The GoI has extended the Interest subvention Scheme on KCC issued to crop loan farmers to the KCC issued to Animal Husbandry and Fisheries farmers from 2018-19. Farmers can avail crop loan through Kisan Credit Card.

Agriculture Infrastructure Fund Explained Current Affairs Upsc Current Affairs

Hello Welcome to Infin InsightsDo consider subscribing to the channel and also like and share the videoThis video is about Interest subvention scheme for.

Interest subvention scheme for farmers upsc. The Cabinet Committee on Economic Affairs CCEA on Wednesday approved a modified scheme for extending interest subvention for those setting up grain-based along with molasses-based ethanol. The interest subvention will be given to Public Sector Banks PSBs Private Sector Banks Cooperative Banks and Regional Rural. The interest subvention will be given to Public Sector Banks PSBs Private Sector Banks Cooperative Banks and.

Further from 2009-10 to incentivize the prompt payee farmers t he GoI also introduced a provision of Prompt Repayment Incentive PRI under the Scheme. Presently loan is available to farmers at an interest rate of 7 per annum which gets reduced to 4 on prompt repayment. The Union Cabinet has approved the Interest Subvention Scheme ISS for farmers for the year 2017-18.

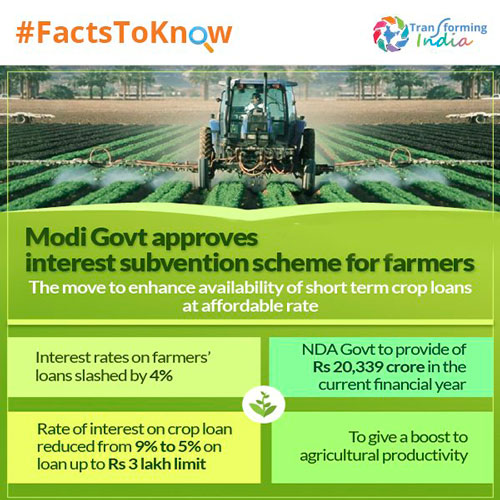

The scheme is being implemented for the year 2018-19 and 2019-20. 20339 crore for this scheme. Presently loan is available to farmers at an interest rate of 7 per annum which gets reduced to 4 on prompt repayment.

The Government of India GoI has been implementing the Interest Subvention Scheme ISS since 2006-07 under which short term crop loans upto Rs. It aims to provide short-term crop loans up to 3 lakh to farmers at an interest rate of 7 per annum. The Union cabinet has approved the Interest Subvention Scheme ISS for farmers for the year 2017-18.

The Agriculture Infrastructure Fund AIF was announced in May 2020 by the Government of India for farm-gate infrastructure for farmers. 3 lakh payable within one year at only 4 per annum. The Government has allocated Rs.

The duration of the scheme shall be from FY2020 to FY2029 10 years. Crop loan upto Rs3 lakhs at 7 rate of interest. The policy came into force with effect from Kharif 2006-07.

Government would bear interest subvention for five years including one year moratorium against the loan availed by project proponents from banks 6 per annum or 50 of the rate of interest charged by banks whichever is lower. 2 interest subvention is given to farmers which is reimbursed to banks through RBI and NABARD. Kisan Credit Card KCC extended to Animal Husbandry and Fisheries farmers.

The Government has fixed a target of 10 blending of ethanol into motor fuel by 2022 and 20 by 2030. The interest subvention scheme for farmers aims at providing short term credit to farmers at the subsidised interest rate. This interest rate becomes 4 due to 3 interest subvention incentives provided to those farmers who repay crop loan on time.

The policy came into force with effect from Kharif 2006-07. This will help farmers getting short term crop loan up to Rs. It is a facility for investment for post-harvest management infrastructure and community farming assets through interest subvention and credit guarantee.

1 Lakh Crore will be provided by banks and financial institutions as loans. Additionally 3 prompt repayment incentive PRI is provided for good credit discipline. Importance of this news for UPSC.

The Government of India has since 2006-07 been implementing the Interest Subvention Scheme under which short-term crop loans upto Rs3 lakh are made available to the farmers at an interest rate of 7 percent per annum by the Public Sector. The Central Government provides to all farmers for short term crop loan upto one year for loan upto Rs. Loan credit limit is fixed on the basis of crop sown and area under cultivation.

The interest subvention scheme for farmers aims at providing short term credit to farmers at subsidised interest rate. Vii Interest Subvention Scheme ISS. The Kisan Credit Card Scheme is implemented by Commercial Banks RRBs Small Finance Banks and Cooperatives.

Salient Highlights The objective of the scheme is to make available agricultural. The policy came into force with effect from Kharif 2006-07. Interest Subvention Scheme ISS.

Following Imp Interest Subvention Scheme for Farmers. 300 lakh are made available to farmers at subvented interest rate of 7 per annum. Interest subvention of 2 to banks and 3 to farmers towards Prompt Repayment incentive is extended on short-term loans up to Rs2 lakh to animal husbandry and fisheries farmers apart.

Credit facility to farmers. In this article you can get all the relevant information on the Agriculture Infrastructure Fund. The scheme is being implemented for the year 2018-19 and 2019-20.

The Government provides interest subvention of 3 on short-term crop loans up to Rs300 lakh. The Government provides interest subvention of 3 on short-term crop loans up to Rs300 lakh. Government schemes especially for the agriculture sector are important for the UPSC exam prelims and mains.

Further the schemes are compulsory for loanee farmers and voluntary for non-loanee farmers. The scheme is being implemented for the year 2020-21. Under this scheme the farmers can avail concessional crop loans of upto Rs3 lakh at 7 per cent rate of interest.

Interest Subvention Scheme ISS was launched for short term crop loans in 2006-07. 3 lakhs borrowed by them. Interest subvention scheme.

Interest subvention for short term crop loans. The interest subvention scheme for farmers aims at providing short term credit to farmers at subsidised interest rate. Under the scheme Rs.

Second Tranche Of Economic Stimulus Package Legacy Ias Academy

Farmer S Suicide And Interest Subvention Scheme Insightsias

Agriculture Infrastructure Fund Next Ias Current Affairs Blog

Cabinet Approval For Agriculture Infrastructure Fund Upsc Current Affairs

National Rabi Campaign 2020 Upsc Iasbhai

Agriculture Infrastructure Fund Next Ias Current Affairs Blog

Agriculture Infrastructure Fund Aif Scheme Civilsdaily

Central Sector Scheme Of Financing Facility Under Agriculture Infrastructure Fund Current Affairs Insight

Interest Subvention Scheme For Farmers Journalsofindia

Doubling Farmers Income Journalsofindia

09 July 2021 Daily Current Affairs For Upsc

Bank Exams Interest Subvention Scheme Part 1 Offered By Unacademy

Editorial Notes Why All Crop Loans Should Be Routed Through Kisan Credit Cards

What Is Interest Subvention In Simple Language With English Subtitles Youtube

Agriculture One Year Current Affairs For Upsc Cse Mains

Interest Subvention Scheme Iss Current Affairs Gk News Gktoday

2.png)

Jatin Verma S Ias Academy 8882932364 Jatin Verma Best Ias Coaching In Karol Bagh Ias Coaching In Karol Bagh Classroom Courses For Ias Coaching In Karol Bagh Foundation Batches For Ias

2 12 G Sa Agricultural Credit Farm Loan Waivers Interest Subvention Scheme Explained Youtube

Union Government Has Introduced A New Scheme Of Interest Subvention On Working Capital Loans For Dairy Sector For Supporting Dairy Cooperatives And Farmer Producer Organizations Engaged In Dairy Activities For Implementation During