Policy loans are borrowed against the death benefit and the insurance company uses the policy as collateral for the loan. Life Insurance for Individuals.

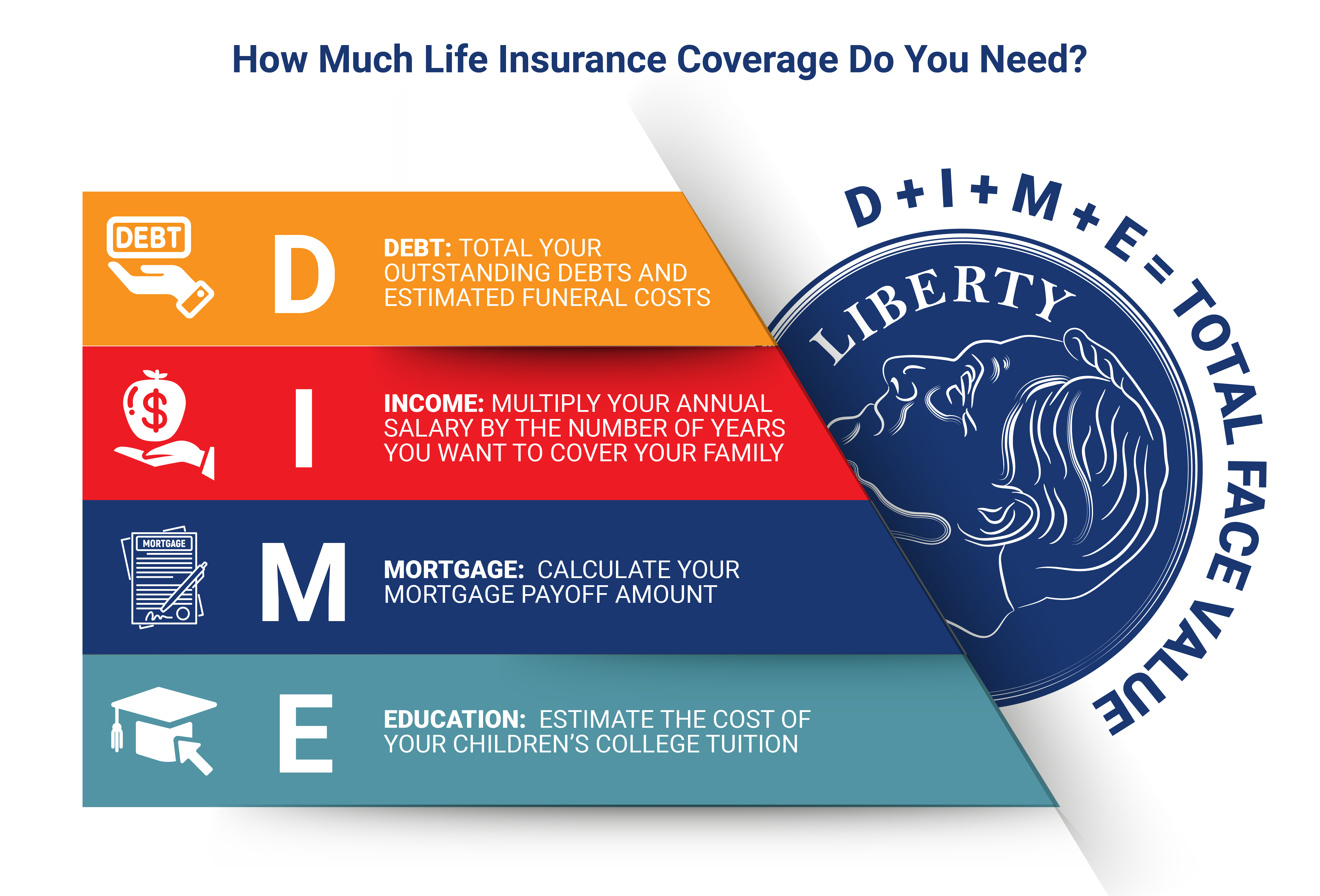

How Much Does Million Dollar Life Insurance Cost Who Needs It

If you decide to take out a loan against your policy you are generally not obligated to pay it.

Can i borrow against my prudential life insurance policy. This percentage varies for different products and does not take into account any outstanding unpaid premiums. And if you borrowed your entire cash value this means your beneficiaries could be left with nothing which would totally void the life insurance aspect of your policy. During the 2015 taxation year he borrowed money from London Life against those two life.

Permanent life insurance can help with business continuation when a partner or key employee dies. You can take out a loan against the policy or you can simply cash out your policy and take the full amount. Yes the maximum loan amount is 80 or 90 of the accumulated policy values.

In this scenario youre not borrowing directly from your policy but the policy is your collateral. If you need cash you might be able to borrow against your life insurance policy. When you borrow based on your life insurance policys cash value you are borrowing money from the life insurance company.

Borrowing against your life insurance policy can impact your beneficiaries. It can take many years to build up any significant cash value in a permanent life insurance policy. Our program works with all types of life insurance policies including the Federal Employees Group Life Insurance FEGLI Program.

Special circumstances may allow a. Health Insurance for Individuals. Learn more about taking a loan out on a term life insurance policy.

Current rates can be much lower than traditional loans through banks. That is depending on what kind of policy you have. Can I apply for a cash loan against my policy.

If you dont pay it back before you die your insurer will take the money out of the death benefit. Permanent life insurance can be used to fund non-qualified retirement plans. Borrow from a life insurance policy if you must but try to avoid making surreptitious loans for things like a vacation or other non-essential uses.

How much you can borrow from a life insurance policy varies by insurer but the maximum policy loan amount is typically at least 90 of the cash value with no minimum amount. How Much Can You Borrow from a Life Insurance Policy. You can also cash out a permanent policy but doing so also leaves you without coverage.

In the early years of the policy there may be little value if any to borrow against Risk of. It is not possible to take out a loan against a term policy because it only offers pure death benefit protection and does not have any cash value. You should never use a life insurance policy to fund an uncertain enterprise such as a trip to Las Vegas even if you think you will be able to recoup the money immediately.

You can borrow against a permanent life insurance policy with a cash value. It can offer you advantages over credit card debt or personal loans from a bank. If you have term life insurance you cant take out a life insurance loan.

There are several distinct advantages to borrowing against a life insurance policy. Investments Life Insurance Retirement Planning for Individuals. Borrow from the policy Many policies allow you to borrow against the cash value.

Borrowing against life insurance may be easier than getting a loan elsewhere because theres no credit check and a. You cant borrow against them and if you decide to surrender a term life insurance policy you wont receive money in return. Life Insurance Retirement Investments for Individuals.

For the most part you can borrow against a permanent life insurance policy since it has a cash surrender value. LINK by Prudential for Individuals. It can also help facilitate the exchange of business ownership in the event of your or a partners retirement disability or deathwithout depleting the business capital.

When you need cash for a big expense such as college tuition a loan from your life insurance policy can be a saving grace. If you are interested in borrowing against your term or group life insurance policy please contact us. A life insurance loan is only available in cash value policies such as whole life insurance universal life insurance or variable universal life insurance.

X Research source As for term life policies these are not loan sources since they dont have a cash value that can be borrowed. Workplace Benefits for Individuals. The case involved a taxpayer who held two life insurance policies with London Life.

Interest rates when borrowing from a life insurance policy are often lower than other sources. A case Neszt vThe Queen 2019 TCC 139 decided this past summer however shows that there can be a dramatic difference from a taxation point of view between taking a policy loan versus taking a loan against the policy. If you need cash your life insurance.

You can only borrow against a permanent or whole life insurance policy.

Here Are 15 Reasons Why You Should Review Your Life Insurance Policy Annually A Must Read Life Insurance Policy Insurance Policy Insurance

:max_bytes(150000):strip_icc()/life_insurance_151909996-5bfc371046e0fb005147a943.jpg)

How Cash Value Builds In A Life Insurance Policy

Why Persistency Ratio Matters In Insurance

Common Types Of Life Insurance Infographic Whole Life Insurance Life And Health Insurance Insurance Infographic

The Impossible Search For No Load Life Insurance Agency One

What Is Modified Whole Life Insurance Secrets Revealed

The Ultimate Guide To Life Insurance The Dough Roller

Life Insurance Policy Review Review Your Life Insurance Policy

How Does Life Insurance Work Forbes Advisor

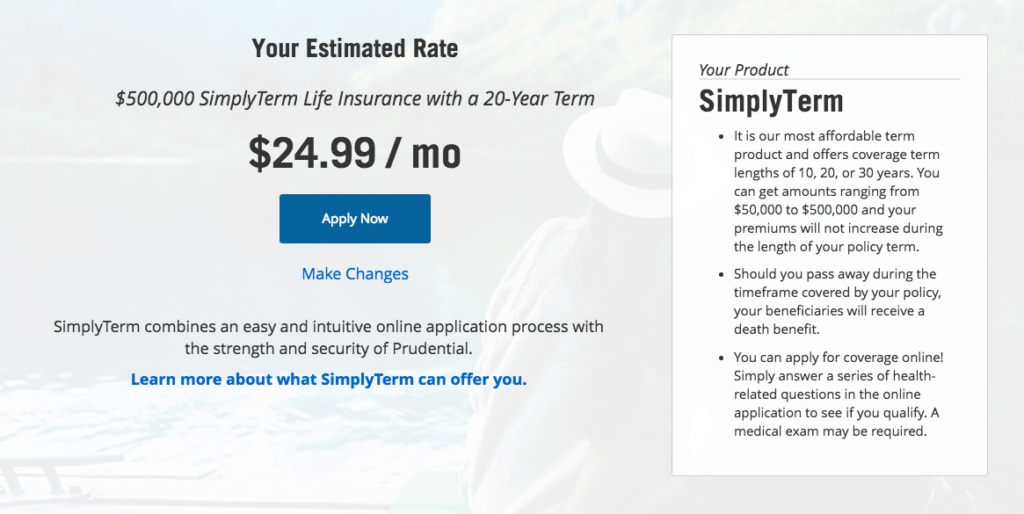

Prudential Whole Life Insurance Review Get Online Quote

Review Your Life Insurance Coverage Will It Last Forever

Prudential Pruterm Worklife 65 Review Thetruthaboutinsurance Com

Whole Life Insurance Faqs What S The Best Way To Compare Whole Life Insurance Policies

/shutterstock_241803703-5bfc3d8b4cedfd0026c592da.jpg)

How Can I Borrow Money From My Life Insurance Policy

Collateral Assignment Life Insurance Policy Sample Form Life Insurance Policy Insurance Policy Insurance

Life Insurance Policy Loans Tax Rules And Risks

![]()

Term Life Insurance India Compare Buy Insurance Plans Car Life Health Term Plan

Group Life Insurance Who Is Issued A Certificate Of Insurance Mlshara

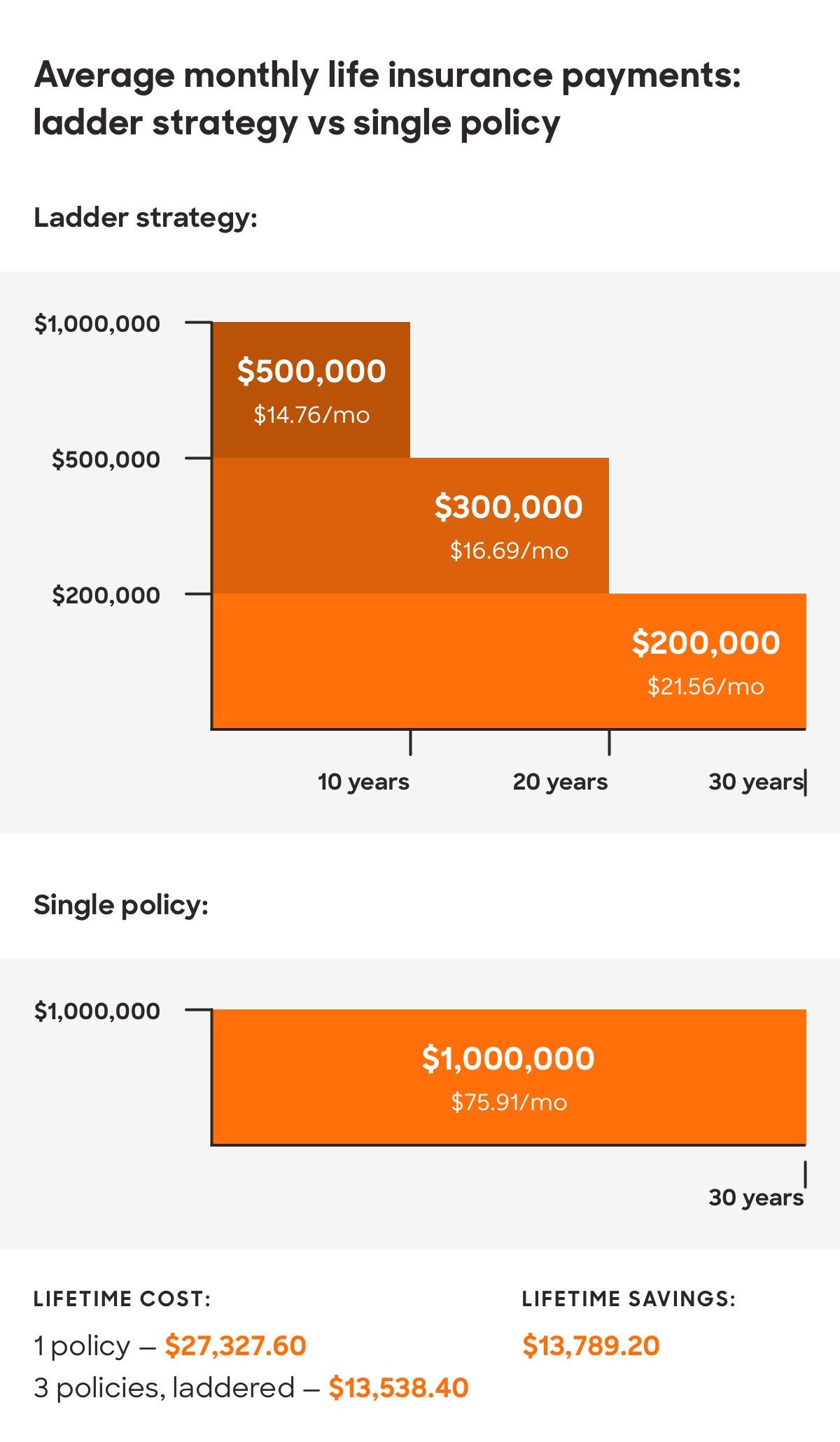

How To Save Money On Life Insurance With The Ladder Strategy