It can simply pass along higher costs. High inflation would cause investors to want to safe guard their investments by buying gold stocks.

How To Prepare For Inflation 8 Actionable Tips

Good inflation-hedging investments include stocks TIPS and tangibles like gold or real.

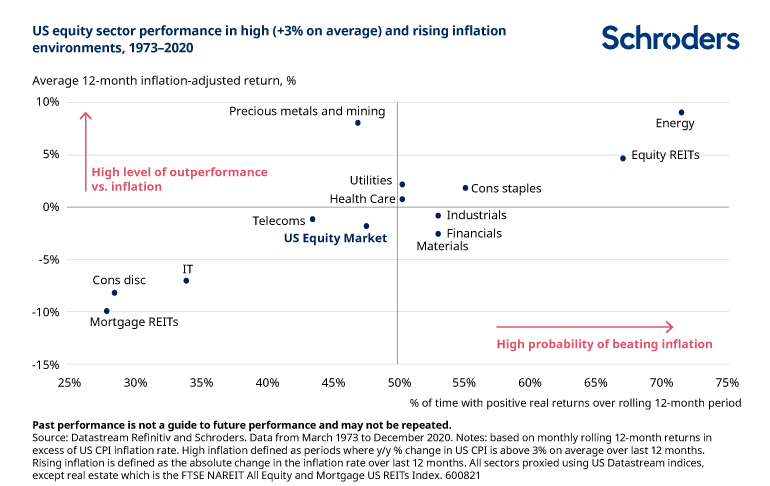

Best sectors to invest during high inflation. Investors turn to safe haven investments such as gold stocks when they see high inflation in the economy. Real estate performs well because landlords and property owners see the values of their. Other hedges to inflation include investing in real estate gold and even cryptocurrencies advisors say.

Real estate investment trusts REITs could also provide protection against inflation. Exposure to companies in the natural resources sector can provide a hedge against inflation. But its unlikely to see much of a boon from a rise in inflation.

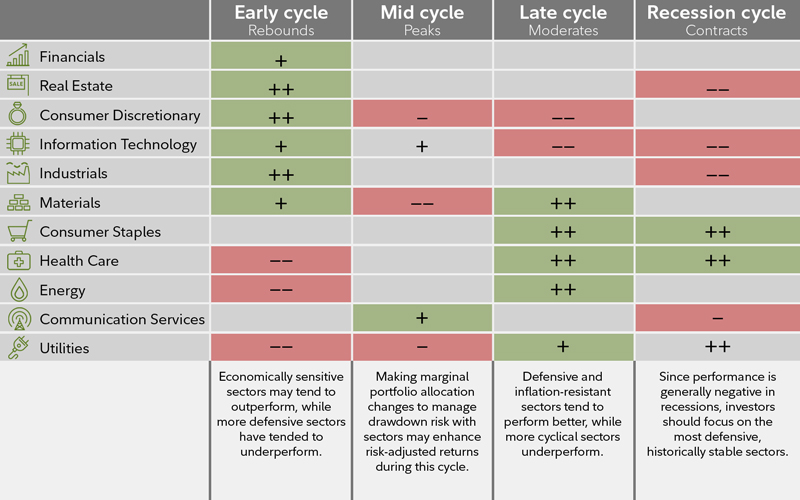

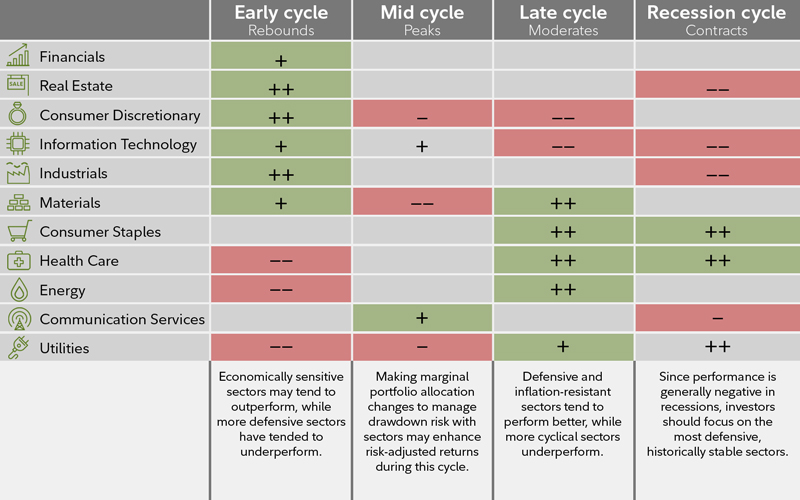

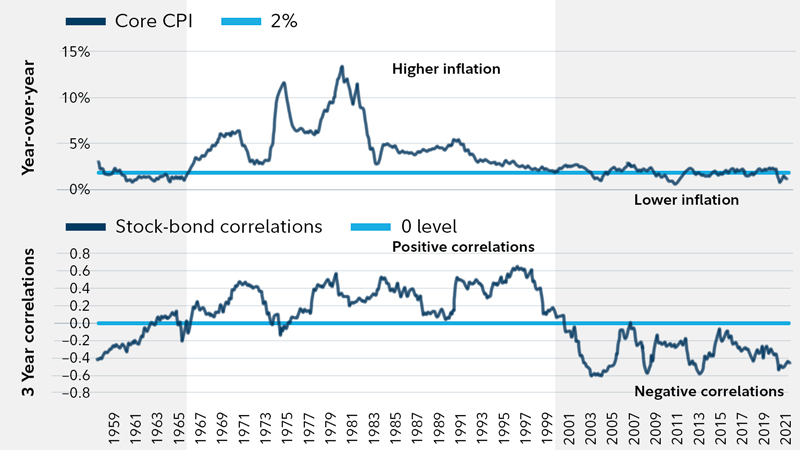

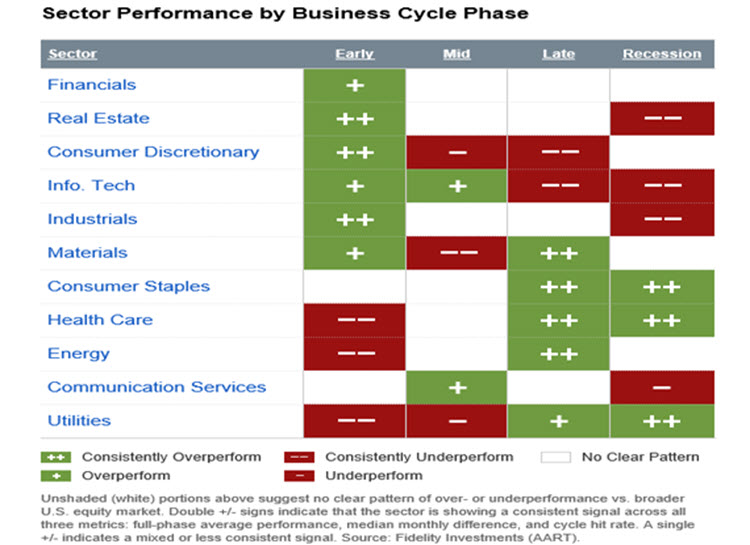

The principal value of TIPS is tied to changes in. Among the indexs 12 sectors energy 049 and industrials 034 are the most positively correlated while communication services -028 healthcare -024 and consumer discretionary -021. The best sectors in this phase include energy utilities healthcare and consumer staples.

These businesses include metals and mining agribusiness and energy. A simple generalization is that the transportation sector tends to do just fine amid a rise in inflation. The Federal Reserve dismissed inflation.

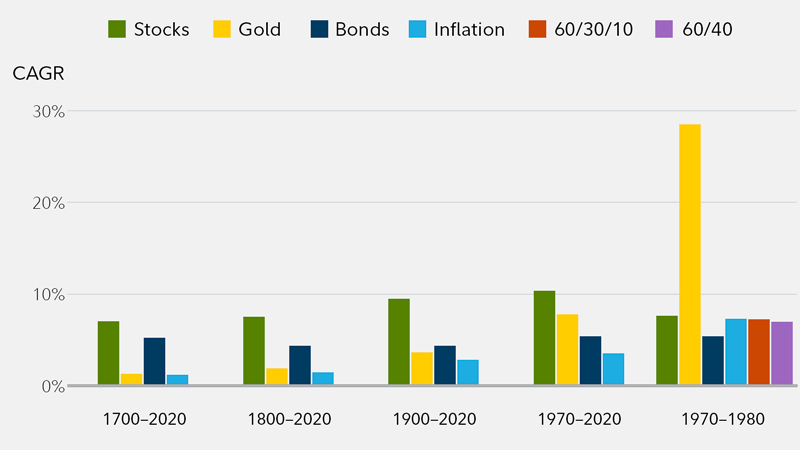

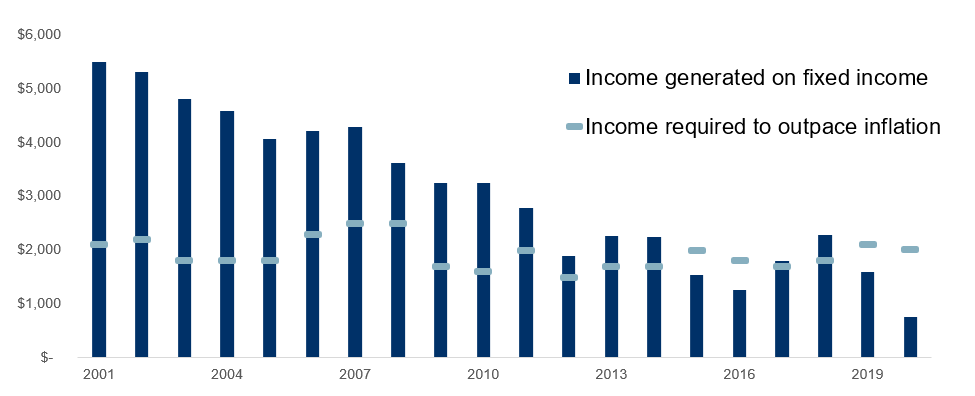

While its true that money market funds currently pay next to nothing theyre the cash investment of. ETFs that have natural resources sector exposure can also provide a hedge against inflation. Gold has historically been a popular commodity for protecting your investment portfolio against inflation.

You can also opt to invest in a mutual fund or exchange traded fund ETF that specializes in gold. Now betting on any individual commodity may. If you suspect that inflation will be a factor in the future its best to keep any cash-type investments in money market funds or a high-interest cash account like Unifimoney.

Real estate might also benefit from being a hard asset Thornton said noting that many categories within the sectorhotels self-storage apartmentsare. Treasury Inflation-Protected Securities are the most straightforward way to protect against a potential increase in inflation says Arnott. That makes this sector easy to look past for inflation stocks.

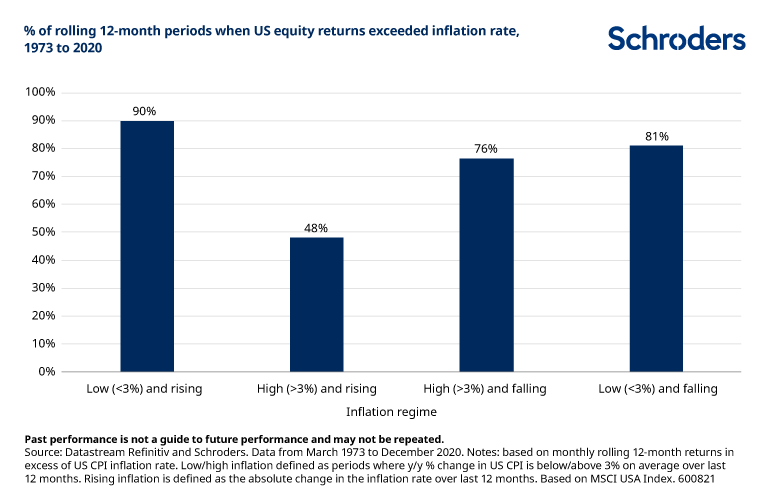

Relative to fixed income and equities hard assets are typically regarded as an inflation hedge. Many investments have been historically viewed as hedgesor protectionagainst inflation. The stock market took a hit when the US.

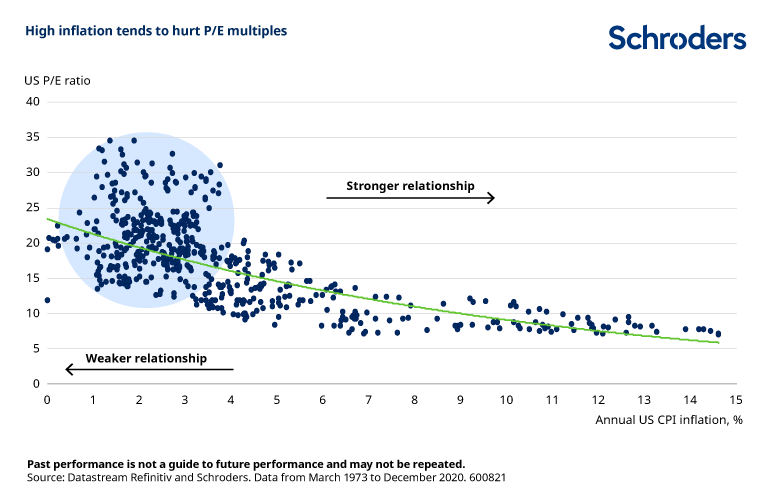

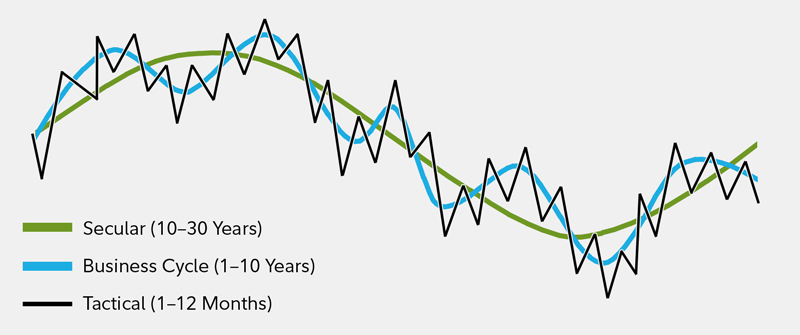

Investing for inflation involves picking assets that appreciate are tangible or pay variable interest. Growth is slowing and begins to appear overheated in this phase as inflation climbs higher and stock prices begin to look high compared to earnings. Since gold prices coincide with inflation by investing in gold you have a.

Gold traditionally is an investment commonly held when there is economic instability. Whether energy metals agricultural goods or other commodities most tend to rise during times of high inflation. Department of Labor recently reported the consumer price index jumped 42 in April its largest gain since 2008.

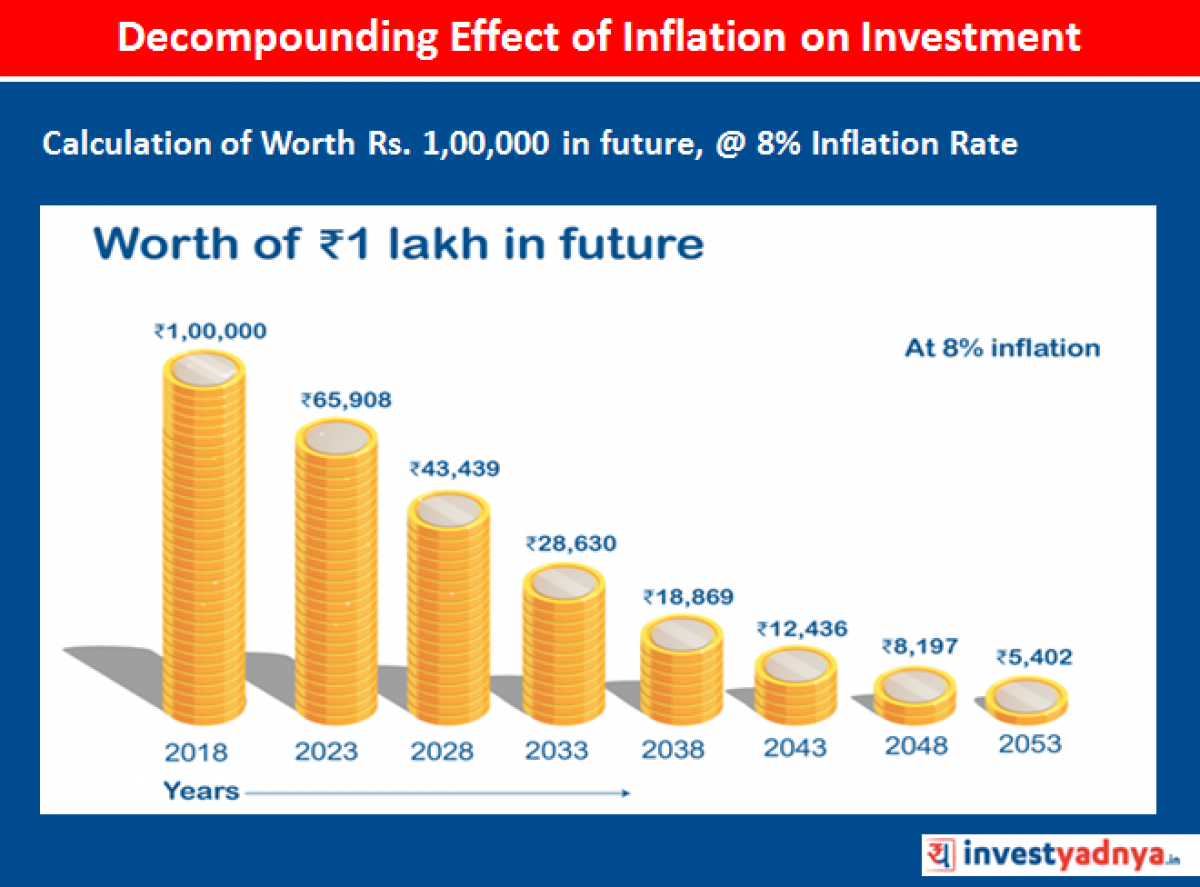

Effects Of Inflation On Investments

Which Equity Sectors Can Combat Higher Inflation Cityam Cityam

Which Equity Sectors Can Combat Higher Inflation Cityam Cityam

How To Hedge Against Inflation 5 Best Investments

Effect Of Inflation On Investment Yadnya Investment Academy

/inflation1-af8fc85b3d3f46eabd3477b6efd8055d.jpg)

Inflation S Impact On Stock Returns

The Business Cycle Equity Sector Investing Fidelity

How To Invest If Inflation Surges

6 Sectors Which Benefit From High Inflation Fairmont Equities

How To Protect Your Money From Inflation Portfolio Plan Fidelity

Warren Buffett Explains How To Invest In Stocks When Inflation Rises

How To Defend Against Inflation Financial Times

How To Protect Your Money From Inflation Portfolio Plan Fidelity

The Business Cycle Equity Sector Investing Fidelity

Sector Rotation Strategies Fidelity

Which Equity Sectors Can Combat Higher Inflation Cityam Cityam

/dotdash_INV-final-Inflation-Trade-May-2021-01-fd06eca0c9f2471f9555cd138890ab0e.jpg)