You may ask What is the reserve ratio. The required reserve ratio is the fraction of deposits that the Fed requires banks to hold as reserves.

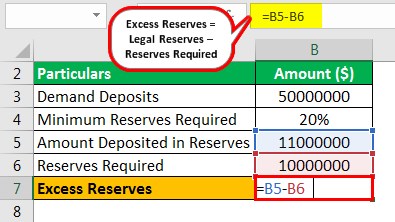

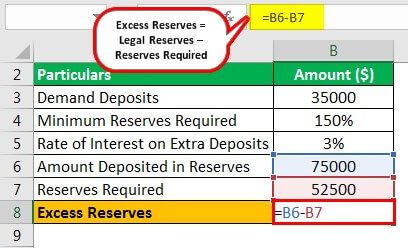

Excess Reserves Formula Example How To Calculate Excess Reserves

0 Total reserves required reserves excess reserves 450 300 excess reserves excess reserves 300.

How do you calculate reserve requirement. Calculate the Required reserves. Required reserves 01 1000 100. How do you calculate reserve ratio.

Finally to calculate the maximum change in the money supply use the formula Change in Money Supply Change in Reserves Money Multiplier. While the required reserve ratio is set by an outside controlling financing board the actual reserve ratio on hand can be calculated by dividing the amount of deposited money retained on hand by the bank by the total amount of deposited money that the bank has. How do you calculate the required reserve ratio.

Click to rate this post. A more detailed description of the system can be found in the ECB publication entitled The single monetary policy in the euro. Why does the Federal Reserve require.

The required reserve ratio is the fraction of deposits that the Fed requires banks to hold as reserves. Some associations prefer the pooling method because it provides greater flexibility if the. Actual costs of a maintenance project exceed the amount estimated in the reserve study or the.

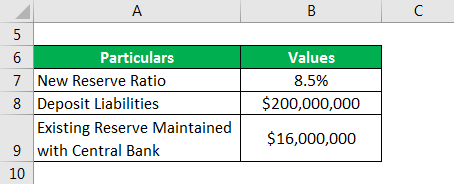

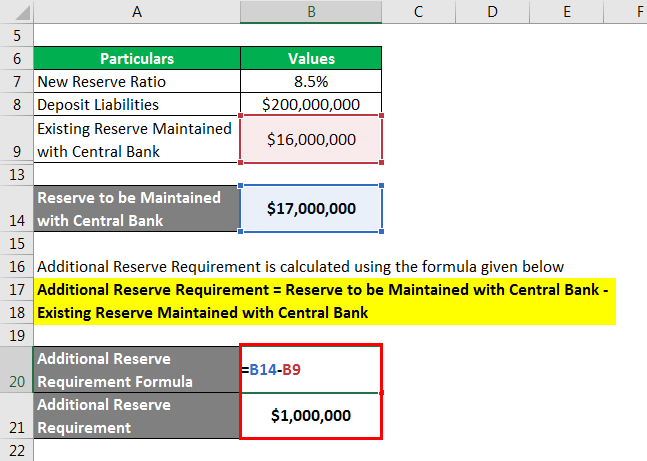

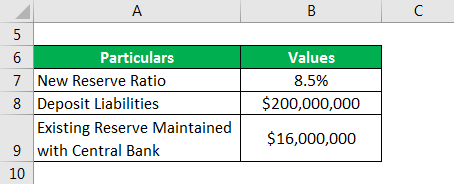

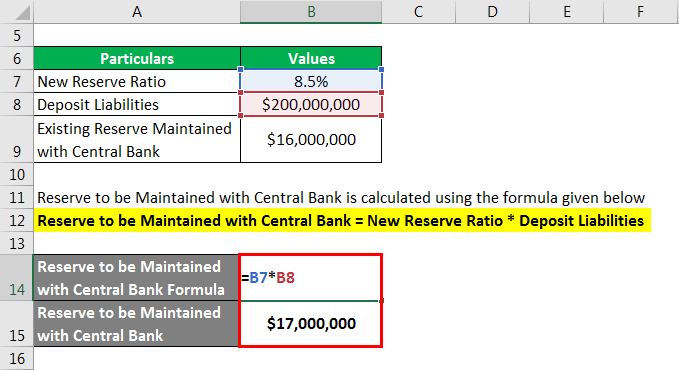

Additional Reserve Requirement is calculated using the formula given below Additional Reserve Requirement Reserve to be Maintained with Central Bank Existing Reserve Maintained with Central Bank Additional Reserve Requirement 17 million 16 million Additional Reserve Requirement. The calculation for a bank can be derived by dividing the cash reserve maintained with the central bank by the bank deposits and it is expressed in percentage. How do you calculate required reserve ratio.

Associations may calculate these required reserves using the component straight-line method or the pooling cash flow method. The required reserves in this case are 100 and the bank is able to lend out the remaining 900. The length of a reserve computation period depends on the frequency with which an institution reports an FR 2900 report.

Regardless of its length each reserve. Refer to the Calculation of Reserves. It did so to encourage banks to lend out all of their funds during the COVID-19 coronavirus pandemic.

Reserve requirements are calculated by applying reserve ratios specified in Regulation D to an institutions reservable liabilities See Reserve Ratios as reported on the Report of Transaction Accounts Other Deposits and Vault Cash FR 2900 during the reserve computation period. How do you calculate total reserves. Reserve Requirement Ratio.

This is telling us that the commercial bank needs to keep 10 of its deposits as required reserves therefore. On March 15 2020 the Fed announced it had reduced the reserve requirement ratio to zero effective March 26 2020. The required reserve ratio is the fraction of deposits that the Fed requires banks to hold as reserves.

The requirement for the reserve ratio is decided by the central bank of the country such as the Federal Reserve in the case of the United States. We can then use the money multiplier to figure out the current deposit balance 300mm10 3000. The minimum required reserves are documented in the Eligibility Matrix.

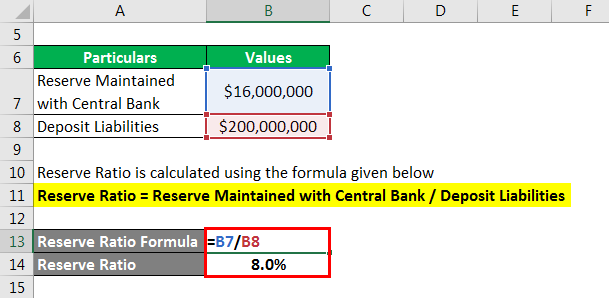

However when a borrower has multiple financed properties and is financing a second home or investment property the lender must apply the applicable additional reserve requirements for the other financed second home and investment property transactions. The calculation for a bank can be derived by dividing the cash reserve maintained with the central bank by the bank deposits and it is expressed in percentage. Welcome to the Genius Family where we save money and save time.

As of July 2021 this reserve requirement is. You can calculate the reserve ratio by converting the percentage of deposit required to be held in reserves into a fraction which will tell you what fraction of each dollar of deposits must be held in reserves. The formulas for calculating changes in the money supply are as follows.

What are total reserves. You can calculate the reserve ratio by converting the percentage of deposit required to be held in reserves into a fraction which will tell you what fraction of each dollar of deposits must be held in reserves. The requirement for the reserve ratio is decided by the central bank of the country such as the Federal Reserve in the case of the United States.

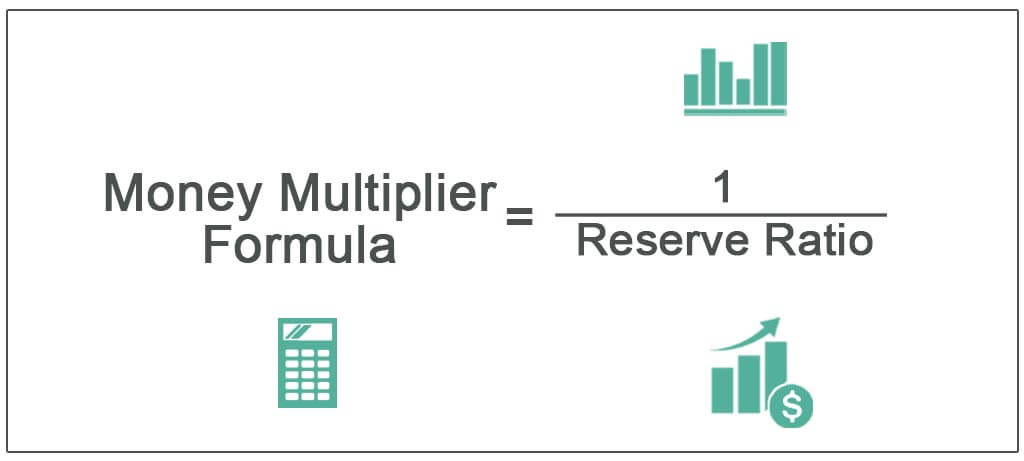

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Firstly Money Multiplier 1 Reserve Ratio. What is CRR formula.

How to calculate the minimum reserve requirements. The required reserve ratio is the fraction of deposits that the Fed requires banks to hold as reservesYou can calculate the reserve ratio by converting the percentage of deposit required to be held in reserves into a fraction which will tell you what fraction of each dollar of deposits must be held in reserves. This page provides summary information on how to determine the reserve requirements of an individual credit institution subject to the ECBs minimum reserve requirements.

The reserve ratio is the portion of reservable. Manually underwritten loans. How do you calculate total reserve change.

How do you calculate reserve requirement ratio. You can calculate the reserve ratio by converting the percentage of deposit required to be held in reserves into a fraction which will tell you what fraction of each dollar of deposits must be held in reserves.

Education What Effect Does A Change In The Reserve Requirement Ratio Have On The Money Supply

Calculating A Bank S Reserve Ratio Youtube

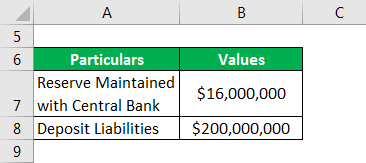

Reserve Ratio Formula Calculator Example With Excel Template

Excess Reserves Formula Example How To Calculate Excess Reserves

Reserve Ratio Formula Calculator Example With Excel Template

Bank Balance Sheet Free Response Question Video Khan Academy

Money Multiplier Formula Step By Step Calculation Examples

Reserve Ratio Formula Calculator Example With Excel Template

Reserve Ratio Formula Calculator Example With Excel Template

Reserve Ratio Formula Calculator Example With Excel Template

Money Creation Yellow Page Worksheet

Reserve Requirements Monetary Policy Instruments Monetary Policy Bank Of Korea

Money Creation Yellow Page Worksheet

Reserve Ratio Formula Calculator Example With Excel Template

/dotdash_final_Deposit_Multiplier_Dec_2020-01-12355ee057a74ef1887bb1066444b606.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)