If youve done that and your employer is paying you back normally this would be a benefit in kind which means youd need to pay tax and national insurance on it. Coronavirus relief checks wont have to be repaid feds say.

Updated Employer Tax Credits Under The Ffcra And The Cares Act Sequoia

You should only do this if youre not making another claim.

Do i have to pay back the coronavirus tax relief. Eligibility criteria for interest relief. It is not taxable income it is essentially a credit Wilson said. 2 You may have to pay back the IRS if youre not qualified but getting relief cash Credit.

And it likely will approve trillions more in future stimulus in the coming months. Trump signs executive orders enacting 400 unemployment benefit payroll tax cut after coronavirus stimulus talks stall Payroll taxes will be deferred but only for a few months Its true. Your payment may be delayed if.

You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week. Congress is about to add nearly another 500 billion to the more than 2 trillion it already spent to fund coronavirus relief. IRS confirms the stimulus check is not taxable On their Economic Impact Payment - the official name for the stimulus payments under the Coronavirus Aid Relief.

But specifically for those working from home because of coronavirus for the 202021 tax year ending 5. Experts have warned those no longer eligible for the payment based on their 2021 tax return may want to opt out ahead of time - or risk have to repay the IRS. Under the new system taxpayers who still owe money to the government will.

For most people the payments from the IRS will amount to 1200 for individuals and 2400 for married couples filing jointly. COVID-19 Payroll Tax Relief - Credits and Deferral. The IRS is asking the following to return their coronavirus stimulus checks.

You must file your 2020 tax return to qualify for this interest relief. Tax Guy Coronavirus stimulus-package tax relief. People will receive an.

I will have to pay back the stimulus check next tax season. The Families First Coronavirus Response Act FFCRA provides 100 of the funds needed by employers with fewer than 500 employees to pay. April 6 2020 at 1141 am.

Coronavirus 1000 relief check plan not even final yet and experts say fraudsters are already looking to cash in. Coronavirus-related Relief for Retirement Plans and IRAs For qualified individuals the CARES Act allows up to 100000 of coronavirus-related distributions to be excluded from the additional 10 tax on distributions from eligible retirement plans and IRAs. Electing employees may not claim a charitable deduction for the value of the donated leave.

Yes the value of leave donated in exchange for amounts paid before January 1 2021 to organizations that aid victims of COVID-19 is excludable from an employees income for California income tax purposes. The IRS unveiled new debt relief options on Monday for taxpayers still reeling from the coronavirus pandemic. You must use the online service to get your payment reference number before you can pay HMRC back.

Family members of deceased individuals for the deceased persons portion Incarcerated individuals. So if you were able to get the stimulus check last year or early this year for the second round you already. Interest relief if you received COVID-19 benefits Interest relief on 2020 taxes owing will be given to people who have a total taxable income of 75000 or less in 2020 and received at least one COVID-19 benefit in 2020.

Perhaps it is a good time to start thinking about how. Many businesses that have been severely impacted by coronavirus COVID-19 qualify for employer tax credits the Credit for Sick and Family Leave the Employee Retention Credit and Paid Leave Credit for Vaccines. Two COVID-19 aid packages recently became law that deliver federal assistance to employers by providing them credits against their payroll taxes.

As part of the governments ongoing coronavirus response people who already have installment agreements did not have to make payments due between April 1 and July 15 2020. Read our stimulus checks live blog for the latest updates on Covid-19 relief. Withdraw 100K from your IRA and repay in 3 years with zero tax liability Published.

This includes if you have to work from home. Videos and reports claiming that youll have to pay back the relief checks the federal government is sending to.

Nj Property Tax Relief Program Updates Access Wealth

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Income Tax Rebate Tax Rebate Under Section 87a Hdfc Life

Irs Penalty Calculator Infographic Tax Relief Center Budget Planner Irs Budgeting

Mortgage Interest Tax Deduction What You Should Know Nextadvisor With Time

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

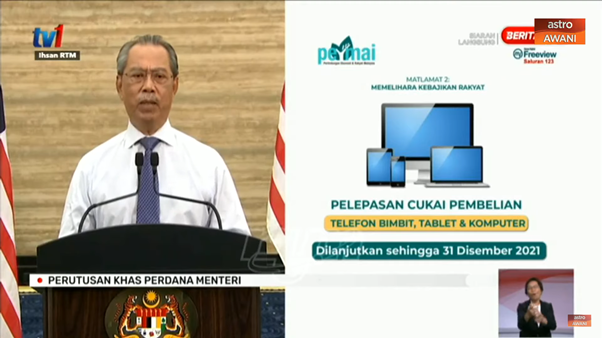

Govt Extends Tax Relief For Phones Computers Includes Covid 19 Tests For Medical Tax Relief

Irs Releases Draft Form 1040 Here S What S New For 2020 Irs Forms Tax Return Income Tax Return

Have You Received An Additional Letter About Your Tax Credit Renewal From Hmrc Low Incomes Tax Reform Group

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

Tax Credits And Coronavirus Low Incomes Tax Reform Group

2 Provisions That Allow For 100 000 Tax Free Ira Borrowing The Borrowers Tax Free Tax Deductions List

Tax Overdue Tax Debt Relief Tax Debt Irs Taxes

![]()

Coronavirus Home Page Taxpayer Advocate Service

Digital Services Dealing With Your Tax And Tax Credits Online Low Incomes Tax Reform Group

Almost 800 000 Tax Relief Claims For Working From Home Gov Uk