The nations largest cable TV company tested the effect of a price reduction for premium movie channels. It lowered prices from 12 to 995 and found that the number of customers rose by almost 50.

Finance Malaysia Blogspot 2018

Along East River Road outside of the district boundaries is a slow sloped and curved progression towards the water and gentle slope with a sand beach at the end of and east of the road while the topography is steeper on the west side of the road overlooking the river.

Banks br blrbfr and indicative. However when banks are holding capital above the tier 1 capital level mandated by the Basel Accord and when loss rates are low regulators are reluctant to force regulations on banks. Value Value is comprised of Institutions that are classified as. You can get a 025 percent discount on your interest rate for owning a qualified Chase account another 012 percent.

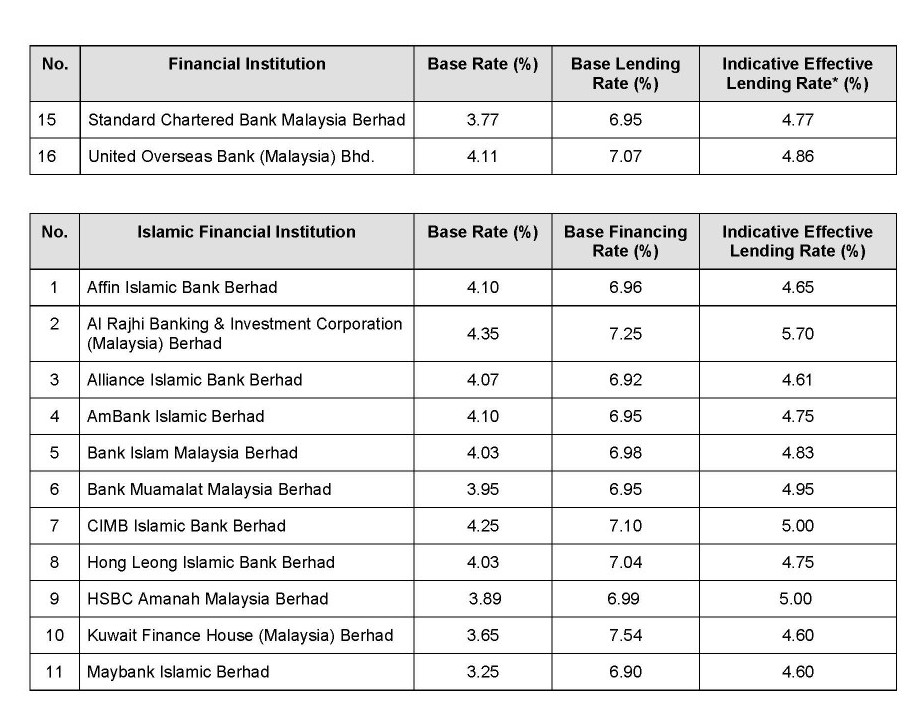

Parent bank and its non-US. Branches and agencies the banks parent holding company and majority-owned banking. Indicative effective lending rate refers to the indicative annual effective lending rate for a standard 30-year housing loanhome financing product with financing amount of RM350k and has no lock-in period.

These portfolios typically exhibit price-to-earnings price-to-book. BR Bank Reconciliation - an adjustment was made to your account for some reason. Bank Rate BR or Discount Rate and Inflation Bank rate BR is one of the most effective weapons employed by almost all central banks to control credit in the financial system.

Banks need an integrated approach if they want to evolve to become an integral part of their customers lifestyles. How about Islamic loans. According to Wikipedia - a bank reconciliation is a process that explains the difference on a specified d.

It is widely assumed that a change in Bank Rate brings corresponding change in the Market Rate too. The below table shows the total common equity tier 1 or CET1 capital requirements for each large bank. The demand for premium movie channels is elastic in this price range.

Branches and agencies should also be excluded from the FR 2900. Across the street is PS 81 and all within walking distance is the Riverdale YM-YWHA Key Foods Citibank and Chase BankPhotos may be our model unit and are indicative of typical finishes and floor plan Amenities. As at 6 August 2020.

Banks must disclose the measured changes in economic value of equity EVE and changes in net interest income NII under the prescribed interest rate shock scenarios set out in SRP31In disclosing Table IRRBBA and Template IRRBB1 banks should use their own internal measurement system IMS to calculate the IRRBB exposure values unless instructed by their. Left bundle branch block is important because it often indicates that some form of underlying cardiac. Left bundle branch block LBBB is an abnormal pattern seen on an electrocardiogram ECG.

Under its framework for large banksthose with more than 100 billion in total assetscapital requirements are in part determined by stress test results which provide a risk-sensitive and forward-looking assessment of capital needs. There is a direct relation between Bank Rate and Market Rate. You may want to check with your bank and ask for details.

More specifically it indicates that the cardiac electrical impulse is not being distributed across the ventricles of the heart in the normal way. 02 March 2018 Banks BR BLRBFR and Indicative Effective Lending Rates as at 19th Feb 2018 After the latest Overnight Policy Rate OPR hike by Bank Negara Malaysia BNM in January 2018 all the banks and financial institutions react to increase their lending rates accordingly. RHB Bank Bhd has trimmed its BR to 325 from 35 and its BLR to 62 from 645.

Core Value investors focus on buying companies at relatively low valuations on an absolute basis in relation to the market or its peers or in comparison to an individual stocks historical levels. Dogs and Cats Allowed. Several banks have reduced their base rate BR base lending rate BLR and fixed deposit FD following the 25 basis points bps cut in overnight policy rate OPR by Bank Negara Malaysia BNM on Tuesday.

Citizens Banks standard home equity line of credit has a 10-year draw period and a 15-year repayment term with a variable interest rate between 25. In contrast related depository institutions on the Call Report include the foreign head office and its US. Banks and gentle slopes.

Its deposit rates will also be lowered by 25bps. If a banks core and digital platforms are not seamlessly integrated it. Find seller financed Food Trucks Coffee Shops Cafes or other Newcastle WA Restaurants and Food Businesses.

Why Chase Bank is the best home equity line of credit for customer discounts. Browse Newcastle WA Restaurants and Food Businesses for sale on BizBuySell.

Finance Malaysia Blogspot 2018

Finance Malaysia Blogspot Banks Br Blr Bfr And Indicative Effective Lending Rates As At 19th Feb 2018

All About Br Base Rate And Blr Base Lending Rate In Malaysia Propertyguru Malaysia

Finance Malaysia Blogspot 2018

The Latest Base Rate Br Base Lending Rate Blr And Base Financing Rate Bfr As At 21st December 2018 Malaysia Housing Loan

Finance Malaysia Blogspot Banks Br Blr Bfr And Indicative Effective Lending Rates As At 19th Feb 2018

Finance Malaysia Blogspot 2018

Latest Base Rates Br Base Lending Rate Blr Interest Rates Mypf My

Https Www Bnm Gov My Documents 20124 914558 Br Table For Bnm Website Pdf 29adaefc 5c22 A0b8 76e4 306dcd16d9b4 T 1598215007277

Latest Base Rates Br Base Lending Rate Blr Interest Rates Mypf My

What To Know About Base Rate Br Base Lending Rate Blr Spread Rate When Selecting A Home Loan Iproperty Com My

Finance Malaysia Blogspot 2018

All About Br Base Rate And Blr Base Lending Rate In Malaysia Propertyguru Malaysia

Latest Base Rates Br Base Lending Rate Blr Interest Rates Mypf My

Finance Malaysia Blogspot Banks Br Blr Bfr And Indicative Effective Lending Rates As At 19th Feb 2018

The Latest Base Rate Br Base Lending Rate Blr And Base Financing Rate Bfr As At 21st December 2018 Malaysia Housing Loan

Finance Malaysia Blogspot 2018

Finance Malaysia Blogspot 2018

Finance Malaysia Blogspot Banks Br Blr Bfr And Indicative Effective Lending Rates As At 19th Feb 2018