Rated 5 stars on Feefo. If you want to buy a property to let out and need a mortgage youll usually find LTVs on Buy to Let mortgages are generally a bit lower than they are on residential mortgages as they represent a higher risk to lenders.

How To Calculate Your Home S Equity Loan To Value Ltv Tips

Its also worth noting that all FHA loans require borrowers to purchase mortgage.

What is the highest loan to value mortgage. Below 80 is considered low with 85-90 and upwards considered high. The maximum LTV for an uninsured mortgage is 80 while the maximum LTV for an insured mortgage is 95. Higher LTVs are seen as riskier.

Conventional loans typically have a higher bar for approval than other types of loans. The maximum amount youre likely to be able to borrow is 75 to 80 of the property value. The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford.

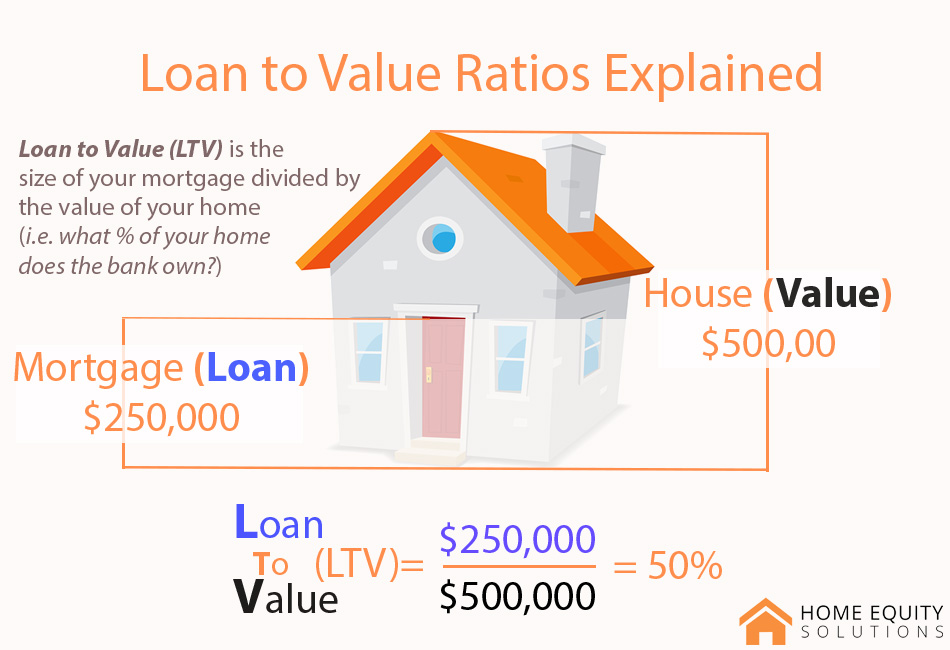

So imagine you are going to buy a house that is worth 250000 and you have applied for a mortgage for 200000. For a home mortgage the maximum loan-to-value ratio is typically 80. Bear in mind too that buy-to-let mortgage rates will usually be higher than residential.

For example many of them wont lend above 75-80 at or above 1000000 regardless of other factors. Our maximum mortgage calculator helps you calculate the maximum monthly mortgage payment and total mortgage amount you can afford. For most forward mortgages conventional mortgages that amortize regularly the maximum loan-to-value ratio for loans without private mortgage insurance PMI ratio is typically 80 percent.

Higher loan-to-value ratios may require a borrower to purchase insurance to protect the lender or result in higher interest. You can get a conventional loan. At 45 your maximum mortgage.

If your credit score falls between 500 and 579 your LTV ratio cant be higher than 90. Some allow a combined loan-to-value ratio of around 85 while others go as high as 95. This is the Loan to Value Ratio.

The maximum loan-to-value allowed under FHA loans is 965. The loan to value in this situation is 80. You will likely find different requirements for each lender.

For example if youre buying a home thats appraised at 200000. But if you only had 25000 the Loan to Value Ratio is 9167 which is over the lenders 90 Maximum LTV Ratio. A low LTV ratio means that it would be more likely for your mortgage lender to recover the amount of the mortgage should you default even if.

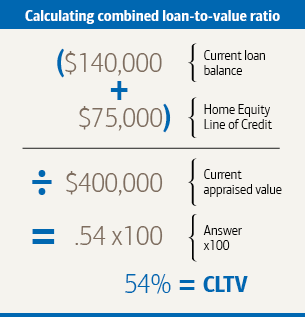

For homebuyers who are trying to qualify for an FHA loan an acceptable loan-to-value ratio is 965 if your credit score is at least 580. If were talking existing mortgages in the case of refinance loans its the outstanding loan balance divided by the appraised value. The CLTV Combined Loan To Value measures your first and second mortgage combined against your appraised home value.

Loan-to-value LTV is a term that refers to the ratio of a loans amount to the value of the property at the time the loan is taken out. Your deposit will be 50000. Conventional loans usually meet guidelines set by Fannie Mae and Freddie Mac two government-sponsored enterprises that buy mortgages from lenders.

If you know you want a second mortgage to take cash out of your home either to fix your home up. The lowest LTV mortgages available come with a ratio of 60 going right up to 100 for the highest. Some you may appeal.

CLTV applies to both home equity loans and. The amount you can borrow varies by lender. Low LTV mortgages come with low interest rates but high deposits and vice versa for loans with high ratios.

Simply put the loan-to-value ratio or LTV ratio as its more commonly known in the industry is the mortgage loan amount divided by the lower of the purchase price or appraised value of the property. This calculator is for you if you are reviewing your financial stability as you get ready to purchase a property. If a lender will lend up to a maximum of 90 LTV then you have met the criteria with a loan to value of 8833.

What is the maximum Loan-to-Value. Its also worth mentioning that most lenders impose LTV limits at certain mortgage sizes. Mortgage loans backed by the Federal Housing Authority FHA come with a different set of rules.

Or pay for another large expense shop around with different lenders. Loan to value or LTV is one of the most widely used phrases in the mortgage industry and media grabbing the headlines whenever new housing figures are announced. This maximum mortgage calculator collects these important variables and determines the maximum monthly housing payment and the resulting mortgage amount.

Pin On 2018 Kentucky First Time Home Buyer Mortgages For Fha Va Khc Usda And Rural Housing Fannie Mae

The Top 10 Costly Mistakes Home Buyers Make Mortgage Loans Mortgage Rates Mortgage

The Higher Loan To Value For Your Gold Is Assured At Our Branches Maximum Loan Amount Lowest Intrest Rate Hassle Fre Gold Loan Loan Interest Rates Loan

Image Result For Mortgage Loan Has Funded Reverse Mortgage Mortgage Info Mortgage

Fha Cash Out Refinance Guidelines Cash Out Refinance Cash Out Fha

Personal Loans For Homeowners Borrow Between 3000 00 And 30000 With A Person Mortgage Broker Mortgagebroker Mortgage Brokers Home Mortgage Unsecured Loans

Questions You Should Mortgage Lenders Freeandclear Mortgage Process Mortgage Loans Mortgage Lenders

How To Calculate Your Home S Equity Loan To Value Ltv Tips

What Happens If You Default On A Second Mortgage Loan Canada Wide Financial Second Mortgage Mortgage Loans Mortgage

Louisville Kentucky Va Home Loan Mortgage Lender Kentucky Va Mortgage Requirements For Bankruptcy Forec Va Mortgage Loans Mortgage Loans Refinancing Mortgage

What Is Va Loan An Overview Of Va Home Loan 2019 Refinance Prep Yourself Before Your Refinance Your Mortgage Ref Home Appraisal Home Loans Home Refinance

Maximum Loan To Value Ratio Definition

Make Out The Maximum Amount You Can Receive From A Mortgage Loan Fast And Easy Mortgage Mortgageloan Finan Payday Loans Loans For Bad Credit Mortgage Loans

Maximum Loan To Value Ltv Ratio For The Fha Mortgage Program Fhahandbook Com

Calculate Mortgage Loan Amortization With An Excel Template Free Office Com Mortgage Amortization Calculator Mortgage Loans Mortgage Refinance Calculator

The Federal Housing Finance Agency Fhfa Set Maximum Conforming Loan Limits For Mortgages To Be Acquired By Fannie Mae And Freddie Fannie Mae Finance The Unit

Pin By Guardian Mortgage On Selling Your Home Home Improvement Loans Home Improvement Move On Up

Loan To Value Explained Home Equity Solutions

Fha Closing Cost Explained Mortgage Loan Facts Fha Ltv Maximum Is 96 5 Borrower Needs A 3 5 Investment Gift Funds Mortgage Loans Closing Costs Fha Loans