Ordinary taxable income brackets for use in tax planning and filing 2010 tax returns due April 18 2011 the later date is due to a federal holiday in Washington DC. Lowered income tax rates at all levels of taxable income except the lowest bracket and lowered the income range for upper brackets.

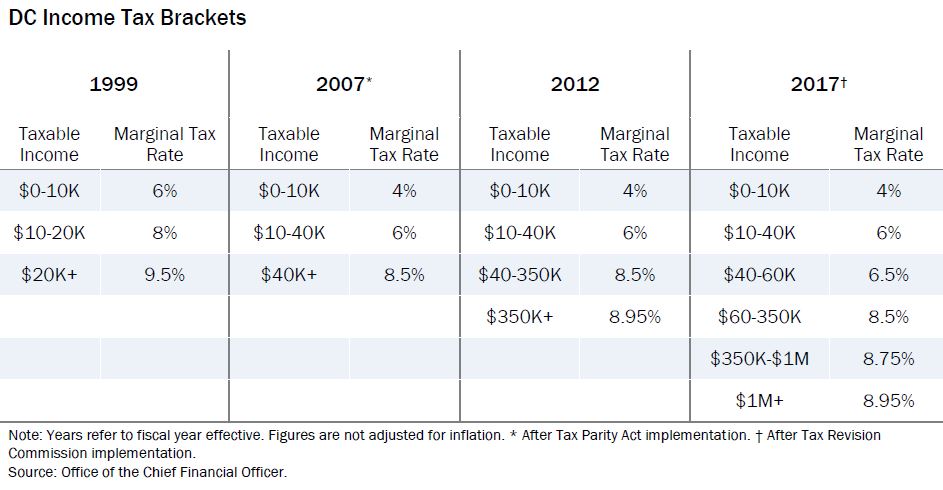

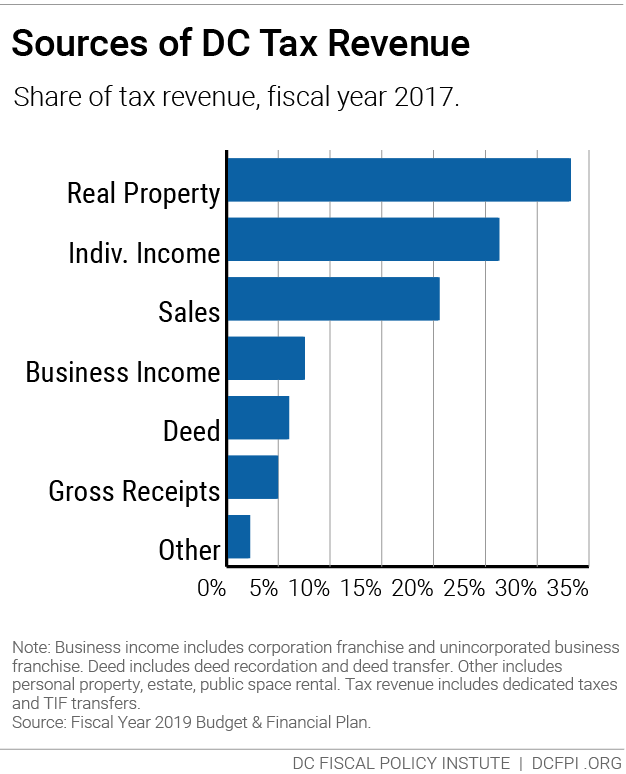

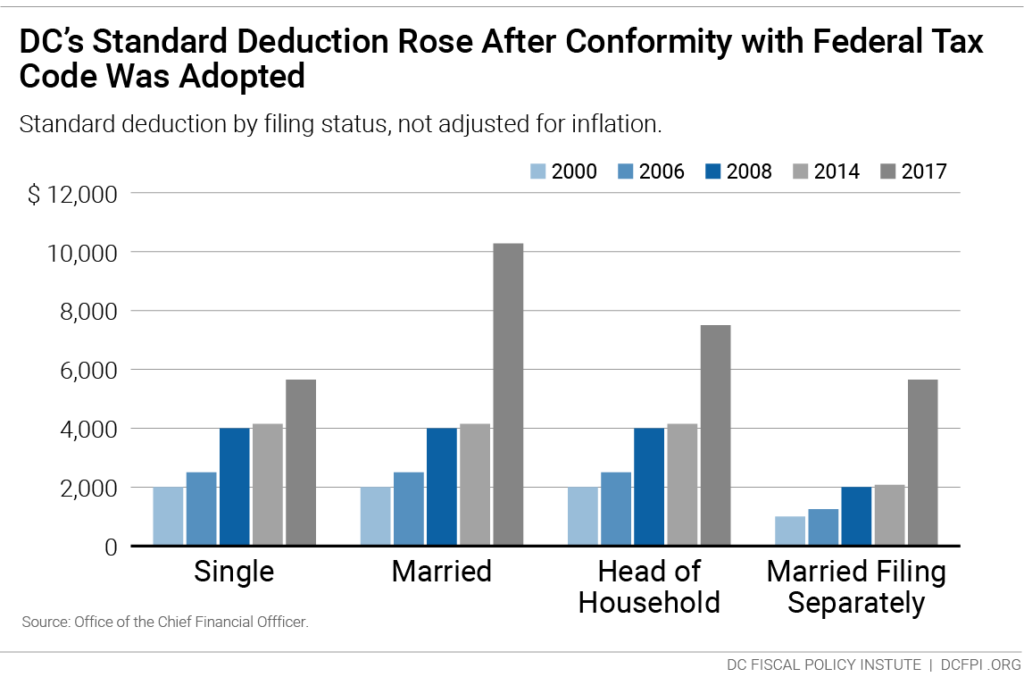

Taxes In The District The Evolution Of Dc Tax Rates Since The Early 2000s

REV-276 -- Application for Extension of Time to File.

Personal income tax 2010 residential. The Missouri Department of Revenue received more than 238000 electronic payments in 2020. Residential Property With effective from Year of Assessment YA 2009 Malaysian resident who acquired any residential property are given the specially designed tax relief of up to RM10000 a year for 3 consecutive years from the first year the interest is paid. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims.

Increased the credit from 1000 to 2000 per. For amended return mark this box. Please have a copy of your notice Federal and State tax returns and all W-2 forms available when you call.

Property tax relief credit from RI-1040H line 15 or 22attach form RI -1040H. 2010 estimated tax payments and amount applied from 2009 return. Tax-free exchange of rental property occasionally used for personal purposes.

What You Need to Know if You Hire Domestic Help - For tax year 2011. Prop Percent of Home Value. General Information about Individual Income Tax Electronic Filing and Paying Filing and paying taxes electronically is a fast growing alternative to mailing paper returns and payments.

REV-413 F -- 2010 Instructions for Estimating PA Fiduciary Income Tax for Estates and Trusts Only. Pay by creditdebit card or bank draft by phone at 1-877-252-3252. You can no longer claim a refund for Tax Year 2010.

General Information for Senior Citizens and Retired Persons - For tax year 2010. Exceptions to Requirement That Vermont Filing Status Must Mirror Federal Filing Status. Jerry Brown D has proposed a ballot initiative to re-enact the higher rates.

Then download print and mail the 2010 IRS Tax Forms to the address listed on the IRS and State Forms. Repealed personal and dependent exemptions which equalled4150 for each taxpayer spouse and eligible dependent in 2017. R-540INS 110 request for efund of louisiana Citizens Property insurance Corporation Assessment Louisiana Revised Statute 476025 allows a refundable tax credit to reimburse citizens who paid between January 1 2010 and.

Information for Income Tax Preparers - For tax year 2010. Individual income tax changes all of which expire after 2025. Information and online services regarding your taxes.

RHODE ISLAND 2010 RESIDENT INDIVIDUAL INCOME TAX RETURN First Name Spouses First Name. 59 5 cl. January 22 2009.

59 5 cl. Select your state s and download complete print and sign your 2010 State Tax Return income forms. PA-8879 -- 2010 PA e-file Signature Authorization.

Wisconsin Department of Revenue. Disallowance of Bonus Depreciation Provisions of Federal Economic Stimulus Act of 2008. Personal Income Tax 2010.

Individual Income Tax Decreases California s across-the-board addition of 025 to each tax bracket will expire on schedule on December 31 2010 after existing for two years. PA-8453 -- 2010 Pennsylvania Individual Income Tax Declaration for Electronic Filing. If an individuals Adjusted Gross Income for 2009 was less than 500000 and more than half of the gross income was from a business with fewer than 500 workers the estimated income taxes for 2010 estimated tax payments can be based on the lesser of 90 percent of tax liability for 2009 or 2010.

240 108 amending GL. However no property except property entitled to a pollution control abatement or a cogeneration facility 30 megawatts or less in capacity will be exempt if it is used in the manufacture or generation of electricity and it has not received a manufacturing. Download Property Taxes on Owner-Occupied Housing as Percentage of Median Home Value by State Calendar Year 2010 An Excel file and PDF are available at the bottom of the page.

Available for individual not related to employer who is hired after February 3 2010 and before January 1 2011 Individual must certify under penalties of perjury he or she was not employed for more than 40 hours in the 60-day period ending on the day the employee begins employment Amount of forgiveness for first quarter 2010 treated. If you meet certain qualifying use standards you may qualify for a tax-free exchange a like-kind or section 1031 exchange of one piece of rental property you own for a similar piece of rental property even if you have used the rental property for personal purposes. Individual 2010 income Tax For address change mark this box.

Complete the voucher at the bottom of your notice and mail check or money. New York States Real Property Tax Credit for Homeowners and Renters - For tax year 2010. 2010 Individual Income Tax Forms.

The top rate will drop from 1055 on income over 1 million to 103. 2010 tax rates Tax rate. RI 2010 income tax withheld from Sch W line 21 please attach forms W-2 1099 etc18A.

Using The Tax Structure For State Economic Development Urban Institute

Taxes In The District The Evolution Of Dc Tax Rates Since The Early 2000s

Historical Delaware Tax Policy Information Ballotpedia

The Top 1 Percent Pays More In Taxes Than The Bottom 90 Percent Tax Foundation

The Top 1 Percent Pays More In Taxes Than The Bottom 90 Percent Tax Foundation

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

No Income Tax But Watch Wait Until You Experience Toll Road Monopoly Moving To Florida Florida Florida Life

Taxes In The District The Evolution Of Dc Tax Rates Since The Early 2000s

Biden Tax Plan And 2020 Year End Planning Opportunities

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

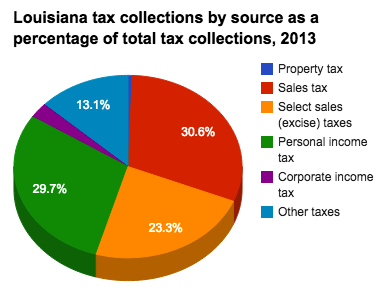

Historical Louisiana Tax Policy Information Ballotpedia

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center