Generally where the Rental Relief Framework applies the rental waivers may be offset partially or otherwise against any monetary payments or rental reductions provided or earlier agreed to by the landlord and the tenants on or after 1 February 2020 as well as any property tax rebate that owners have passed on or are obliged to pass on to their tenants on or before 31 July 2020 in respect of the property. As a result your clients may ask you about what they can claim this tax time.

Covid 19 Crisis May Affect Tax Angles For Rental Property Losses Mlr

Our website provides some frequently asked questions FAQs and other information to help you and your clients understand their rental property obligations and what information your clients need to give you in order to lodge correctly.

Covid 19 tax relief for rental property owners. The government has implemented stimulus measures to combat the economic impact of the COVID-19 pandemic including tax relief provisions under the CARES Act that could benefit property owners and real estate-related businesses. Affected by the COVID-19 pandemic The Franchise Tax Board FTB has announced special tax relief for California taxpayers affected by the COVID-19 pandemic. Owners of rental properties suffered major financial difficulties during the COVID-19 pandemic.

Paying or Collecting Rent Tenants who are asked to self-isolate or who cant work may have difficulty affording their rent. Net operating losses carried back 5 years. Whether your loan is owned by the government a national or state charter bank or private institution you may be.

The type of benefit you are eligible for depends on the type of rental income you incur. In coordination with the State of California Citigroup JP Morgan Chase US Bank Wells Fargo and close to 200 state-chartered banks credit unions and servicers have committed to providing relief for single- and multifamily rental property owners in California. COVID Relief Hotline Call 213 351-8450 for 24x7 support via SMS text and live support between 830 am.

Bills tax relief rental supports and the health and safety information listed on this page is meant to support tenants and property owners minimize COVID-19 pandemic impacts. CRA has put together many emergency response benefits to help individuals and business owners. Tax Relief for Rental Real Estate Owners with COVID-19.

Stimulus property tax relief. Ppp for rental property owners. Theres a large list of government-sponsored and private relief programs to help US.

On Friday the president signed the COVID-19 aid relief and economic stimulus package known as the CARES Act providing a 2 trillion stimulus package which includes 349 billion allocated to small businesses expands unemployment insurance payments provides certain tax. Outside of federal and state deadline changes landlords should know about the following COVID-19 tax relief options. The deadline for making individual retirement account IRA and health savings account HSA contributions for the 2019 tax year has also been moved to July 15th.

On financial relief programs available to REALTORS. You must own your rental properties under an LLC and should apply for relief as a business with not more than 500 employees. Please refer to the COVID-19 Temporary Measures Rental.

If you live in a rental property thats financed by Fannie Mae you may qualify for additional rental support through its Disaster Response Network. Rental property owners in need of emergency financial assistance have access to various federal and state programs. The federal state and local governments announced several protections.

Stimulus and Relief Packages for Property Owners and Businesses. Office industrial properties owners are obliged to provide rental relief for a period of. Shops owners are obliged to provide rental relief for a period of up to 4 months from April to July 2020.

The second Amending Finance Law adopted on Thursday 23 April 2020 allows a landlord to deduct from its taxable profits the loss resulting from a rent waiver without the said. Whether your loan is owned by the government a national or state charter bank or private institution you may be eligible to reduce or delay payments for up to 12 months. With the help of HUD-approved housing advisors renters affected by COVID-19 can get help with their housing.

Affected taxpayers are granted an extension to file 2019 California tax returns and make certain payments until June 15 2020 in line with Governor Newsoms March 12 Executive Order. Households affected by COVID-19. For other non-residential properties eg.

Many residential rental property owners have had their rental income affected by COVID-19. Property owners impacted by COVID-19 may be eligible for temporary reliefThe federal state and local governments announced several protections. Property owners impacted by COVID-19 may be eligible for temporary relief.

For many rental property owners the tax kicker is the depreciation deductionThat is the cost of a rental building not the land can be depreciated over 275 years for a residential building and over 39 years for a commercial building even while the property increases in value over time. For qualifying commercial properties eg. Covid-19 Tax incentive for landlords to waive rent adopted version 27 April 2020.

Below are financial aid programs currently available to US. That in turn could allow cities counties and states to provide property tax relief for homeowners and still have access to funding for administration schools and other services. See our FAQ for Rental Property Owners for more information.

Rental property owners who are struggling due to the COVID-19 crisis may be eligible for a 90-day grace period for all mortgage.

Rental Property Management Spreadsheet Template Rental Property Management Rental Property Rental Property Investment

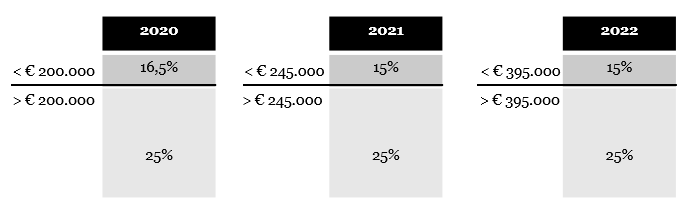

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

No Transfer Tax For First Time Buyers From 2021

No Transfer Tax For First Time Buyers From 2021

How To Manage Rental Properties A Simple Step By Step Guide

Rental Income Tax Guide Covid 19 Tax Relief More

Rental Income Expense Worksheet Rental Property Management Rental Income Real Estate Investing Rental Property

How To Save Tax On Rental Income Deductions Calculations Procedure

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Iras Rental Relief Framework Reporting Ya 2021 Rental Income By Individuals Who Are Owners Of Non Residential Properties

Pin On Spanish Life Properties

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

5 Reasons You Should Hire A Property Manager For Your Rental Home Rental Property Management Property Management Being A Landlord

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Rental Properties Which Expenses Can You Claim

Types Of Taxes In The Netherlands I Amsterdam

Rental Property Tax Deductions Property Tax Deduction

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips