If youre like me you plan to earn as many rewards points as possible without paying a penny in interest or fees. Making the decision is the hard part once you know which credit card you want all you have to do is apply.

If you are looking to build credit a stricter card with a low limit might be a good starting point.

What should you look for when choosing a credit card brainly. During april cash receipts totaled 248600 and the april 30 balance was 56770. If you use the card consistently. What you want in a card your income your credit score your spending patterns and your.

You might be curious to know whether you should get it or not. Nowadays there is a wide variety of options to choose from them. Financial experts recommend that you pay off your balance every.

However others may want to transfer a balance using an introductory 0 interest balance transfer credit card. Fees And Charges This is the biggest thing to watch out for. Things to look for when choosing a credit card.

This can have a negative effect on your credit score. If youre new to credit its wise to start out with a low credit limit to become familiar with responsible credit card habits. The fees for credit cards generally include interest rate charged on the balances annual fees penalties for late payments and other costs.

But without understanding the important things to watch out for it. The easiest and quickest way to apply for a credit card is on the issuers website. Even though it may come as good news some are not worth applying.

If you use the card consistently you may also want to pay a fee to get rewards like air transfer or. Here you can get a credit card according to your preferences and needs. Today were walking through how to choose the best credit card for you.

You may include any income you have reasonable expectation of access to including your spouses or relatives income. Since many of the best credit cards include annual fees its important that youre choosing the right credit card for your goals and spending habits to ensure any and all cards in your wallet are worth the expense. It is important that you look over credit offers carefully so you can make an educated and wise decision on which card to choose.

Fees And Charges This is the biggest thing to watch out for. If you want something there as an emergency fund a small interest card might be worth looking into. The application will ask for some basic information like your address Social Security number and annual income.

This can vary from one company to another. Financial experts recommend that you pay off your balance every. Determine the cash payments made during april.

5 Things To Look For When Choosing One If you need or want a credit card for those emergencies in your life when you have no cash you need to be careful what card you apply for. But if youre looking to earn some rewards from your purchases there are specific cards for that as well. So without further ado lets get into it.

If you can pay off the balance at the end of every month youll need a card thats different from someone who wants to carry the balance. On april 1 the cash account balance was 46220. Be wary of no-limit credit cards because they can sometimes look maxed out on your credit report.

Student credit cards unsecured cards meant for college students who are new to credit are easier to qualify for than other types of credit cards. There are five key things you need to know before you sit down to evaluate your credit cards or look for new ones if thats the best option. One of the reasons why there are so many types of credits cards is that all cards are not made equal.

Thats why you must shop around and get one that best fits your needs and preferences. Things to look for when choosing a credit card. This can vary from one company to another.

If you merely choose the first credit offer you receive in the mail you. Basically if youre approved for one of these you will get a credit limit to spend within and charged an interest rate for money that you owe on the card. The fees for credit cards generally include interest rate charged on the balances annual fees penalties for late payments and other costs.

Here are some aspects that you should pay attention to when choosing credit cards. How to choose the right credit card. This is the most common card and what you typically think of when you think of a Credit Card.

Home credit cards Things to look for when choosing a credit card. Here are some aspects that you should pay attention to when choosing credit cards. If you can pay off the balance at the end of every month youll need a card thats different from someone who wants to carry the balance.

The first and most popular is the standard credit card AKA Unsecured Card. There are hundreds of credit cards out there to choose from. The very first thing you should consider when choosing a credit card is what you plan to do with the card.

One of the reasons why there are so many types of credits cards is that all cards are not made equal. So are secured credit cards which generally. Some financial situations allow a higher credit limit.

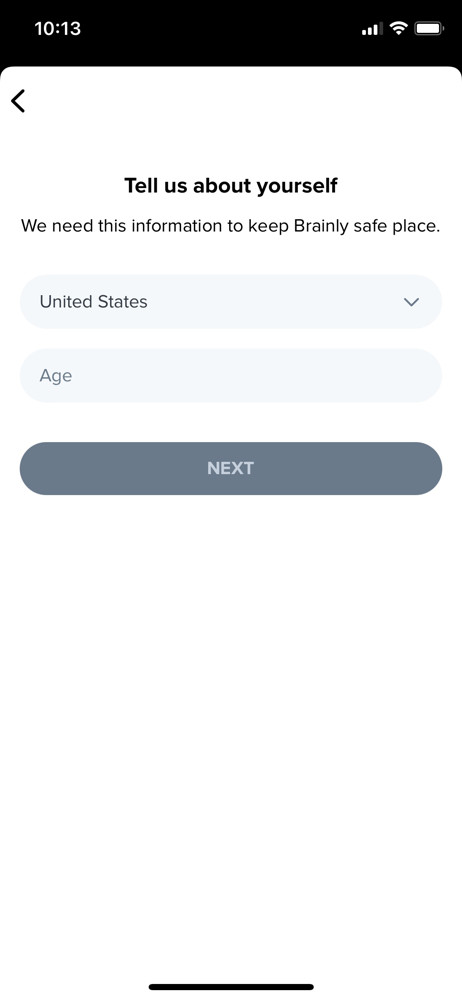

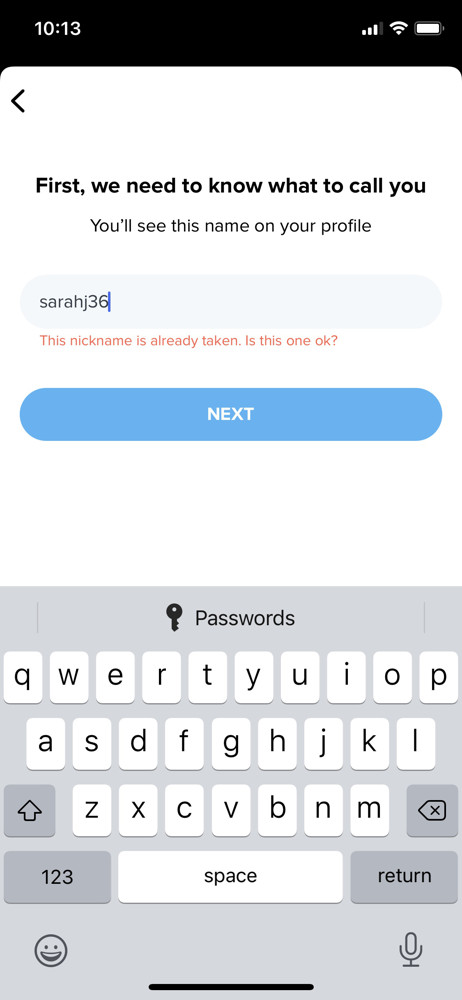

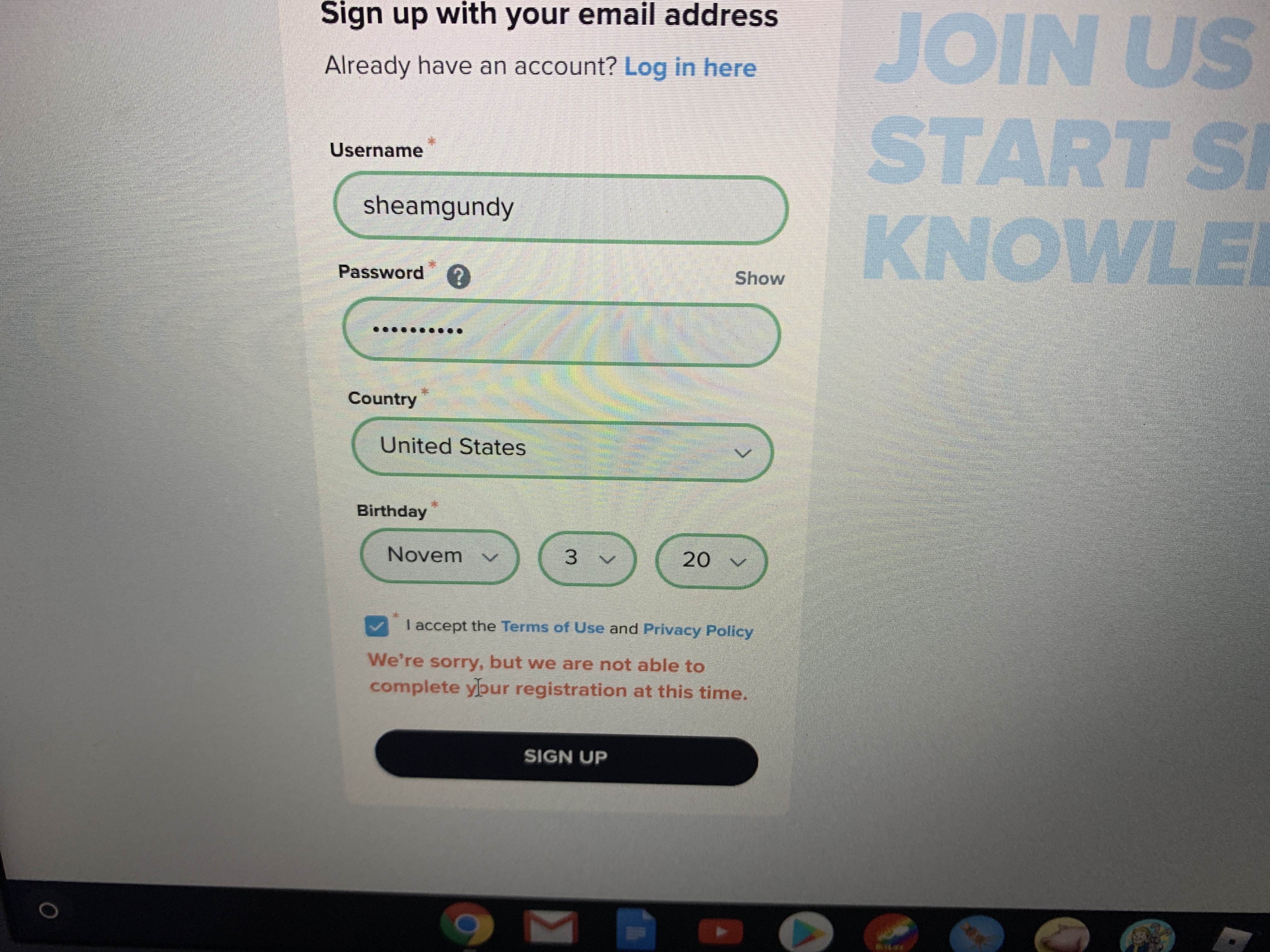

Brainly Reviews 161 Reviews Of Brainly Com Sitejabber

What Is One Strategy That Can Help A Person Avoid Spending Too Much Money On Interest When Borrowing Brainly Com

Brainly Reviews 161 Reviews Of Brainly Com Sitejabber

Brainly A Crowdsourced Homework Helper For Students Raises 30m To Expand In The Us Techcrunch

How Does Brainly Make Money Quora

Free Breainly Account To Use Positive Quotes

Brainly Reviews 161 Reviews Of Brainly Com Sitejabber

Brainly Reviews 161 Reviews Of Brainly Com Sitejabber

I Need To Select The Items That Are Needs For My Bank Statement Brainly Com

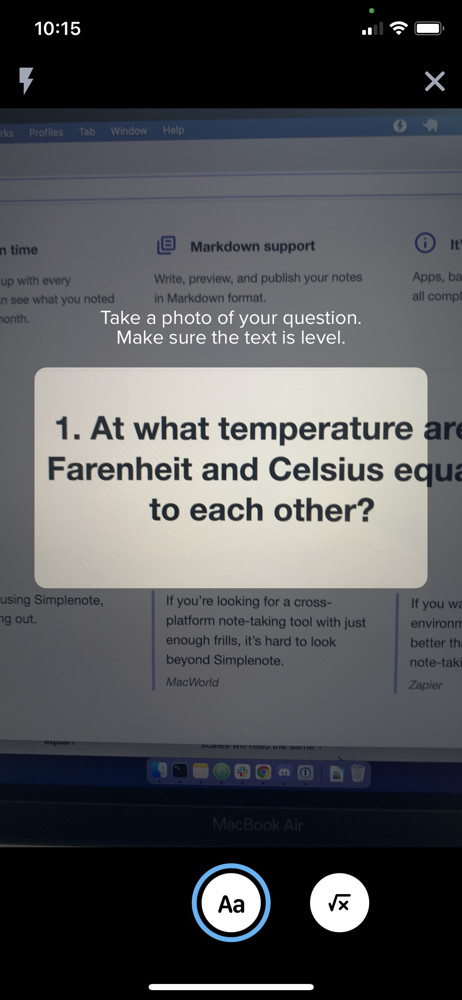

Brainly Homework Help App App Reviews Download Education App Rankings

Select The Items That Are Needs From Your Credit Card Statement Brainly Com