DOAJ is a community-curated online directory that indexes and provides access to high quality open access peer-reviewed journals. What is a domestic systemically important bank and why is it important.

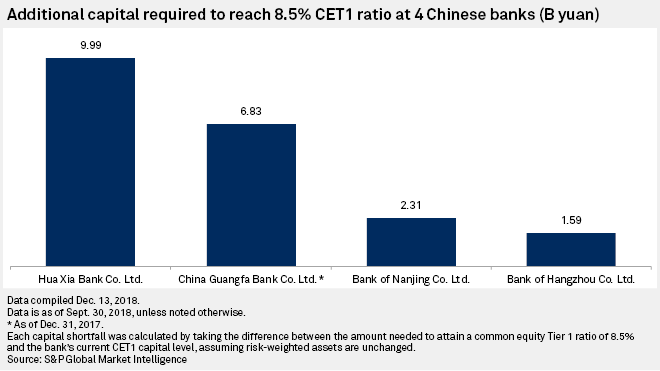

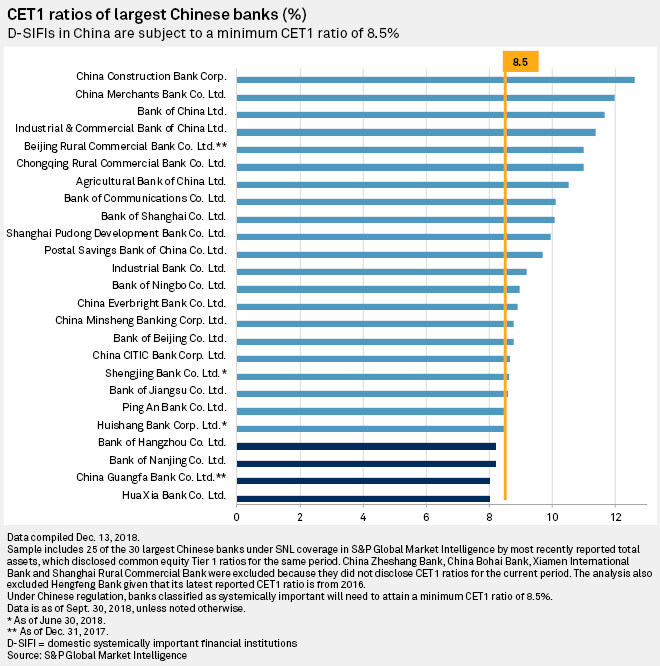

As Local Systemic List Grows At Least 4 Chinese Banks May Need Fresh Capital S P Global Market Intelligence

The PBOC and the China Banking and Insurance Regulatory Commission have jointly come out with a system to identify domestic systemically important banks D.

Domestic systemically important banks (d-sibs) china. The 12 principles can be broadly categorised into two groups. The first group SCO505 focuses mainly on the assessment methodology for D-SIBs while the second group RBC407 focuses on higher loss absorbency HLA for D-SIBs. This paper serves as a response to the official assessment approach proposed by Basel Committee to identify domestic systemically important banks D-SIBs in China.

This paper serves as a response to the official assessment approach proposed by Basel Committee to identify domestic systemically important banks D-SIBs in China. D- SIB- meaning concerns need and management. Before the formulation of the D-SIB list and regulations Chinas four large State-owned banksIndustrial and Commercial Bank of China China Construction Bank Bank of China and Agricultural Bank of China have already been designated as global systemically important banks by the Financial Stability Board an international financial standard setting body and an arm of the G20.

The Chinese governments final assessment framework for domestic systemically important banks D-SIB has adopted a broader approach than we had anticipated based on earlier draft consultations and we now believe at least 20 of the 30 large banks under consideration will fall into the D-SIB category says Fitch Ratings. The Peoples Bank of China PBoC has published a set of long-overdue guidelines to select the countrys domestic systemically important banks D-Sibs. SBI ICICI and HDFC remain Systemically Important Banks.

Fitch Ratings-ShanghaiHong Kong-07 December 2020. Our analysis presents not only current levels of domestic systemic importance of individual banks but also the changes. We believe the framework should help strengthen the resilience of Chinas.

This paper serves as a response to the official assessment approach proposed by Basel Committee to identify domestic systemically important banks D-SIBs. Fitch Ratings-ShanghaiHong Kong-07 December 2020. This paper serves as a response to the official assessment approach proposed by Basel Committee to identify domestic systemically important banks D-SIBs in China.

The rationale for focusing on the domestic context is outlined in paragraph 17 below. The Hong Kong Monetary Authority HKMA has completed its annual assessment of the list of Domestic Systemically Important Authorized Institutions D-SIBs. The Banking Capital Rules and the HKMAs regulatory framework for D-SIBs follow the provisions in A framework for dealing with domestic systemically important banks issued by the Basel Committee in October 2012 by enabling the Monetary Authority i to designate an authorized institution as a D-SIB if the Monetary Authority considers.

Domestic systemically important bank. ChinaBankingRegulatoryCommissionCBRCalsofol-lowed the BCBS assessment framework and proposed that sizeinterconnectednessnonsubstitutabilityandcomplexity should be considered when evaluating domestic systemic importance of banks in guidance on the implementation of the new Regulatory Standards for Chinese banking sys-. Also in 2011 BOC followed ICBC and ranked number 2 in domestic systemic importance in Chinese banking sector see Table 16.

We also consider the systemic risk of the whole banking system by investigating how D. We also consider the systemic risk of the whole banking system by investigating how D-SIBs and non-D-SIBs. RBI categorises IDBI Bank as Private Sector Bank.

For Prelims and Mains. Based on the assessment results Industrial and Commercial Bank of China Asia Limited has been added to the list of authorized institutions designated as D-SIBs and therefore the overall. Our result demonstrates that the biggest systemic risk originates from Industrial and Commercial Bank of China ICBC with 20 of the system with Bank of China BOC followed with 168.

The Committee has developed a set of principles that constitutes the domestic systemically important bank D-SIB framework. Our analysis presents not only current levels of domestic systemic importance of individual banks but also the changes. The Chinese governments final assessment framework for domestic systemically important banks D-SIB has adopted a broader approach than we had anticipated based on earlier draft consultations and we now believe at least 20 of the 30 large banks under consideration will fall into the D-SIB category says Fitch Ratings.

A starting point for the development of principles for the assessment of D-SIBs is a requirement that all national authorities should undertake an assessment of the degree to which banks are systemically important in a domestic context. Our analysis presents not only current levels of domestic systemic importance of individual banks but also the changes. The Assessment Measures for Domestic Systemically Important Banks were jointly issued Thursday by the Peoples Bank of China PBOC and the China Banking and Insurance Regulatory Commission CBIRC and will go into effect on Jan.

China is likely to list at least 10 out of 30 institutions as domestic systemically important banks D-SIBs Fitch ratings estimates and based on the regulators draft consultations and could influence views over systemic importance for some banks. D-SIB means that the bank is too big to fail.

China Bank Capital Adequacy Ratios 10 Domestic Systemically Important Banks Say Fitch

Explained D Sib Domestic Systemically Important Bank Norms

Pdf Domestic Systemically Important Banks A Quantitative Analysis For The Chinese Banking System

China Bank Capital Adequacy Ratios 10 Domestic Systemically Important Banks Say Fitch

China To List 10 Commercial Banks As D Sibs Asian Banking Finance

Pdf Domestic Systemically Important Banks A Quantitative Analysis For The Chinese Banking System

Pdf Domestic Systemically Important Banks A Quantitative Analysis For The Chinese Banking System Semantic Scholar

Pdf Domestic Systemically Important Banks A Quantitative Analysis For The Chinese Banking System Semantic Scholar

As Local Systemic List Grows At Least 4 Chinese Banks May Need Fresh Capital S P Global Market Intelligence

Buckets Of Chinese D Sibs Download Table

As Local Systemic List Grows At Least 4 Chinese Banks May Need Fresh Capital S P Global Market Intelligence

China Policy And Markets Round Up Beijing Finalises D Sib Rules Caixin Pmis Hit Decade High Us Bill To Delist Chinese Companies Clears House Globalcapital

Sbi Icici Bank Hdfc Bank Remain Systemically Important Banks Rbi

Buckets Of Chinese D Sibs Download Table

Pdf Domestic Systemically Important Banks A Quantitative Analysis For The Chinese Banking System Semantic Scholar

Pdf Domestic Systemically Important Banks A Quantitative Analysis For The Chinese Banking System Semantic Scholar

Update China Defines Banks That Are Too Big To Fail Caixin Global

Hdfc Bank Not Among Domestic Systemically Important Banks Examrace