A longer term means lower monthly payments but higher total costs. However you do need to know that applying for a debt consolidation loan will trigger a hard inquiry to your credit report.

How Paying Off Student Loan Debt Affects Your Credit Score

This may help you avoid this situation.

Will consolidating credit card debt hurt your credit score. Debt consolidation is the process of replacing one or more loans or credit cards with a new one. It is difficult to say exactly how much but there are things you can do to mitigate the damage. A shorter term will reduce total costs but it means higher monthly payments.

Choose a term that offers monthly payments you can afford. But if you make regular on-time payments on that consolidation loan and pay it off in a reasonable amount of time your credit scores should recover and may even improve over the long run as you get rid of debt. So make sure when youre asking for quotes if the lender places any restrictions on borrowers.

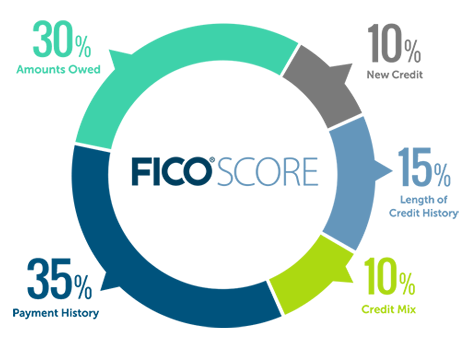

In some cases. The length of your credit history makes up 15 of your FICO credit score and specifically factors in the age of your newest account. The amount that your credit score will drop will depend on your personal financial situation.

Can I use debt consolidation without closing credit cards. Too many of these can actually hurt your credit score making it harder to qualify for things like consolidation loans. The strategy is considered in situations where people want to streamline the repayment of multiple high-interest debt amountsoften with the hopes of saving money and lowering their debt burden.

Nearly 70 of consumers who consolidated debt. Thats why its not a good idea to max out your credit card. Two common debt consolidation approaches include getting a.

Debt consolidation can help you get out of overwhelming debt but it may affect your credit. When you consolidate your credit card debt you are taking out a new loan. Consolidating may even give your credit score a bump according to a new report from Transunion.

Only apply for one loan because applying for multiple loans at once will hurt your credit score. If you get a consolidation loan and keep making more purchases with credit you probably wont succeed in paying down your debt. In the right situation consolidating your debts can simplify your.

Once approved the funds are disbursed to pay off your credit card balances. Over time debt consolidation could actually improve your score for three reasons. At the same time any new loan can cause a short-term dip in your credit scoresso dont be too surprised if you see your credit score change slightly when taking out a.

If youre having trouble with credit consider contacting a credit counselor first. Because the credit card company takes less money than is owed your credit score will be temporarily lowered because you wont pay your debt in full. For example if you have three cards with 5000 limits youve got 15000 total credit available.

Opening a new credit card or taking out a loan for debt consolidation will lower the average age of all your credit accounts which may also temporarily lower your credit score. For example debt management plans ask you to quit using your credit cards. If you do use up your entire credit limit on your card youll discover that your credit score may go down.

Consolidating your debt into a new lower-interest loan a balance transfer credit card personal loan or home equity loan may hurt your credit scores in the short- or medium term. Opening new lines of credit may hurt your credit score. If you cancel a card that reduces the amount of credit you have available and that can lower your credit score.

Most debt consolidation methods will temporarily lower your credit score for a variety of reasons. You may see your credit score drop temporarily at first he said but it will quickly go back up once you pay off the old debt and start making regular payments on the new account. The amount of debt you owe on your credit card is one of the biggest factors affecting your credit score.

According to Brucker debt consolidation can have both short- and long-term effects on your credit score. Debt consolidation has the potential to help or hurt your credit scoredepending on which method you use and how diligent you are with your repayment plan. Debt consolidation can help you save money but one wrong move and it can damage your credit score.

Consolidating your debt can lower your monthly payments but it can also cause a temporary dip in your credit score. This could bring your credit score down a few more points in the short term. And when your credit score goes down you could end up having to pay higher interest rates on any other credit cards or loans you take out.

A loan with fixed monthly payments may actually benefit your credit rating especially if you use the loan to pay off credit cards that are near their limits. Settling a Credit Card Debt Can Lower Your Credit Score Debt settlement affects your credit score. You have to repay the new loan just like any other loan.

1 - Paying off cards reduces your credit utilization ratio which should be no more than 30 of available credit. Effect on Your Credit. Consolidating credit cards with high balances using an installment loan ie.

Goodbye Credit Card Debt Credit Cards Debt Credit Card Credit Card Debt Loan

Refinancing Credit Card Debt And Reducing Interest Payoff Paying Off Credit Cards Budgeting Money Loan Payoff

Goodbye Credit Card Debt Credit Cards Debt Budgeting Money Finances Money

Say Goodbye To Credit Card Payments And Hello To A Happier You Low Interest Rates One Mon Paying Off Credit Cards Credit Card Payoff Plan Credit Card Payment

Goodbye Credit Card Debt Credit Cards Debt Loan Payoff Credit Card

Consolidating Credit Card Debt Without Hurting Your Credit

Credit Card Payoff Credit Card Creditcard Credit Card Tips Kreditkarte Creditcar Credit Card Consolidation Credit Card Application Paying Off Credit Cards

Credit Scores Can Help Or Hurt Your Efforts To Get A Loan For A New Car Or A New Home Learn More About How Scores Are C Credit Score Good Credit

Does Debt Consolidation Hurt Your Credit Nerdwallet

Does Debt Consolidation Hurt Your Credit Score Nfcc

Survey 48 Of People With Credit Card Debt Are Afraid To Consolidate Student Loan Hero

Do You Know About Debt Consolidation Improve Credit Score Credit Repair Debt Consolidation Programs

Goodbye Credit Card Debt Debt Payoff Plan Loan Payoff Credit Card

Will Debt Consolidation Negatively Impact Your Credit Nfcc

Do Debt Consolidation Loans Hurt Your Credit Creditassociates