Unfortunately certain taxpayers have lost their life due to Covid-19. The 35 deferral is only applicable on the PAYE liability declared on the original EMP201 return submitted to SARS.

How To Claim Eis Income Tax Relief A Step By Step Guide

Interest relief if you received COVID-19 benefits Interest relief for individuals with a taxable income of 75000 or less in 2020 and received a COVID-19 benefit Paying your 2020 taxes owing Pay taxes you owe options if you cannot pay or arrange to pay over time.

Covid-19 tax relief for paye. How to Save Income Tax by Donating to the PM CARES Fund and CM Relief Fund During the Coronavirus Lockdown. Any increase in the PAYE liability through a subsequent request for correction will not. The government extended the timelines of filing tax compliances amid COVID-19 The government extended deadlines for various income tax compliances on.

Residents whose ability to work was affected due to COVID-19. Proposed amendments to the Income Tax Regulations COVID-19 relief for pension plans and deferred salary leave plans 1 The Income Tax Regulations are amended by adding the following after section 6801. We have a range of ways to help depending on your circumstances.

The COVID-19 Tax Relief for PAYE is the payment of 65 of the total PAYE liability and deferral of 35 of the total PAYE liability. Interest relief if you received COVID-19 benefits If you meet all the eligibility criteria below you will get interest relief on your 2020 taxes owing. The application period closed on December 2 2020.

The new personal income tax credit would support seniors regardless of their incomes and whether they owe income tax for 2021. Home office expenses for employees Claim a deduction for certain home office expenses on your personal income tax return. Applications are no longer being accepted.

The tax exemption will be limited to Rs 10 lakh for the amount received from any other persons such friends and family. Due to the COVID-19 outbreak the Finance Minister has announced various relief measures and to give effect to this The Taxation and Other Laws Relaxation of Certain Provisions Ordinance 2020 was passed on 31032020. The first deferment can be claimed in your April 2020 EMP201 return which is due by 7 May 2020.

Donations made to the Prime Ministers Citizen Assistance and Relief in Emergency Situations PM CARES fund will be liable for tax benefits as per Section 80G of the Income Tax. Let us look into some major relaxations introduced in the ordinance. To claim CoviD-19 Tax Relief for PAYE.

The fund seeks to provide support for businesses that do not qualify for other Government of Canada COVID-19 relief measures. This measure will give a total of 500 to seniors who receive both the Old Age Security pension and the Guaranteed Income Supplement and will help them cover increased costs caused by COVID-19. Call 1-833-966-2099 about COVID-19 related benefits administered by the CRA.

Updated December 2 2020. You still need to file your tax return by the due date to avoid paying any late-filing penalties. Applications for funding are accepted on an ongoing basis until all funding has been allocated.

Emergency benefit for workers was a one time tax-free 1000 payment for BC. COVID-19 Deferred salary leave plan 1 For the purposes of paragraph 6801a if an employees leave of absence is suspended on or after March 15 2020 referred to in this. The government on Friday extended deadlines for various income tax compliances and also exempted from tax the amount given.

The ex-gratia payment received by family members of a person who has died due to Covid-19 from an employer will be exempted from tax without any limit. Belated income tax returns can now be filed before May 31 2021 In order to provide relief to taxpayers amid the second wave of COVID-19 in the country the. If you have a tax agent they should also be able to help.

11 March 2020 Tax relief and income assistance is available to people affected by the downturn in business due to the COVID-19 novel coronavirus. Now what this means for you as an individual taxpayer. The legislation also made changes to tax relief for employersContinue to check back for updates.

Benefits credits and financial support. Latest Updates on Coronavirus Tax Relief American Rescue Plan Act of 2021 See this IRS news release for more information on individual tax provisions of the American Rescue Plan Act of 2021 signed into law on March 11 2021. The interest relief measure announced today will provide an estimated 45 million low- and middle-income Canadians with the flexibility required to feel confident about accessing the COVID-19 income support without facing additional stress at tax time.

The Covid-19 Tax Relief for PAYE is available for the four-month tax period from 1 April 2020 to 31 July 2020.

Press Release Covid 19 Tax Relief Measures Extended To September 30 2020 Guyana Revenue Authority

How Do Grants Affect R D Tax Relief In The Covid 19 Era Whisperclaims

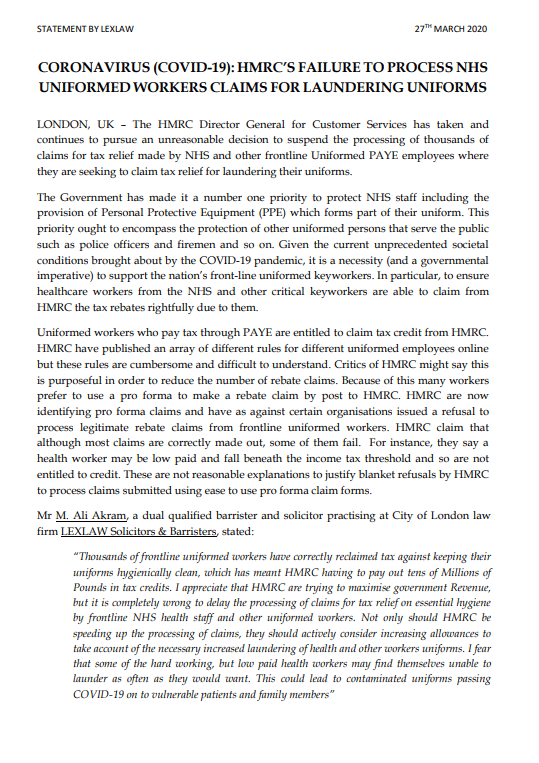

Statement By Lexlaw Re Coronavirus Covid 19 Hmrc S Failure To Process Nhs Uniformed Workers Claims For Laundering Uniforms Lexlaw Solicitors Barristers

Tax Compliance And Covid 19 Hmrc Takes New Approach To Investigations And Disputes Osborne Clarke Osborne Clarke

Hmrc If You Re Working From Home Because Of Covid 19 You May Be Able To Claim Tax Relief It S Quick And Easy To Do On Gov Uk Check If You Re Eligible

Employment Tax Considerations In Light Of Covid 19 Bdo

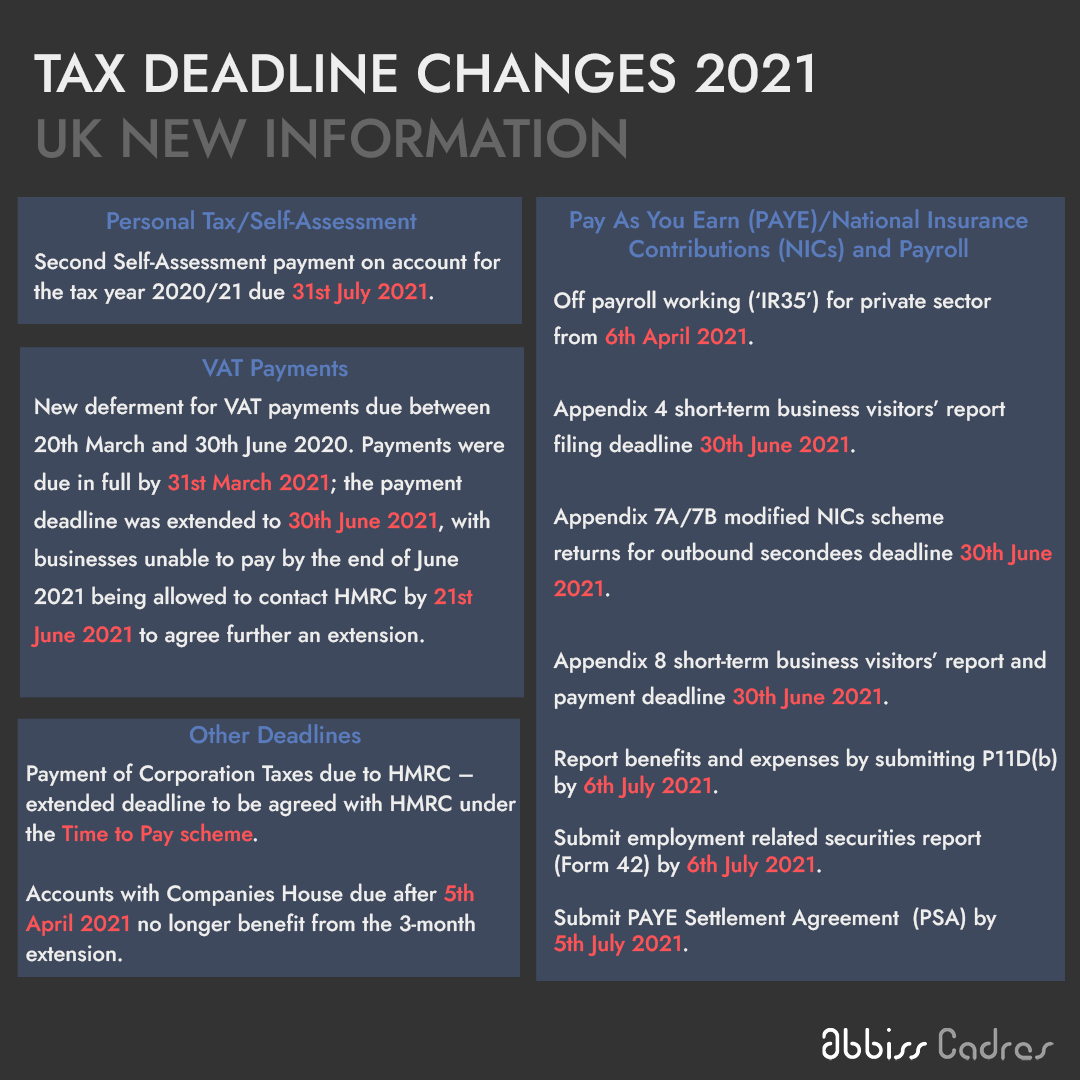

Hmrc 2021 Uk Tax Deadline Changes Amid Covid 19 Abbiss Cadres

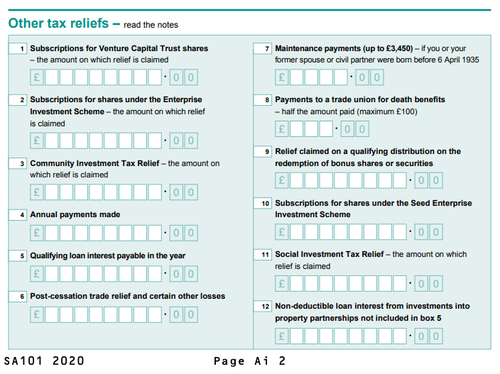

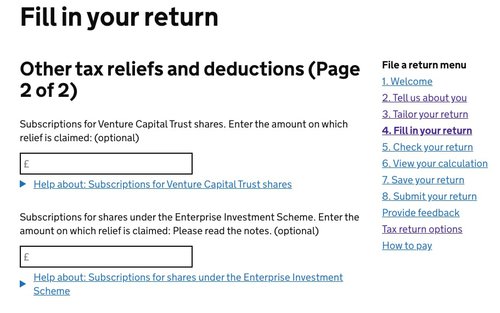

How To Claim Eis Income Tax Relief A Step By Step Guide

Covid 19 The Tax Implications Of Working From Home Insights Uhy Hacker Young

Why Businesses Expect A Shift To Covid 19 Tax Enforcement

Working From Home Tax Relief What We Know About Claiming Hmrc Allowance As New Tax Year Starts

Almost 800 000 Tax Relief Claims For Working From Home Gov Uk

Coronavirus Covid 19 Tax Developments In Ema Kpmg Global

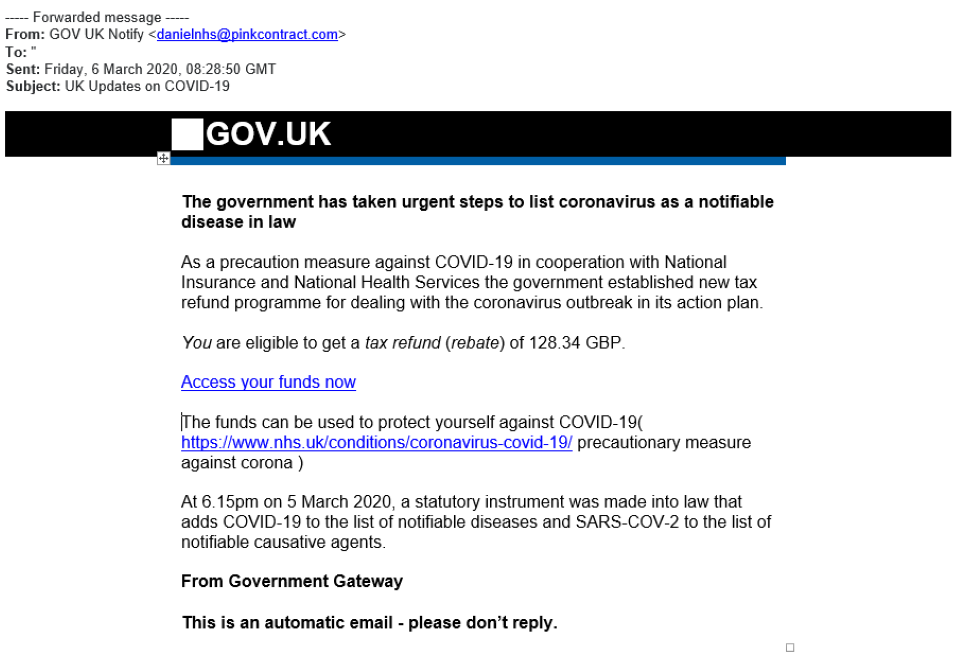

Hmrc Issues Warning On Self Assessment Scammers Ftadviser Com

Coronavirus Scams Please Be Vigilant Low Incomes Tax Reform Group

Denmark Changes Tax Legislation In Light Of Covid 19 Ey Denmark

Tax Dispute Resolution Kpmg Global

Breathing Space For Self Assessment Taxpayers Tax Rebate Services