Apparently even though p2p lending is regulated by the SEC it is still up to the states to decide if they want to allow this kind of investment. P2P lending provides users more privilege in choosing the lending manner and lending objects.

Finance Malaysia Blogspot Crowdfunding What Is P2p Financing And What S In It For Investors

SC-licensed platforms are required to conduct background checks on all potential issuers to verify their business proposition and assess their creditworthiness.

P2p lending knowing all sc approved p2p. P2P lending is a novel instrument that can be beneficial both for borrowers and lenders. In this paper we compare the procedures between P2P lending and bank loan. Most of the platforms assign a loan grade based on 600-900 credit evaluation parameters as part of their process.

Peer-to-peer lending is a relatively recent development that uses the Internet to connect individual investors with other individuals such as small business owners seeking to borrow money. The borrower and the lender. With P2P lending you can take loans directly from other people or businesses.

The phenomenon has grown very popular amongst investors during the last decade due to the possibility of receiving high returns on investments. So the information flow in P2P lending is more frequent and transparent. The main innovation of P2P lending is the direct.

As of May 2020 there are 11 approved P2P lending platforms. After understanding how and why P2P lending existed nowadays click here to read our previous article lets move on knowing all the approved P2P operators in Malaysia now. Among other criteria the directors of an operator must demonstrate that they are fit and proper to operate such business.

You raise a point that to me is the most perplexing of all if a state is allowable for either Prosper or Lending Club then surely it should allow both. Peer P2P lending platform. Peer to Peer P2P lending allows everybody to borrow and lend money without any issue.

The benefit to the people making the loan is that they. 8 Loan management process. Its personal loans can be a good P2P choice for most uses but its high debt-to-income DTI ratio cap of 50 make it particularly great for debt consolidation.

Both the borrower and the lender benefit from peer-to-peer loans. This is a practice that involves borrowing or lending money with the aid of an online platform that matches two individuals. The market share data in this article was taken from Malaysias P2P lending platform performance review done by Fintechnewsmy.

Peer-to-peer or P2P lending has created a financial revolution over the last several years by eliminating the middleman in loan transactions. Prosper is the P2P platform that started it all when it opened its doors in 2005 in the US that is. Have originated more than 48 billion in consumer loans from 2006 to 2018 and PricewaterhouseCoopers expects P2P lending to grow to 150 billion per year by 2025.

However all investments come with a risk and peer-to-peer lending in. All P2P lending platforms operating in Malaysia should be approved by SC as registered recognised market operators. The forms and documentation can be emailed and scanned back and forth.

Most P2P platforms allow all of this to be handled online. You can boost your chance of getting loan approved with. On peer-to-peer lending websites potential borrowers apply for credit receive a credit rating and.

Ive used four p2p lending sites through 2020 two for bad credit loans and two for improving my credit. P2P lending mobile app is a perfect way to connect with landers borrowers. An excellent credit score.

Below is the intro of SC approved P2P operators as at end Aug 2018. As is typically the case with investing greater rewards demand greater risk. P2P lending platforms in the US.

The loan application process works about the same on all but there are some unique features on a few that you dont want to miss. A P2P lending platform operator must be approved by the SC. I focus on the most successful FinTech lending model.

Most loans made on peer to peer lending platforms are for amounts between 2000 and. Before you start investing on a P2P lending platform check if it has been licensed under the SC. P2P Lending Knowing all the SC approved P2P operators.

This streamlines the process tremendously. P2P lending is an innovation to traditional financial loan. Find best P2P lending app of 2020 and know about their business model market growth source of revenue.

Based on SC requirements an operator must be incorporated under Companies Act 1965 with a minimum paid-up capital of RM5 million. As Funding Circles share price plummeted 24 per cent on its first day of trading on the London Stock Exchange its well worth reading this informative guide on Crowdfunding and P2P lending. There are strict guidelines on who these platforms can offer loans to.

What You Need To Know About Crowdfunding And P2P Lending. What You Need To Know About Crowdfunding And P2P Lending. P2P lending platforms in Malaysia.

First lets see how it works. Most of the loans offered within the framework of P2P are unsecured. The P2P platform will check your credit score history and various other parameters before qualifying your profile.

A UK current account is very likely to be protected by the FSCS meaning the first 85000 of deposits is effectively insured and risk-free. P2P lending can offer substantially higher rates than traditional banks and building societies though its not without risk. P2P lending is a form of crowdfunding that connects borrowers with lenders without the involvement of a financial institution.

Https Www Atlantis Press Com Article 125939928 Pdf

Peer To Peer Lending State By State

Finance Malaysia Blogspot P2p Lending Knowing All The Sc Approved P2p Operators

Pdf Regulation Of European Peer To Peer Lending Fintechs Regulatory Framework To Improve Sme S Access To Capital

Pdf Peer To Peer P2p Lending Platform Adoption For Small Medium Enterprises Smes A Preliminary Study

Https Dspace Mit Edu Bitstream Handle 1721 1 98986 921177765 Mit Pdf Sequence 1 Isallowed Y

Pdf Determinants Of Default In P2p Lending

Finance Malaysia Blogspot P2p Lending Knowing All The Sc Approved P2p Operators

Finance Malaysia Blogspot P2p Investment What Are The Differences Between Funding Societies And Fundaztic Platform

Finance Malaysia Blogspot P2p Investment What Are The Differences Between Funding Societies And Fundaztic Platform

Optimal Stackelberg Strategies For Financing A Supply Chain Through Online Peer To Peer Lending Sciencedirect

Finance Malaysia Blogspot P2p Lending Knowing All The Sc Approved P2p Operators

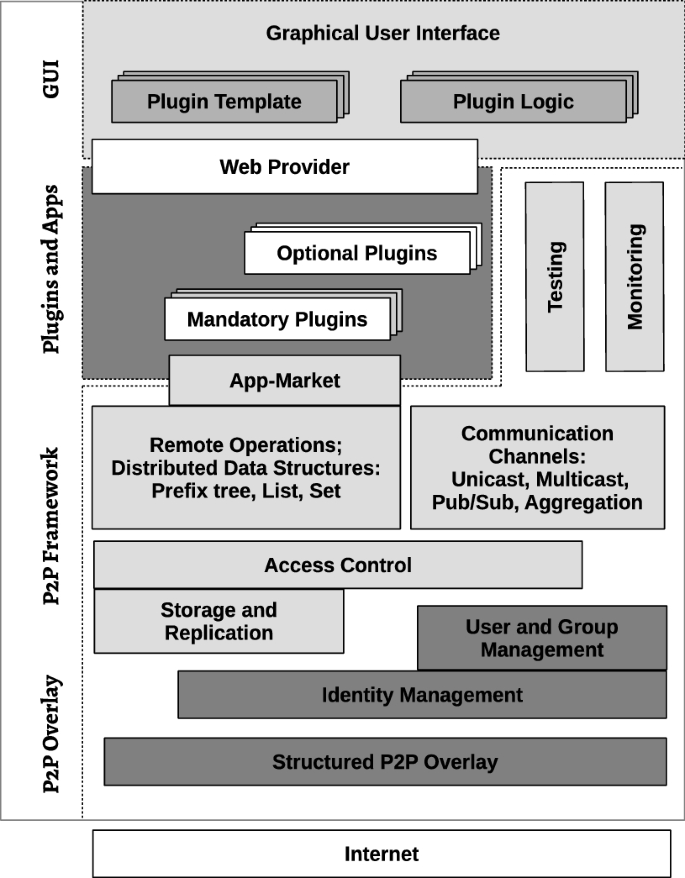

Peer To Peer Based Social Networks A Comprehensive Survey Springerlink

Finance Malaysia Blogspot Crowdfunding What Is P2p Financing And What S In It For Investors

Peer To Peer Lending State By State

Pdf Addressing Information Asymmetries In Online Peer To Peer Lending Fintech And Strategy In The 21st Century

New Page For Updates On The Recovery Of Funds Mintos Blog

Pdf Portfolio Selections In P2p Lending A Multi Objective Perspective

Pdf Peer To Peer P2p Lending Platform Adoption For Small Medium Enterprises Smes A Preliminary Study