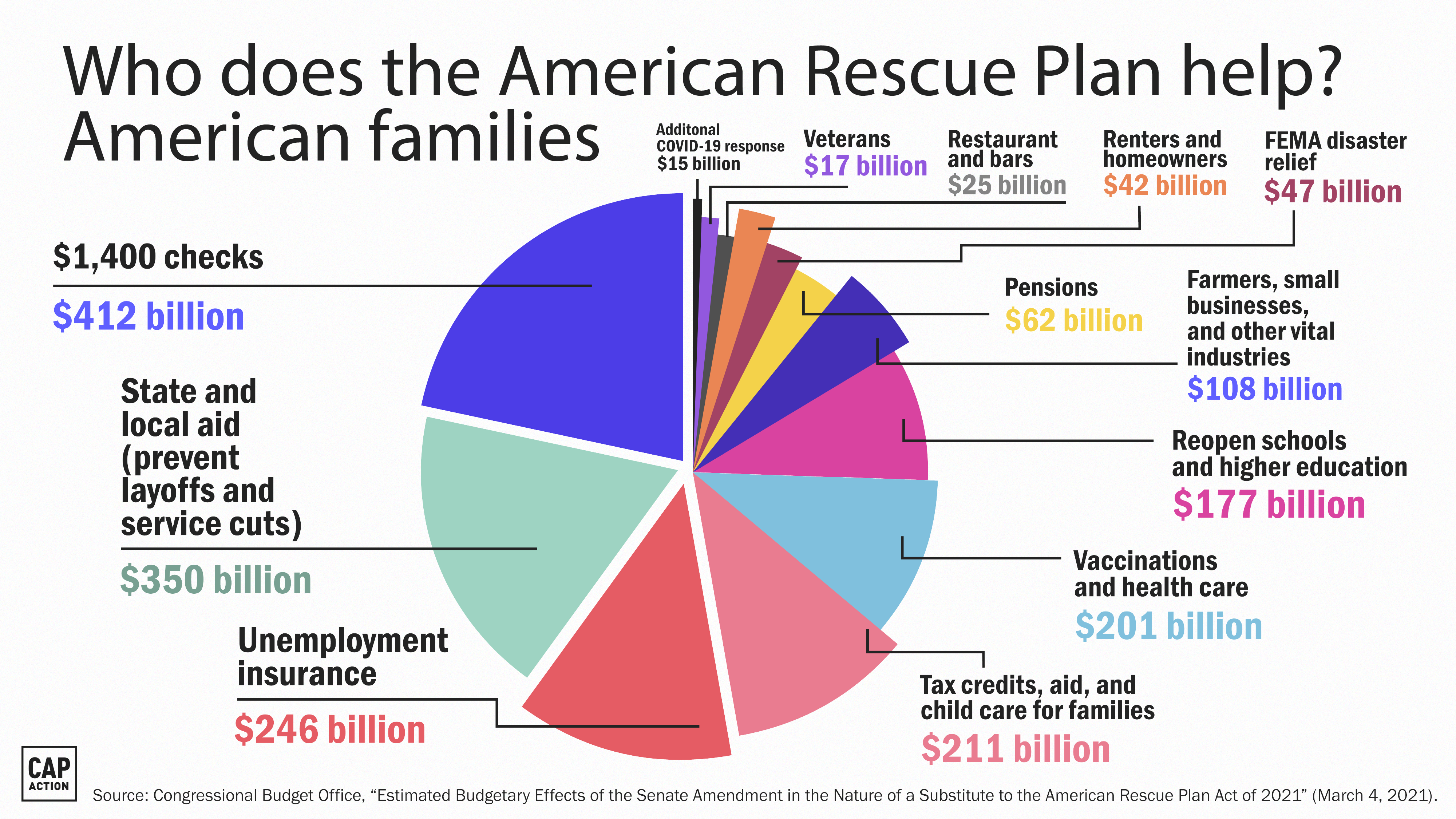

Federal state and local governments have provided or are providing a variety of measures to help individuals and businesses get through the economic challenges presented by. If you receive money from the COVID-19 Provider Relief Fund it will probably be taxed. In light of the global COVID-19 outbreak a series of support measures have been introduced to help businesses and individuals to ease their cash flow.

Is COVID-19 Small Business Grant Scheme taxable. COVID-19-related grants to businesses do not qualify as tax-free under the general welfare exclusion and are generally taxable including state and local grants made under the. Yes the value of leave donated in exchange for amounts paid before January 1 2021 to organizations that aid victims of COVID-19 is excludable from an employees income for California income tax purposes.

Electing employees may not claim a charitable deduction for the value of the donated leave. IRS confirms the stimulus check is not taxable On their Economic Impact Payment - the official name for the stimulus payments under the Coronavirus. The CECRA provided rent relief for certain small businesses not-for-profits and charities experiencing financial hardship caused by COVID-19 and is designed to provide a 75 reduction in rent.

Not taxable as these are unconditional gifts. During this period of uncertainty IRAS continues to extend its assistance and provide tax. BATON ROUGE The Louisiana Department of Revenue advises taxpayers to be aware of the state tax implications of federal COVID-19 relief benefits when they file their 2020 state individual income taxes.

Interest relief for individuals with a taxable income of 75000 or less in 2020 and received a COVID-19 benefit. This program reduced the rent from April. The relief is delivered as no payroll tax payable for the quarter April to June 2020.

It includes several elements like guaranteed free coronavirus testing a boost to unemployment insurance and improvement to food safety programs. The following payouts are taxable being revenue receipts of a business in accordance. Is the 2020 COVID-19 stimulus payment taxable on my 2020 tax return.

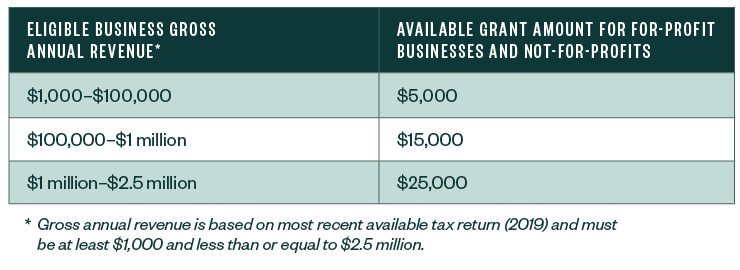

COVID-19 Support Measures and Tax Guidance. LDR is now accepting tax returns through Louisiana File Online the states free electronic tax filing application. So we know that the direct grants of up to 2500 per month for three months to the self employed are taxable - but has anybody found any utterances regarding the COVID-19 Small Business Grant Scheme assistance by grant to Business Rates payers taxable.

Under the Coronavirus Aid Relief and Economic Security Act CARES Act as originally enacted March 27 2020 the Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees.

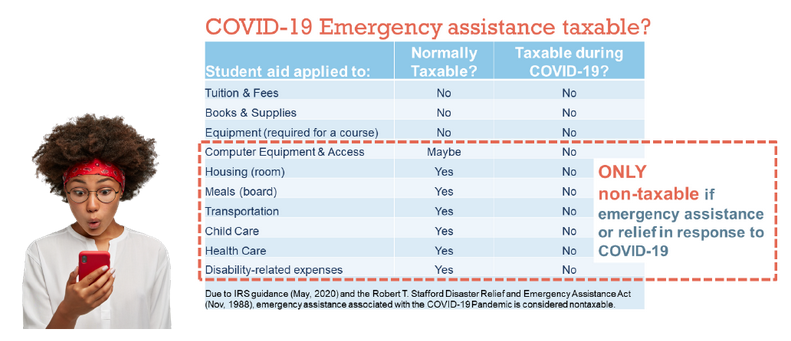

Emergency Assistance Payments Qualify As Welfare Exclusion

Covid 19 Assistance Extended For California Small Business Not For Profits

Coronavirus Covid 19 Updates Alabama Department Of Revenue

Tax Takes Video Series Covid 19 Global Tax Implications Ibfd

Is Covid 19 Financial Relief Taxable

Covid 19 Property Tax Relief Opportunities Salt Shaker

Stimulus Checks Tax Credits Jobless Benefits And More Here S How Newly Passed Covid 19 Relief Bill Could Affect You Ktla

A Year Into Crisis Billionaires Could Pay For 2 3 Of Biden S Covid Relief Bill With Their Pandemic Profits Americans For Tax Fairness

Providers Ask Congress For Tax Relief For Covid 19 Assistance Fiercehealthcare

Key Tax Considerations For Farmers In Early 2021 Center For Agricultural Law And Taxation

Stimulus Check Taxes Will Stimulus Payments Impact Your Taxes Kxan Austin

Deliver Tax Free Covid 19 Relief Payments To Your Employees

Covid 19 Tax Guidance For Businesses Journal Of Accountancy

Are There New Property Tax Discounts In The U S Related To Covid 19 Mansion Global

Unemployment Benefits Are Taxable Lawmakers Seek Change

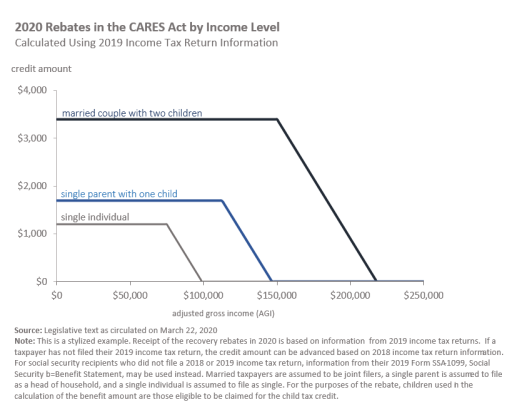

Covid 19 And Direct Payments To Individuals Summary Of The 2020 Recovery Rebates In The Cares Act As Circulated March 22 Everycrsreport Com

The Big Questions About Scholarship Taxability Scholarship America