The amount of federal and state income taxes withheld can depend on your income and how many allowances you claim on your W-4 form. The MLS is an additional 1-15 tax paid by high income earners singles earning over 90000 and couples over 180000 who dont have private hospital cover.

How Much Does Individual Health Insurance Cost Ehealth

Lower insurance premiums through your health insurer or.

Do you pay less tax if you have private health insurance. Check how your employer works out how much tax to deduct from your pay. You usually pay tax on the cost of the insurance premiums if your employer pays for your medical insurance. Since there are Basic-tier hospital policies that cost less than this if youre on a high income if you can reduce.

You have private health insurance that provides hospital cover general treatment extras cover or both. Your income is below a certain limit. Not only do you get to delay paying the taxes theres a small amount of value there available to anyone but when you pay them you pay them at a lower rate a moderate amount of value there.

If you are eligible for the rebate there are two ways you can claim. Healthcare cover is subject to IPT at the standard rate which from June 1st 2017 is 12. Youre right in that you would have paid tax on your company Health Insurance scheme.

As a premium reduction through your private health insurer you pay less upfront to your insurer. For many Australians private health cover makes good sense. Is the healthcare cover subject to Insurance Premium Tax IPT.

Because you waited 10 years past the age of 30 to apply youll pay 20 more for your private health insurance. This can knock as much as 33 off your premiums. In some cases the insurer will lower your premiums based on what you.

HMRC will normally change your tax code to collect the right amount of tax over the year. The prior tax penalty for not having health insurance in 2018 was 695 for adults and 34750 for children or 2 of your yearly income whichever amount is more. A good quality policy looks after your family and provides the security that your family will be looked after quickly when needed.

The amount you will pay in additional tax for not having insurance starts at a minimum of 900 a year Ms Koch says. Or as a tax offset when lodging your annual tax return. It begins at 900 a year for singles and increases the more you earn.

Firstly HMRC taxes Private Health Insurance differently depending on whether its a personal plan or Group Health Insurance your employer offers. But if your employer. When you provide healthcare cover to your employees its considered a benefit in kind.

The federal tax penalty for not being enrolled in health insurance was eliminated in 2019 because of changes made by the Trump Administration. As of 2017 the total Social Security and Medicare tax rate is 153 percent. On the upside if youve held private health insurance for ten continuous years your loading will be removed and will remain at 0 for as long as you retain your hospital cover.

Instead the relief is automatically given as. The health insurance exchange. Health insurance isnt tax deductible but there are a bunch of ways you can pay less tax.

You get the rebate as. Will my employees need to pay on their private healthcare cover benefit. HOW HEALTH FUND PREMIUMS CAN BE SLASHED ONE IN TEN PEOPLE TO AVOID APRIL 1 PREMIUM RISE.

You can deduct your health insurance premiumsand other healthcare costsif your expenses exceed 75 of your adjusted gross income AGI. Your employer must pay half of that so youll see 765 percent automatically withheld from each paycheck. A good way to pay less tax.

These plans may not count as private health insurance options such as short-term plans and catastrophic coverage may offer different benefits but may not count as a qualified health plan under the Affordable Care Act. However as a general rule of thumb theres no tax due on a personal policy. Your taxable income for MLS purposes is over the income threshold and you have approved hospital insurance see below for you and all of your dependents with a registered health insurer.

Employees will need to pay tax on the benefit amount. An offset in your annual tax return this reduces the tax you have to pay. For instance you may be entitled to the private health insurance rebate or offset.

From 1 April 2019 the total yearly front-end deductible or excess on the policy can be no greater than 750 for singles and 1500 for familiescouples. If your employer pays for your medical insurance youll need to pay tax on it. First things first if you pay for private health insurance youre entitled to benefit from tax relief at a rate of 20 per cent on the cost of the premium.

However you dont have to claim this relief from Revenue in order to benefit. Appreciation is also taxed at long-term capital gains rates but well get into that more in. Until 2018 you might have had to pay a tax penalty if you had a plan that did not count as qualifying coverage.

See below Does private cover work. If you want to claim your rebate as a reduced premium contact your insurer. Before ditching your private health insurance check if you will have to pay the Medicare Levy Surcharge.

Different Types Of Health Insurance Plans

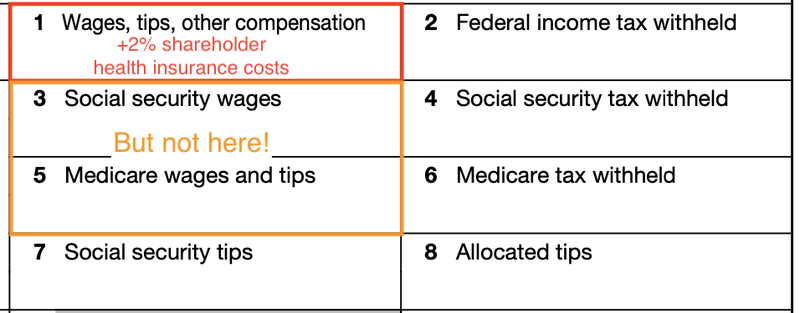

A Beginner S Guide To S Corp Health Insurance The Blueprint

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

Small Business Health Insurance Requirements 2021 Ehealth

Can I Get Health Insurance Through My Llc

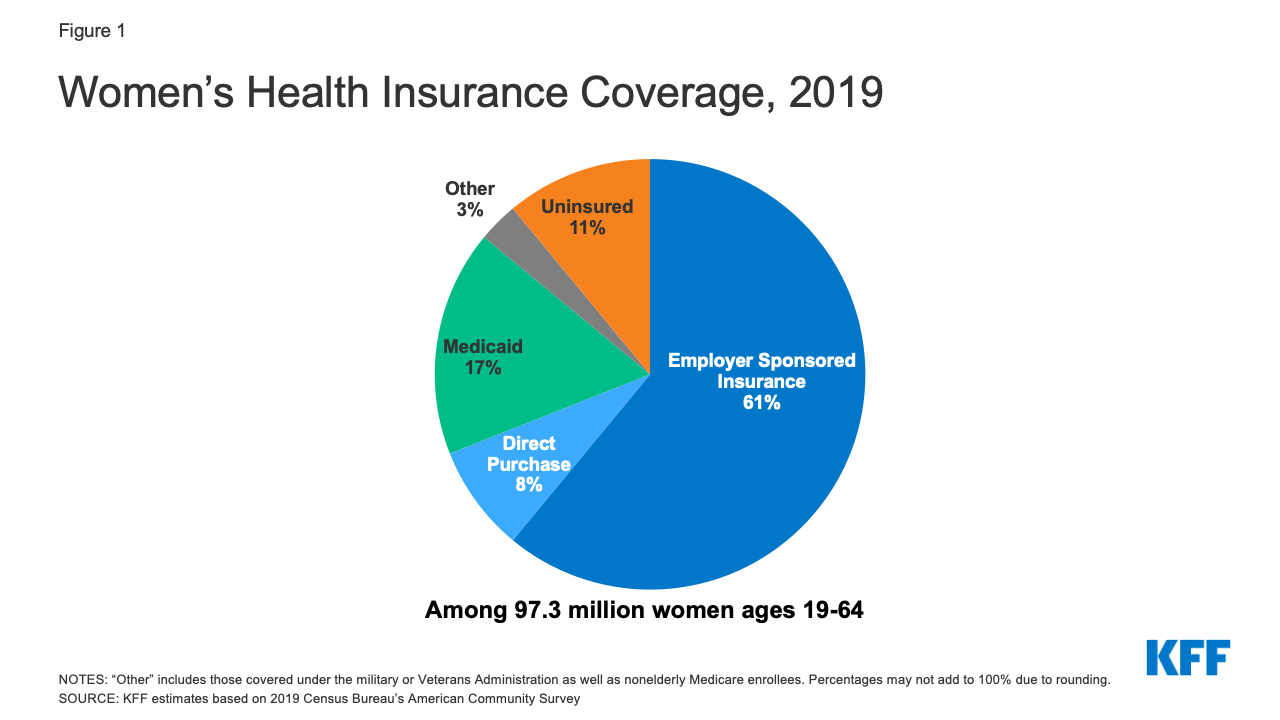

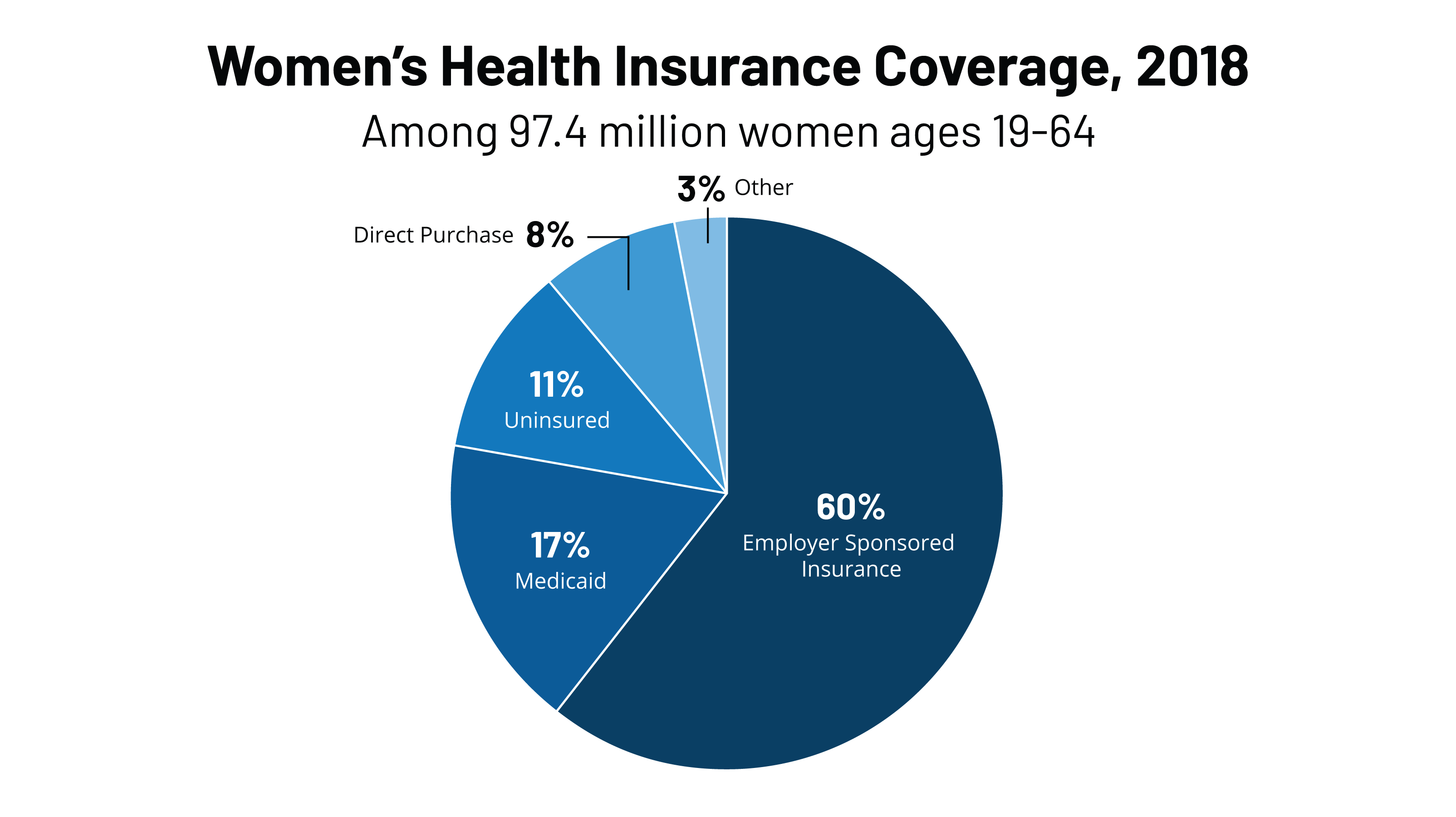

Women S Health Insurance Coverage Kff

The 2020 Changes To California Health Insurance Ehealth

A Beginner S Guide To S Corp Health Insurance The Blueprint

Open Enrollment 2021 Guide Healthinsurance Org

Health Insurance Marketplace Calculator Kff

Flow Chart Employers Guide To Health Insurance Penalties Health Insurance Healthcare Infographics Flow Chart

Women S Health Insurance Coverage Kff

Still Need Health Insurance For 2018 We Can Help Click Or Call Www Morrisonh Best Health Insurance Health Insurance Plans Health Insurance Open Enrollment

Request Our Guide To Understanding Your Insurance Co Insurance Health Information Management Health Insurance

A Beginner S Guide To S Corp Health Insurance The Blueprint

What Tax Changes Did The Affordable Care Act Make Tax Policy Center

Best Cheap Health Insurance In Pennsylvania In 2021 Valuepenguin

If You Are Shopping For Private Health Insurance And Are Ineligible For An Advanced Premium Tax Credit O Private Health Insurance Health Insurance How To Plan