The role of intermediaries and the importance of financial instruments in the financial market are also explained in brief. The rapid growth is both in terms of development of existing financial.

Financial Markets Functions Importance And Types

The Indian financial sector.

What do you understand by indian financial system. And the representative of supply side will be banks financial. Indian Financial system is a system in which people financial institutionsbanks companies and the government demand for fund and same is supplied to them. This system manages the flow of funds between the people household savings of the country and the ones who may invest it wisely investorsbusinessmen for the betterment of both the parties.

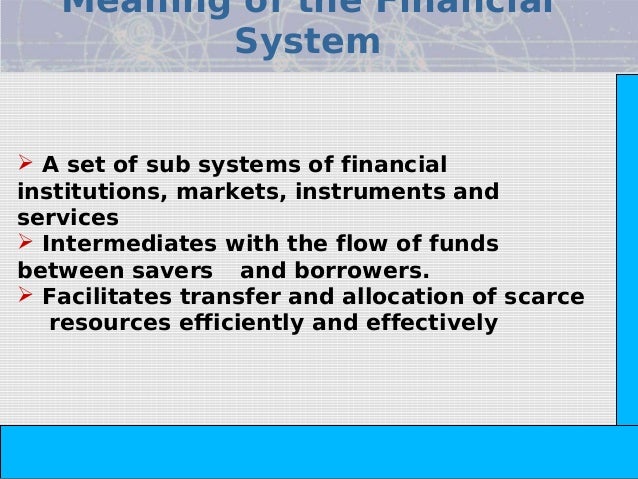

Explain the various sources of such finances. A financial system is also a network of financial institutions financial markets financial instruments and financial services to facilitate the transfer of funds and make sure the flow of the investment in the economy. The Indian financial sector is diversified and is undergoing fast expansion.

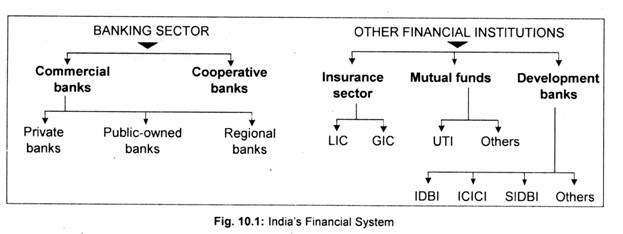

The Banking system of a country is an important pillar holding up the financial system of the countrys economy. These institutions together with the users compile the financial system. The book Indian Financial System comprises various nancial aspects of Indian economy and presents a detailed idea about the oper- ations in the nancial market.

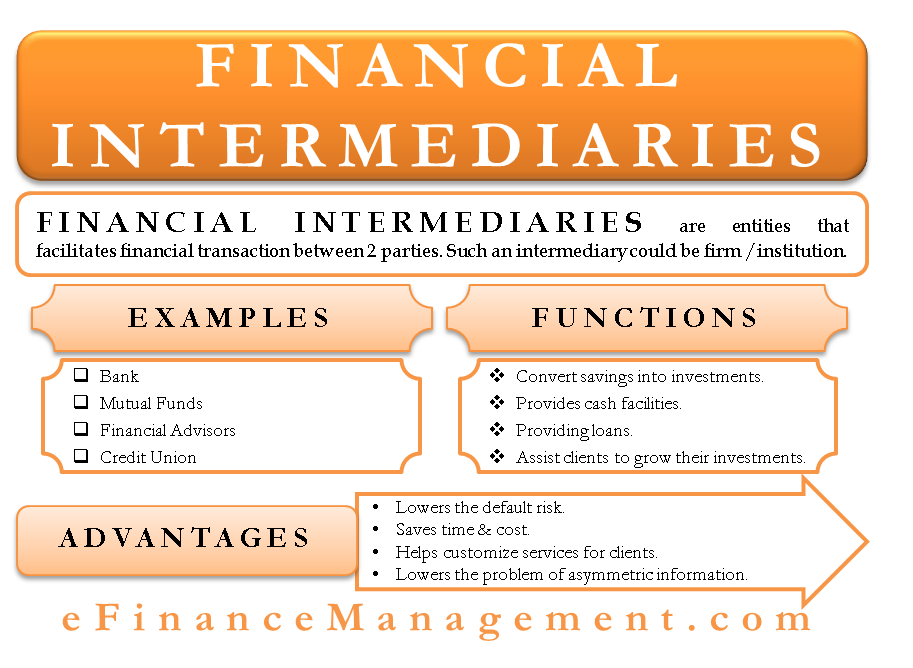

The system consists of savers intermediaries instruments and the ultimate user of funds. The financial system of India facilitates the mobilisation of funds for the economic growth and development of the country and its residents. The primary function of a financial market is to transfer resources efficiently from those having idle resources to others who have a pressing need for them.

The roles of stock exchanges in the primary and secondary market can also be understood. The savers and investors are constrained not by their abilities. The main function of financial management is to mobilize funds for investments as and when they are required at the lowest possible cost and to ensure a fair return to the investors.

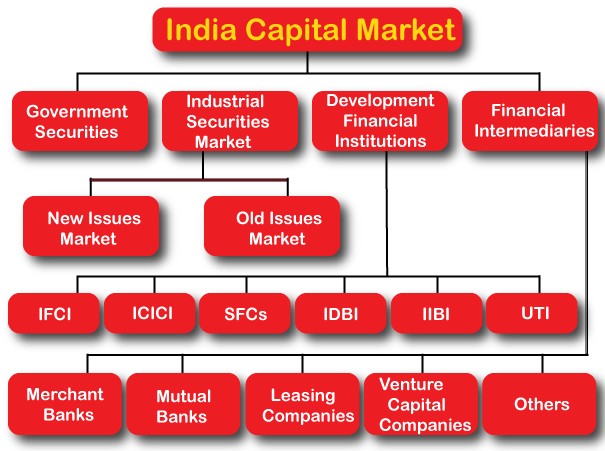

A financial system of any country comprises of end users financial institutions like banks markets national stock exchange other stock exchanges bond market etc. The representatives of demand side can be individual investors Industrial and business companies government etc. Structure of Indian Financial System What is Financial system.

Financial Markets are one of the major constituents of the Indian Financial System. The Indian financial system establishes the bridge between people having surplus funds and people with deficit funds so that the funds available could be better utilised by the individuals or businesses or corporations who know how to multiply it. The existing elaborate banking structure of India has evolved over several decades.

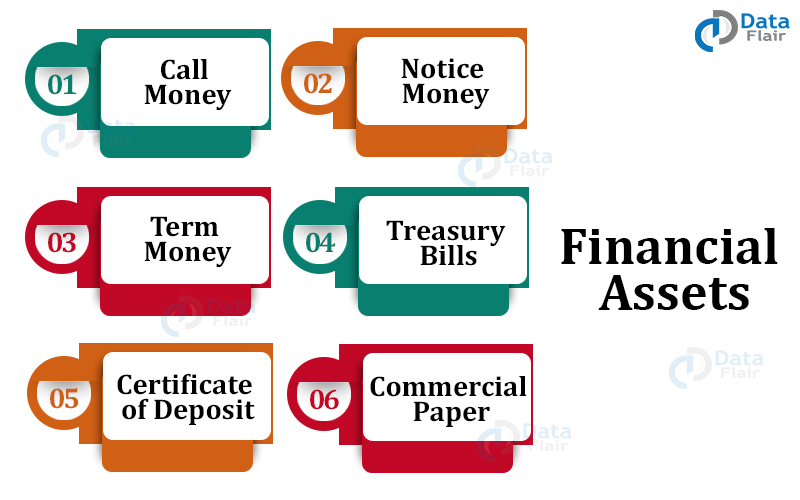

The importance of primary secondary market and shorter money market are explained. Introduction to Indian Financial System The financial system of a country is an important tool for economic development of the country as it helps in creation of wealth by linking savings with investments. The Financial system is a process of allowing net savers to lend funds to net spenders.

The Indian Financial System is one of the most important aspects of the economic development of our country. Business Finance is one of the major factors in all kinds of economic activity. The major role of banks in a financial system is the mobilization of deposits and disbursement of credit to various sectors of the economy.

Functions of Financial System in India Liquidity function The most important function of a financial system is to provide money and monetary assets for the production of goods and services. It facilitates the flow of funds form the households savers to business firms investors to aid in wealth creation and development of both the parties. In other words financial markets provide channels for allocation of savings to investments.

- There are two parts of Indian financial system first demand side and second supply side. Financial System Meaning Functions and Services A financial system is a network of financial institutions financial markets financial instruments and financial services to facilitate the transfer of funds. Financial system a network of financial institutions COMMERCIAL BANKS BUILDING SOCIETIES etc and markets MONEY MARKET STOCK MARKET dealing in a variety of financial instruments BANK DEPOSITS STOCKS and SHARES etc which are engaged in money transmission activities and the provision of LOAN and CREDIT facilities.

Indian Financial system About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features 2021 Google LLC. You understand the financial systems how it works in the Indian market.

Function Of Financial System Business Studies Financial Transfer Function

The Benefits Of Crm For Business Banking Salesforce Com

Financial Intermediaries Meaning Functions And Importance

Indian Financial System Formal Informal Financial System Paper Tyari

Indian Financial System With Diagram

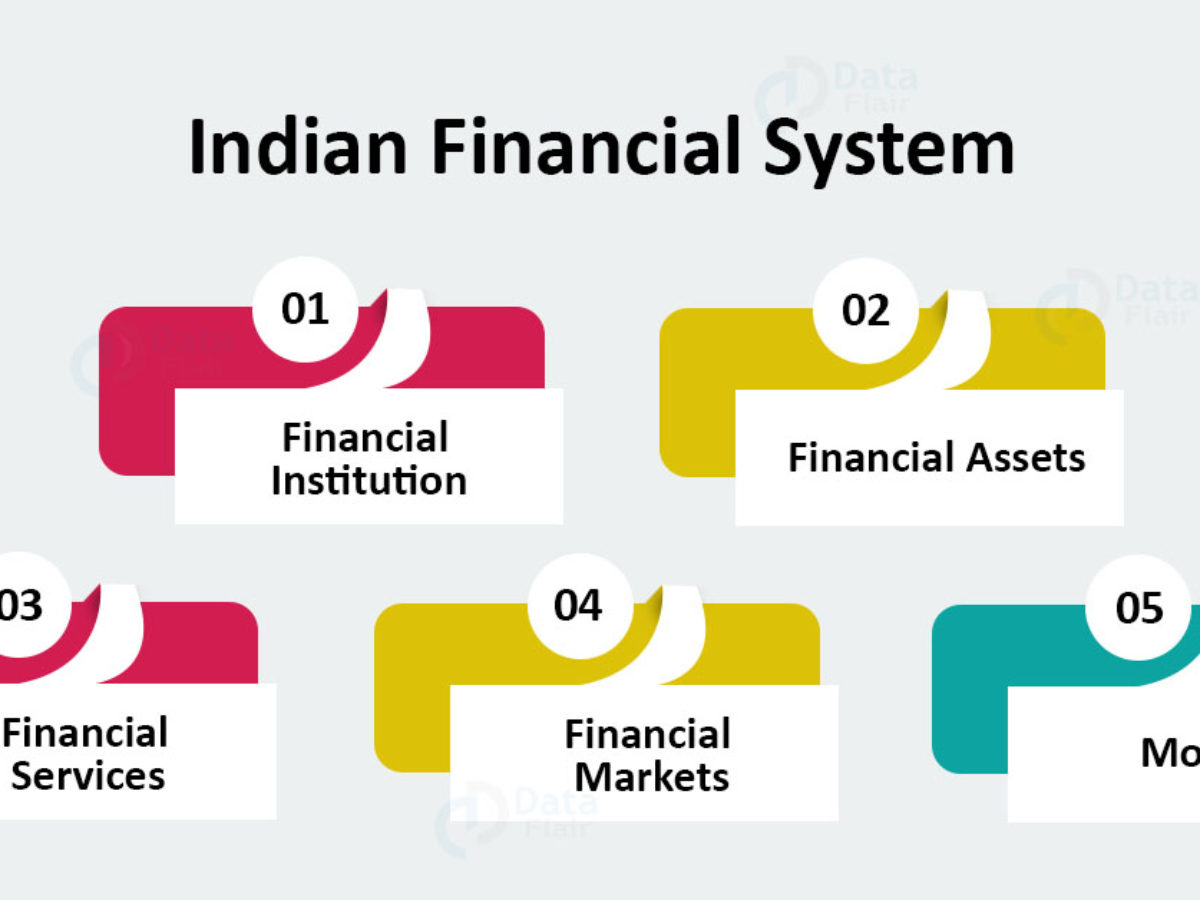

Indian Financial System Components And Functions Dataflair

Indian Financial System Components Definition And Function Thesisbusiness

Banking System In India Indianmoney

Is The Indian Banking System Heading For Collapse Quora

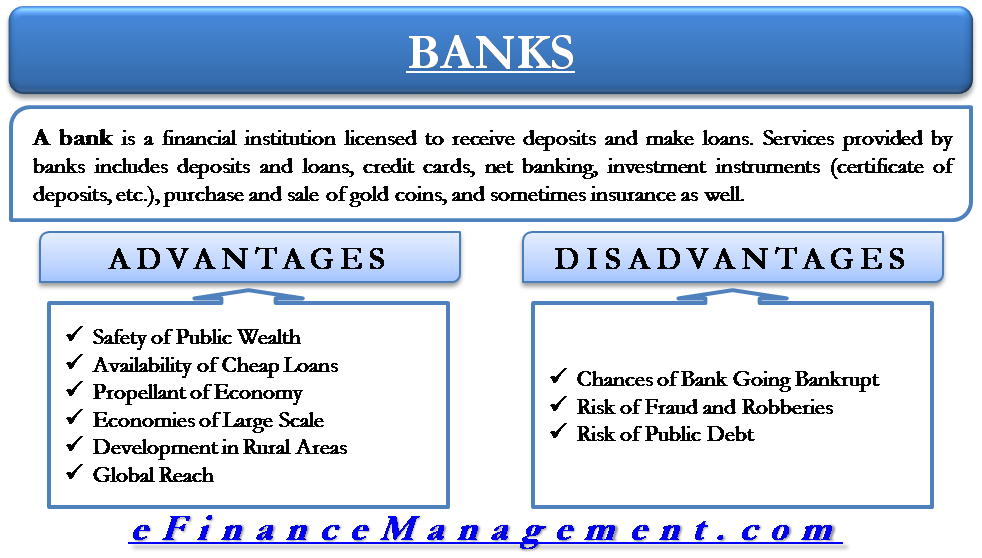

Advantages And Disadvantages Of Banks Efinancemanagement

Indian Financial System Introduction Bba Mantra

Indian Financial System Components And Functions Dataflair

Indian Financial System Components And Functions Dataflair

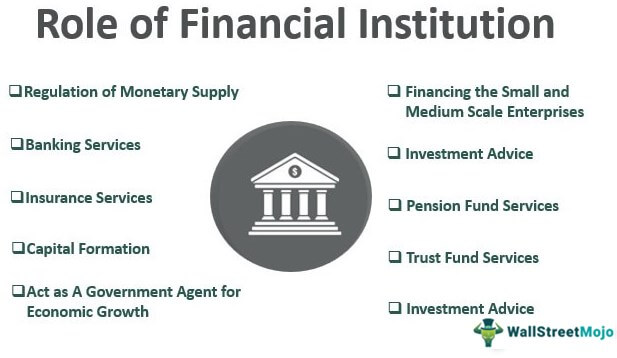

Role Of Financial Institutions Top 10 Roles In Economic Development

Reserve Bank Of India Rbi Definition

Recent Reforms In Financial Sector Indian Financial Sector Reforms

Indian Financial System Components Definition And Function Thesisbusiness

Banking System Definition Types Video Lesson Transcript Study Com