The Xtrackers II Global Government Bond UCITS ETF 1C EUR Hedged invests in Government Bonds with focus World. The underlying bonds have Investment Grade ratings.

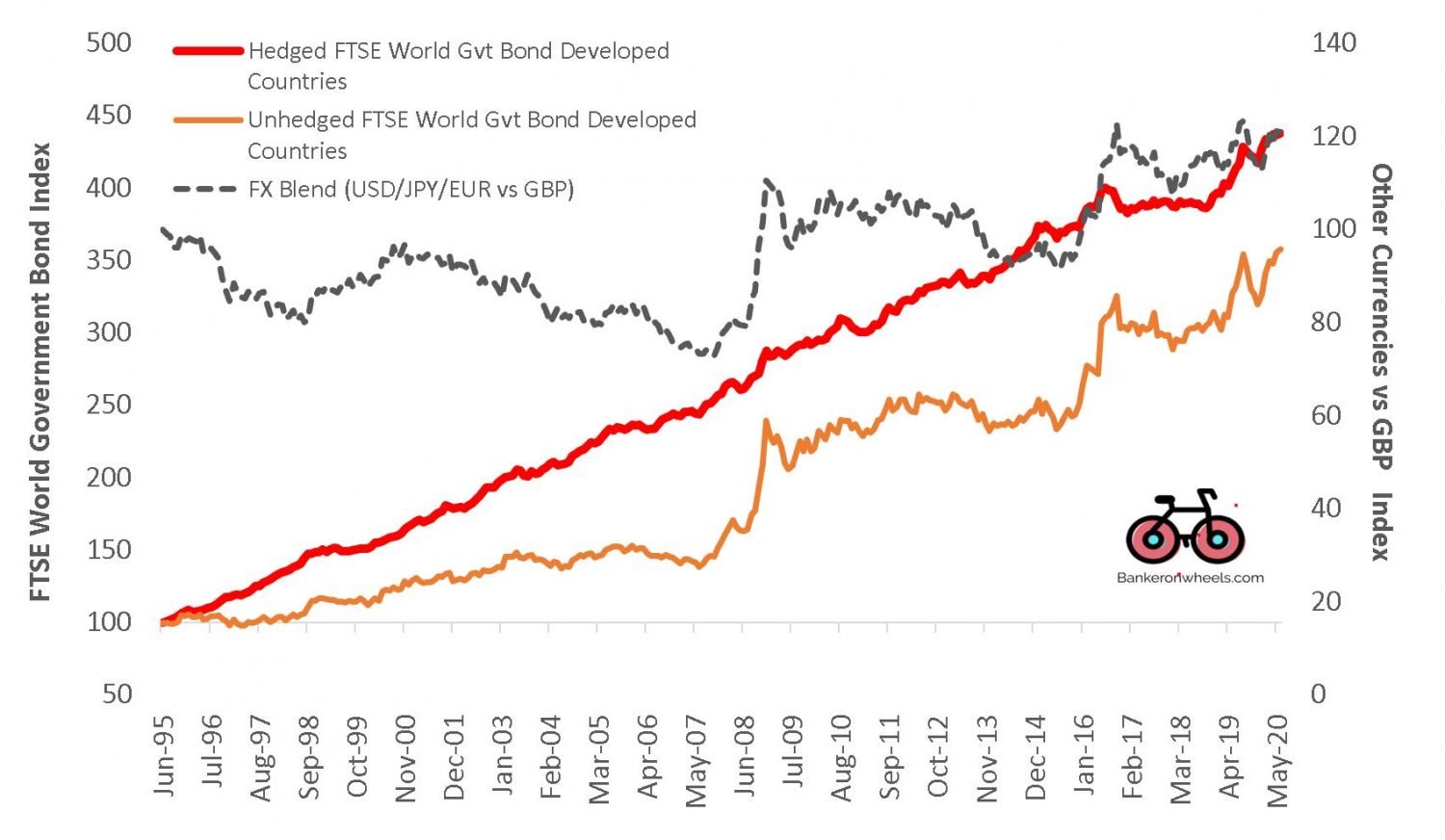

How And When To Hedge Your Investments All You Need To Know About Etf Currency Risk Bankeronwheels Com

FTSE Russell An LSEG Business FTSE World Government Bond Index Developed Markets 1-3 Years Capped Select Index v12 April 2021 3 Europe Middle East and Africa Denmark.

Ftse world government bond index - developed markets in eur. EUR 25 billion Israel. Chinese government bonds will be included in the FTSE World Government Bond index starting in October 2021 following ongoing progress by China to open its market. The WGBI is a widely used benchmark that currently includes sovereign debt from over 20 countries denominated in a.

The index series consists of Investment grade and high-yield multi-currency green debt issued by government government-sponsored supranational organisations and. 11 Savings plan offers for the Xtrackers II Global Government Bond UCITS ETF 1C EUR Hedged 000 190. The FTSE World Government Bond Index WGBI measures the performance of fixed-rate local currency investment-grade sovereign bonds.

Insgesamt gibt es 3 ETFs die den FTSE World Government Bond Index Developed Markets nachbilden und die du auch im Jahr 2021 miteinander vergleichen kannst. FTSE Russells climate risk coverage includes more than 50 developed and emerging market countries. The Fund aims to achieve a return on your investment through a combination of capital growth and income on the Funds assets which reflects the return of the FTSE World Government Bond Index the Funds benchmark index.

FTSE World Government Bond Index Extended WGBI-Extended Archive. The total expense ratio amounts to 025 pa. DKK 20 billion Eurozone Markets.

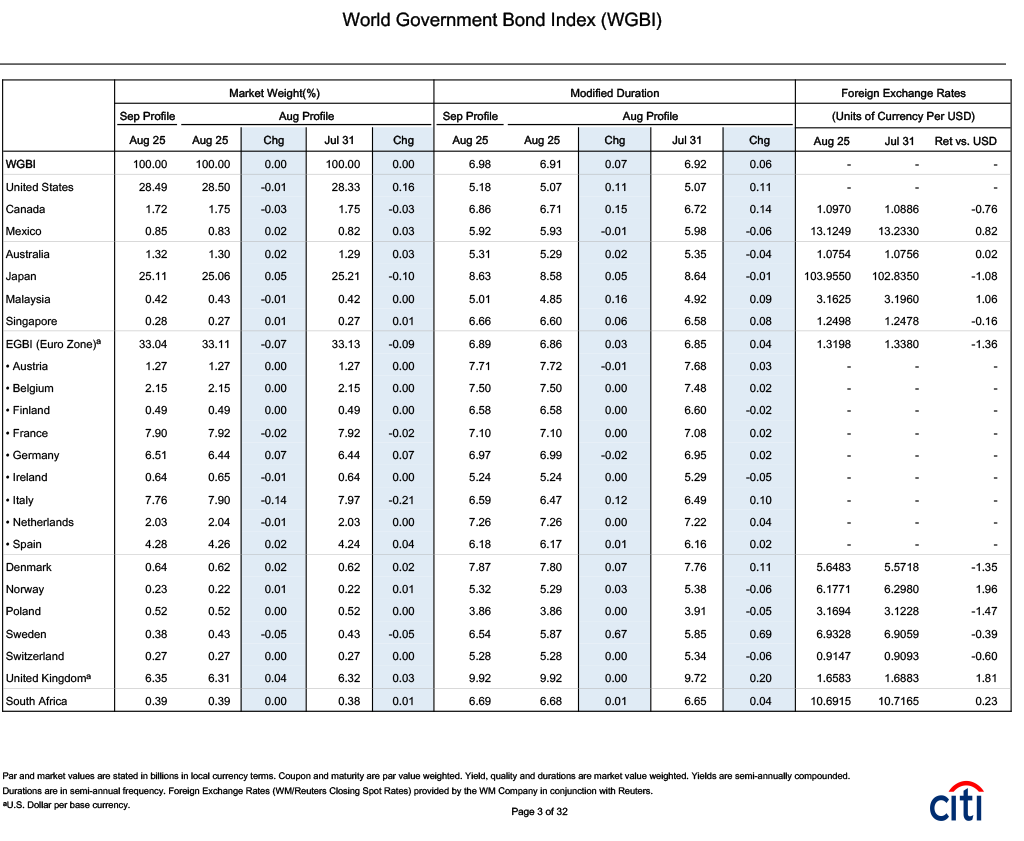

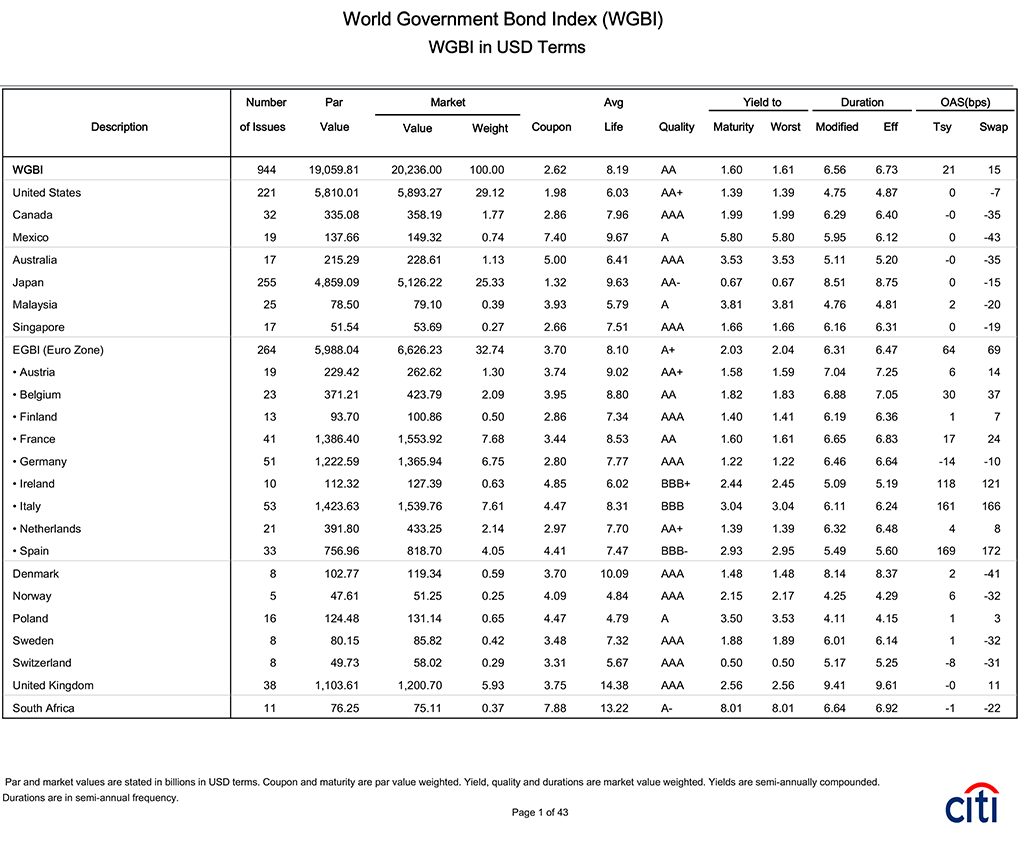

The FTSE World Government Bond Index - Developed Markets WGBI-DM measures the performance of fixed-rate local currency investment-grade sovereign bonds issued in developed markets. The index covers Developed and Emerging markets. The FTSE World Government Bond Index - Developed Markets in EUR terms Index aims to reflect the performance of the following market.

Compare Historical data of FTSE World Government Bond - Developed Markets Hedged EUR index. The index compiler owned by the London Stock Exchange Group said the debt would be added to its flagship World Government Bond Index. FTSE World Government Bond Index - Developed Markets WGBI-DM Archive.

The interest income coupons in the fund is reinvested accumulating. The FTSE All-World Index is a market-capitalisation weighted index representing the performance of the large and mid cap stocks from the FTSE Global Equity Index Series and covers 90-95 of the investable market capitalisation. Tracking FTSE World Government Bond Developed Market Index World developed government bond unhedged 02 Xetra.

The Fund aims to invest as far as possible and practicable in the fixed income FI securities such as bonds that make up the benchmark index and comply with its credit. - Fixed rate debt issued by governments of developed countries - Exposure across the whole yield curve minimum time to maturity of 1 year - Investment grade bonds only Additional information on the Index and the general methodology behind the Citi. Der gemessen am Fondsvolumen grte ETF ist der Xtrackers II Global Government Bond UCITS ETF 1C EUR.

The ETF holds the full range of bond maturities. The FTSE World Government Bond - Developed Markets EUR Hedged index tracks government bonds worldwide issued by developed countries. The index returned an average annual return of.

Currency hedged to Euro EUR. FTSE Russell the global index data and analytics provider has launched the first government bond index to adjust country weights based on climate risk consisting solely of European Monetary Union EMU countries. - Fixed rate debt issued by governments of developed.

The index composition is based on the global sovereign markets and constituents of the World Government Bond Index WGBI excluding any markets that are. The FTSE World Government Bond Index - Developed Markets in EUR terms aims to reflect the performance of the following market. FTSE World Inflation-Linked Securities Index WorldILSI Archive.

The FTSE Green Impact Bond Index Series is designed to measure the performance of green fixed income markets and offers investors a choice of global European or US market coverage. XG7S iShares Global government Bond UCITS USD ETF Acc IE00BYZ28V50 USD Tracking an index composed of local currency bonds issued by governments of developed countries. Go to ETF profile.

FTSE Pan-European High-Yield Bond Index Archive. If you want to browse ETFs with more flexible selection criteria visit our screenerTo see more information of the International Government Bonds ETFs click on one of the. The FTSE World Government Bond Index WGBI measures the performance.

Der gnstigste ETF ist der Xtrackers II Global Government Bond UCITS ETF 5C mit einer Gesamtkostenquote TER von 020.

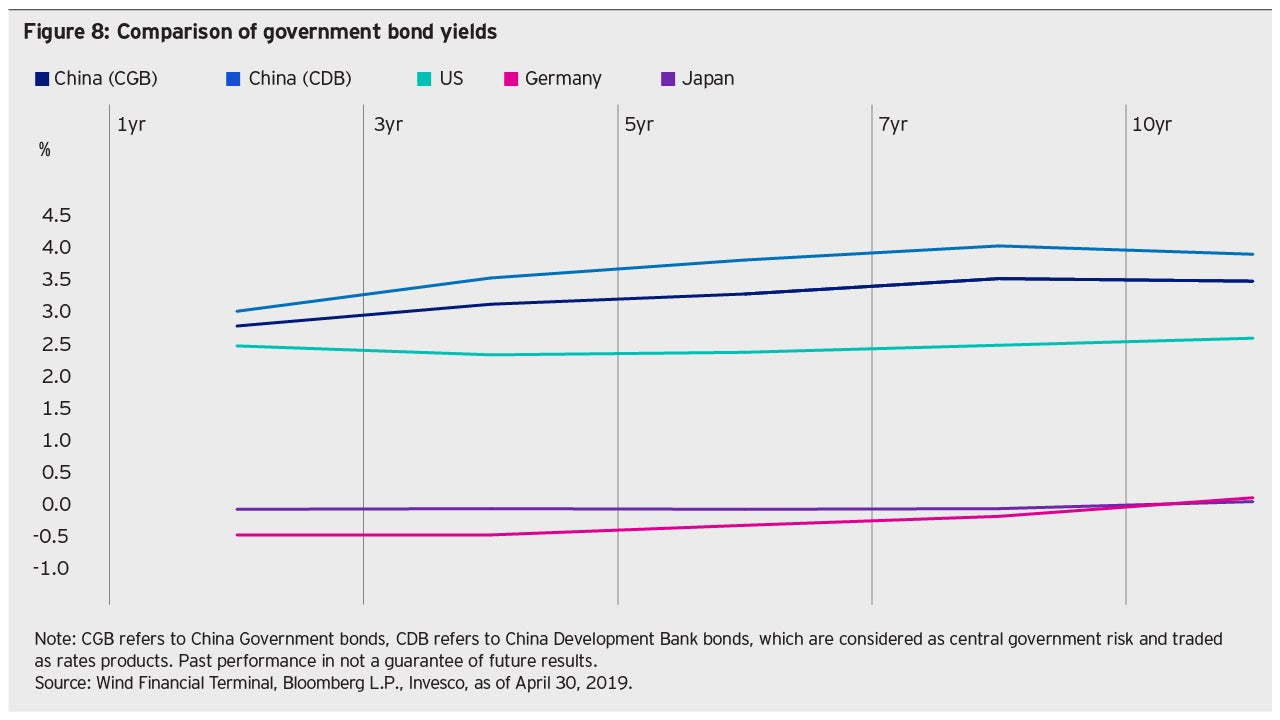

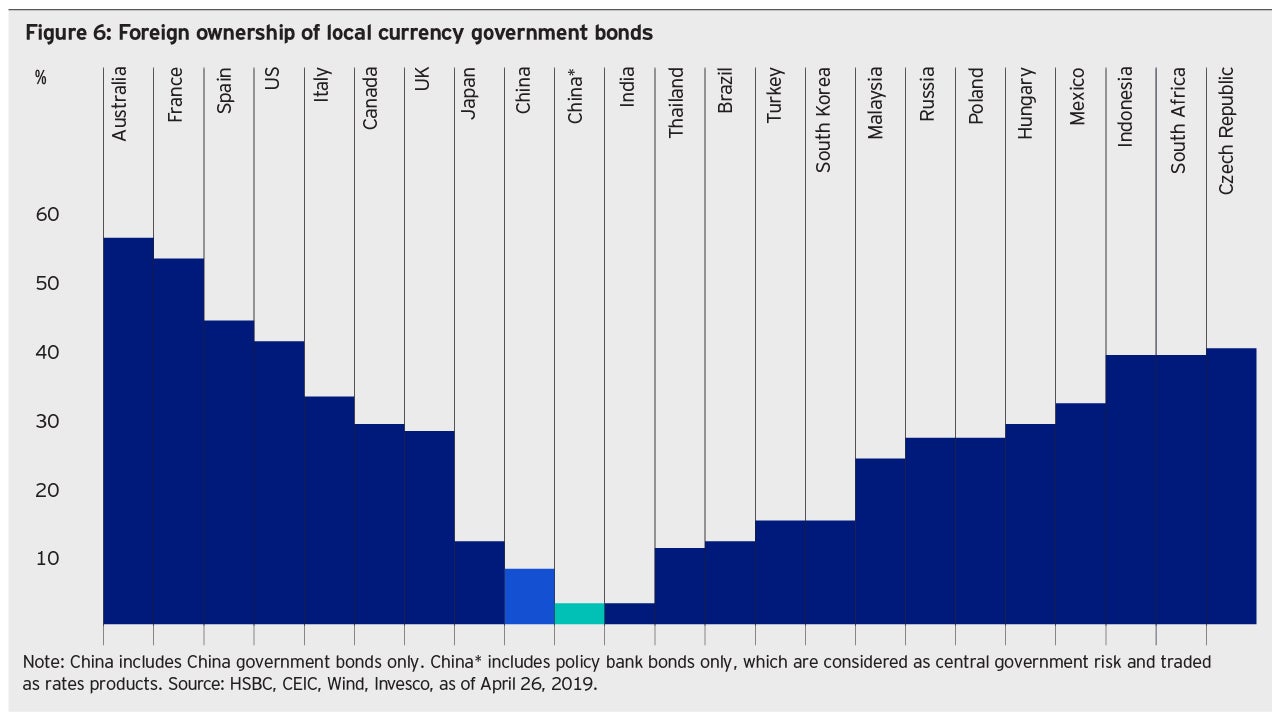

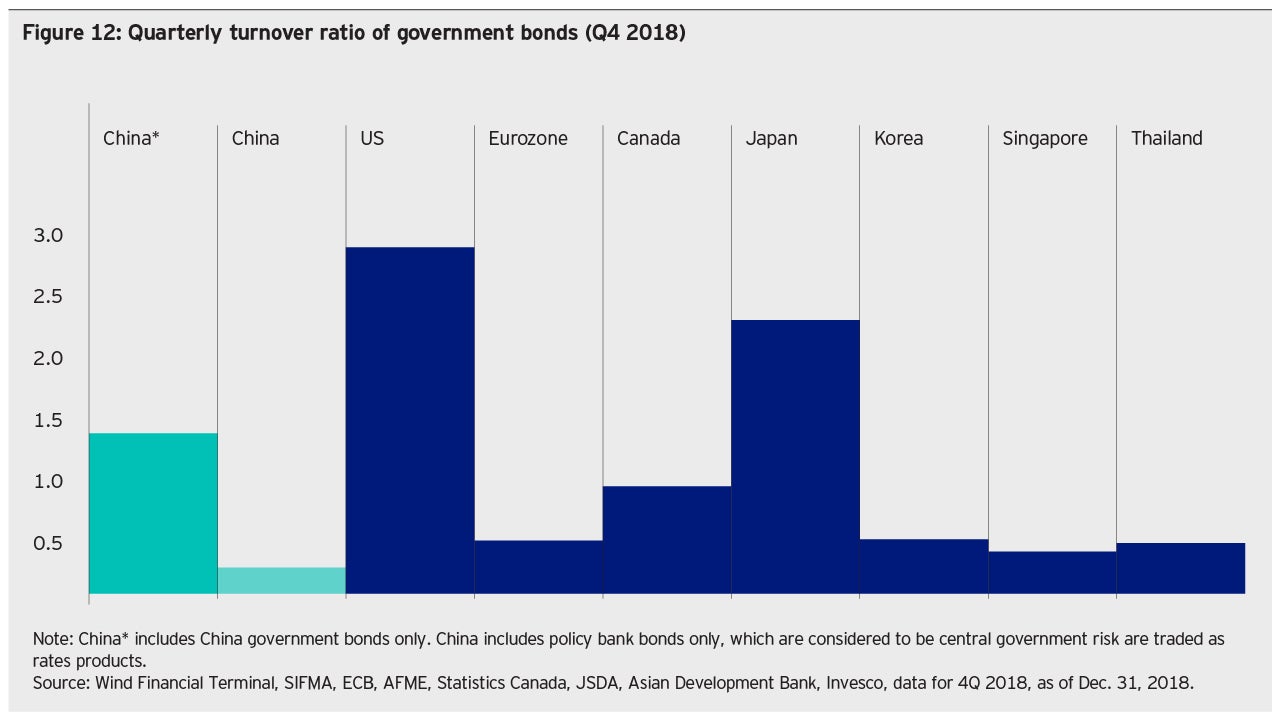

Explaining The Chinese Onshore Bond Market Invest China Invesco

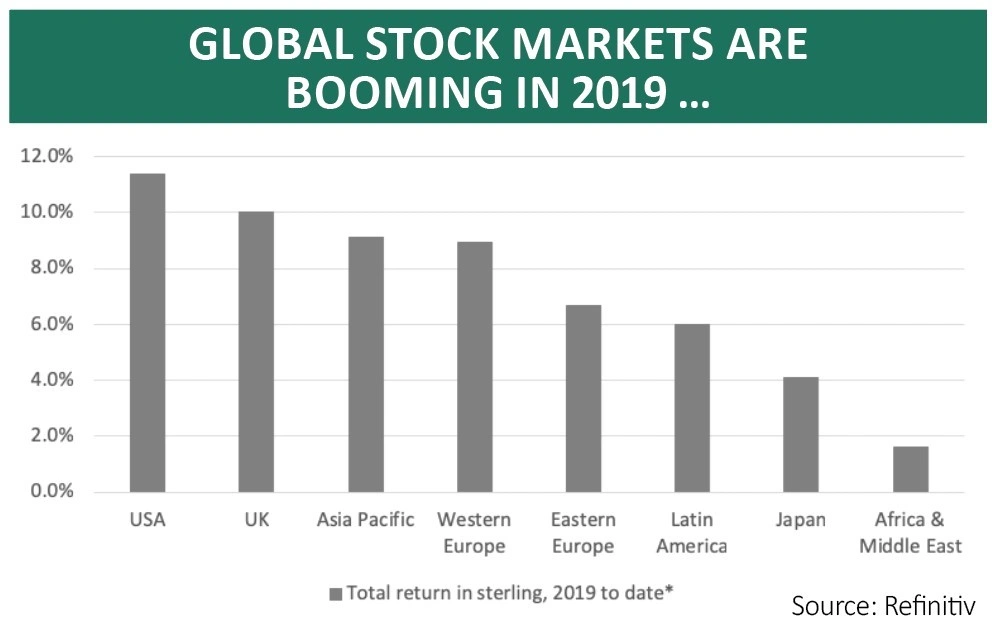

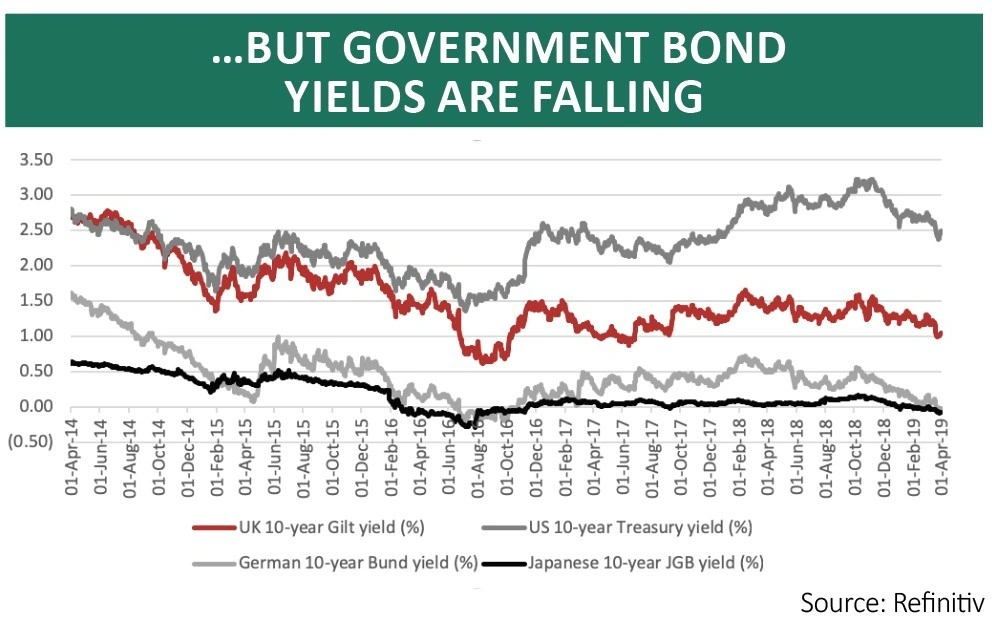

Why Are Government Bond And Share Prices Both Rising Shares Magazine

Yield Book Indices Citi Rafi Bonds Index Series

Understanding Bond Index Funds Monevator

Explaining The Chinese Onshore Bond Market Invest China Invesco

China Is Right To Be Cautious About Opening Up Its Bond Market South China Morning Post

Capital Flight Fear Continues As Malaysia Stays On Bond Watchlist The Star

Ftse Russell Index Selected By Blackrock For First Climate Risk Adjusted Government Bond Etf Ftse Russell

Chinese Bonds Go Global J P Morgan Asset Management

Yield Book Indices Citi Rafi Bonds Index Series

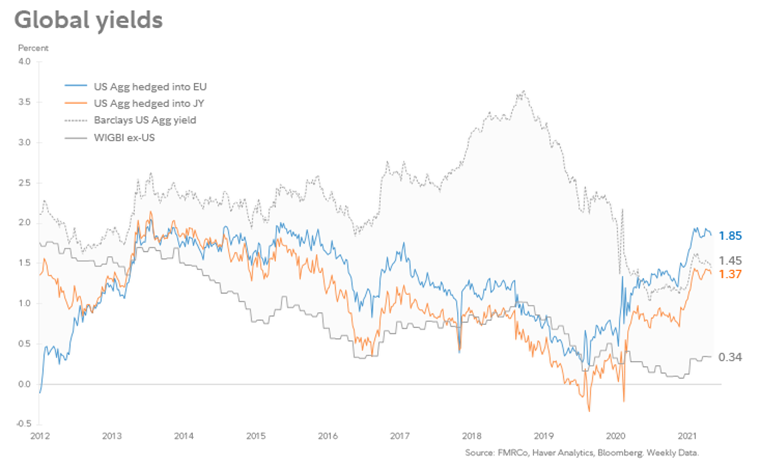

Bond Yields And Inflation Fidelity

Unlocking China S Hidden Bond Treasures Pinebridge Investments

![]()

Bond Etfs For European Index Investors Bankeronwheels Com

Unlocking China S Hidden Bond Treasures Pinebridge Investments

July 16 2021 Equities Mid Year Outlook Bright For International Equities Amid Shifting Paradigms Picture Of Ian Kirwan Ian Kirwan Global Equity Analyst Eaton Vance Advisers International Ltd London On Balance Our Outlook For International Equities Is

Why Are Government Bond And Share Prices Both Rising Shares Magazine

Unlocking China S Hidden Bond Treasures Pinebridge Investments