The 12 principles can be broadly categorised into two groups. The Reserve Bank of India has recently stated that the banks namely State Bank of India ICICI and HDFC Bank are domestic systematically important banks or.

Hong Kong Monetary Authority Systemically Important Authorized Institutions Sibs

Hence the Bangko Sentral is adopting policy measures for DSIBs which are essentially aligned with the documents issued by BCBS on global systemically important banks GSIBs and DSIBs.

What is domestic systemically important banks. According to the RBI some banks become systemically important due to their size cross-jurisdictional activities complexity and lack of substitute and interconnection. What is a domestic systemically important bank and why is it important. A framework for dealing with domestic systemically important banks assessment conducted by the local authorities who are best placed to evaluate the impact of failure on the local financial system and the local economy.

What is the list of systemically important banks. SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs. The additional Common Equity Tier 1 CET1 requirement for D-SIBs was phased-in from April 1 2016 and became fully effective from April 1 2019.

The additional Common Equity Tier 1 CET1 requirement for D-SIBs was phased-in from April 1 2016 and became fully effective from April 1 2019. There are also various national lists of systemically important banks referred to by regulators as domestic systemically important banks D-SIBs. Last week the Reserve Bank of India RBI declared HDFC Bank Ltd to be a domestic systemically important bank D-SIB.

Domestic Systemically Important Banks D-SIBs At the 2011 G20 summit it was proposed that the G-SIFI framework addressing the issue of too-big-to-fail should be extended to cover D-SIBs. According to the RBI some banks become systemically important due to their size cross-jurisdictional activities complexity and lack of substitute and interconnection. What is Domestic Systemically Important Bank D-SIB.

A systemically important financial institution SIFI is a bank insurance or other financial institution FI that US. What is the list of systemically important banks. The banks whose assets exceed 2.

SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs. Whilst maximizing private benefits through rational decisions these institutions may bring negative externalities into the system and contribute to market distortions. 24 rijen Certain large banks are tracked and labelled by several authorities as Systemically Important.

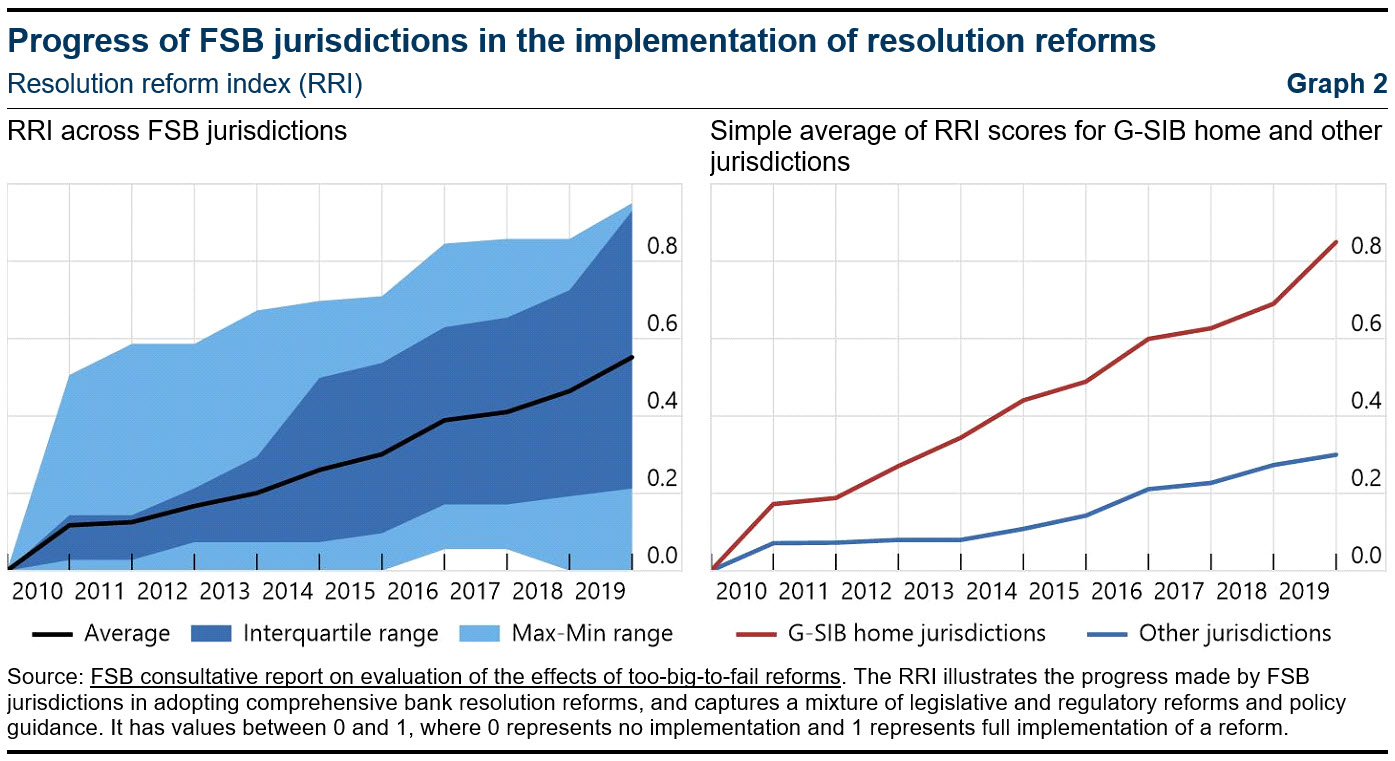

The Committee has developed a set of principles that constitutes the domestic systemically important bank D-SIB framework. Whereas the G-SIB framework considers the global impact of banking failures by realigning the framework it is hoped that the externalities of. The official global list of systemically important banks G-SIBs has been produced each year since 2011 by the Financial Stability Board.

The first group SCO505 focuses mainly on the assessment methodology for D-SIBs while the second group RBC407 focuses on higher loss absorbency HLA for D-SIBs. O-SIIs are institutions that due to their systemic importance are more likely to create risks to financial stability. The other two such banks.

D-SIB means that the bank is too big to fail. Bank Negara Malaysia the Bank today issued the policy document on Domestic Systemically Important Banks D-SIB Framework which sets out the Banks assessment methodology to identify D-SIBs in Malaysia and the inaugural list of D-SIBs. Banks whose assets exceed 2 of GDP are considered part of this group.

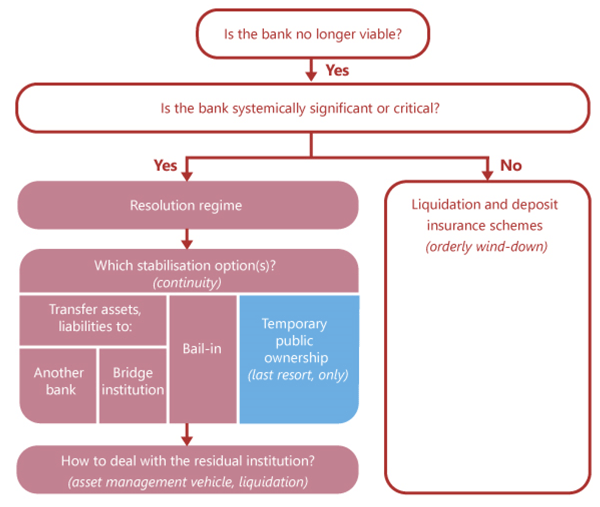

A systemically important financial institution SIFI is a bank insurance company or other financial institution whose failure might trigger a financial crisis. When Systemically Important Banks SIBs were in danger of failure in the past only one. The official global list of systemically important banks G-SIBs has been produced each year since 2011 by the Financial Stability Board.

They are colloquially referred to as. 128 domestic systemically important banks dsibs It is the thrust of the Bangko Sentral to ensure that its capital adequacy framework is consistent with the Basel principles. BCBS and the Financial Stability Board FSB to develop a framework for Domestic Systemically Important Banks D-SIBs1 in addition to the Global Systemically Important Financial Institutions G-SIFIs.

There are also various national lists of systemically important banks referred to by regulators as domestic systemically important banks D-SIBs.

1 German Banks And U S Mortgage Backed Securities Linkages And Download Scientific Diagram

More Lenders Likely To Be Added To Rbi S List Of Systemically Important Banks Report

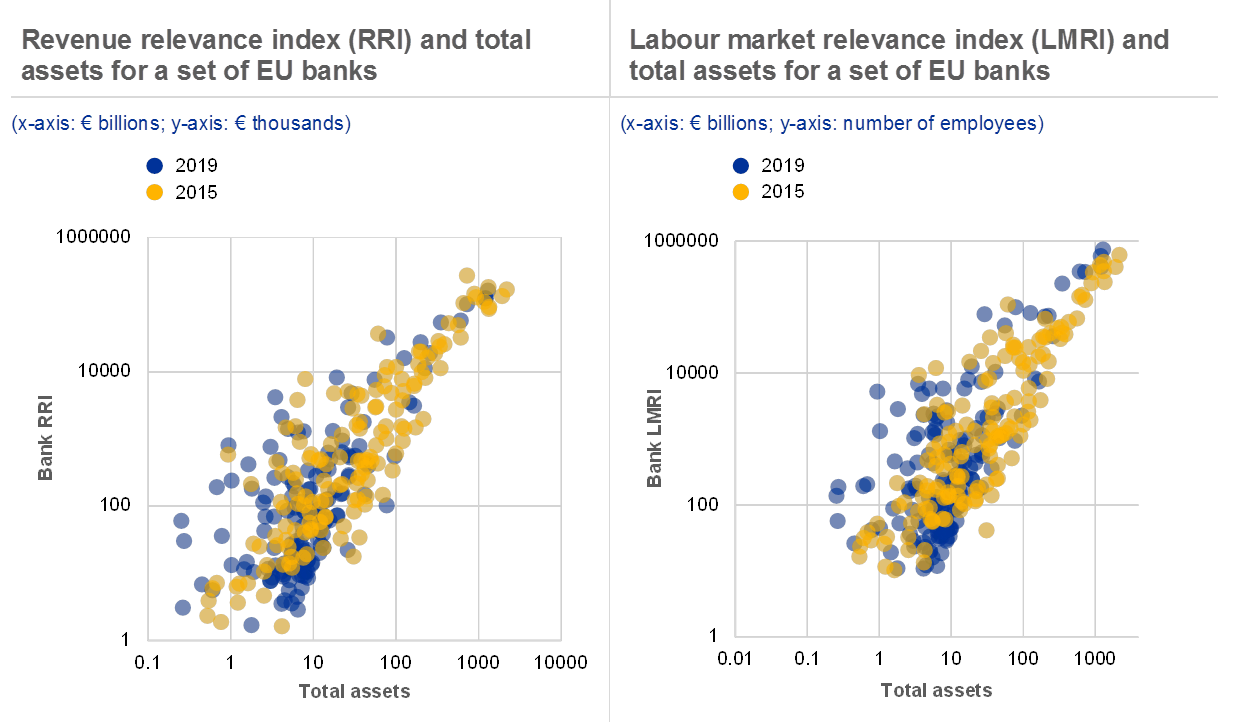

Assessing The Systemic Footprint Of Euro Area Banks

List Of Systemically Important Banks In India D Sibs Framework

Assessing The Systemic Footprint Of Euro Area Banks

Https Www Bis Org Publ Bcbs233 Pdf

Assessing The Systemic Footprint Of Euro Area Banks

Hdfc Bank Not Among Domestic Systemically Important Banks Examrace

Addressing Sifis Implementation Financial Stability Board

Https Www Financialresearch Gov Viewpoint Papers Files Ofrvp 17 04 Systemically Important Banks Pdf

What Are Domestic Systematically Important Banks D Sibs Sbi Hdfc Icici Too Big To Fail

Assessing The Systemic Footprint Of Euro Area Banks

Expectations On The Use Of Pillar Ii Capital Buffers For Dtis Using The Standardized Approach To Credit Risk

Assessing The Systemic Footprint Of Euro Area Banks

Sbi Icici Bank Hdfc Bank Remain Systemically Important Banks Rbi

Bank Resolution Framework Executive Summary

How To Define A Systemically Important Financial Institution A New Perspective Intereconomics

Https Www Bnm Gov My Documents 20124 883228 Policy Document Dsbi Feb2020 Pdf E9ccf184 8530 A328 21fd 23810edddcd9 T 1587360482884