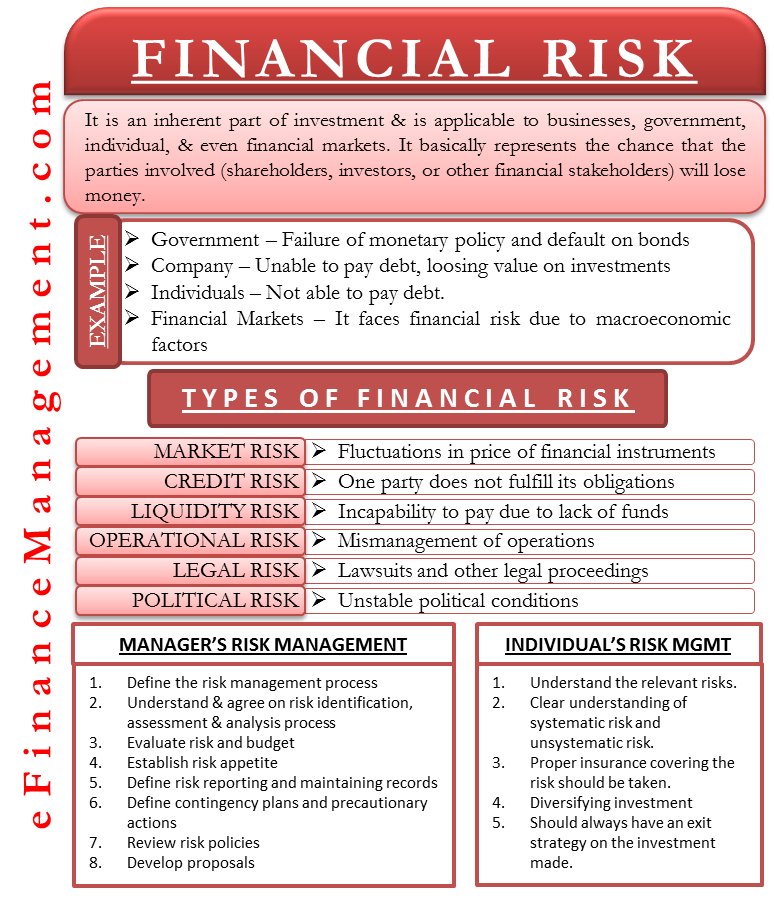

Understanding the concept of financial risk what it is along with the different types of financial risk is helpful when it comes to protecting against the loss or potential loss of money. Risk management is about assessing pricing and making decisions about risk in a marketplace.

Risk Management In Banks Introducing Awesome Theory

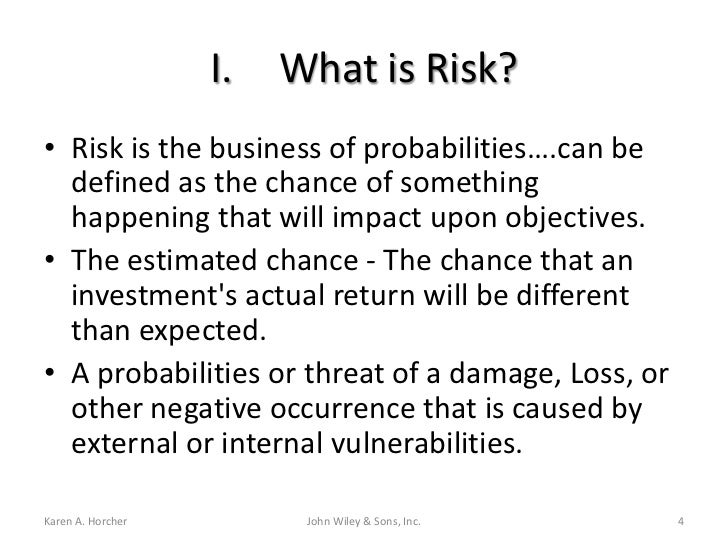

The Oxford Dictionary defines risk as.

What do you understand by financial risk management. Key Takeaways Financial risk generally relates to the odds of losing money. Sure one cannot perfectly plan for every single possible scenario out there but with financial risk management anyone can minimise its effects. How Do You Implement Financial Risk Control.

It alsoensures that management operational. Thus we want to define what is dangerous and what is this unpleasant thing we want to avoid. To fully understand the FRM credential you must understand what financial risk managers do.

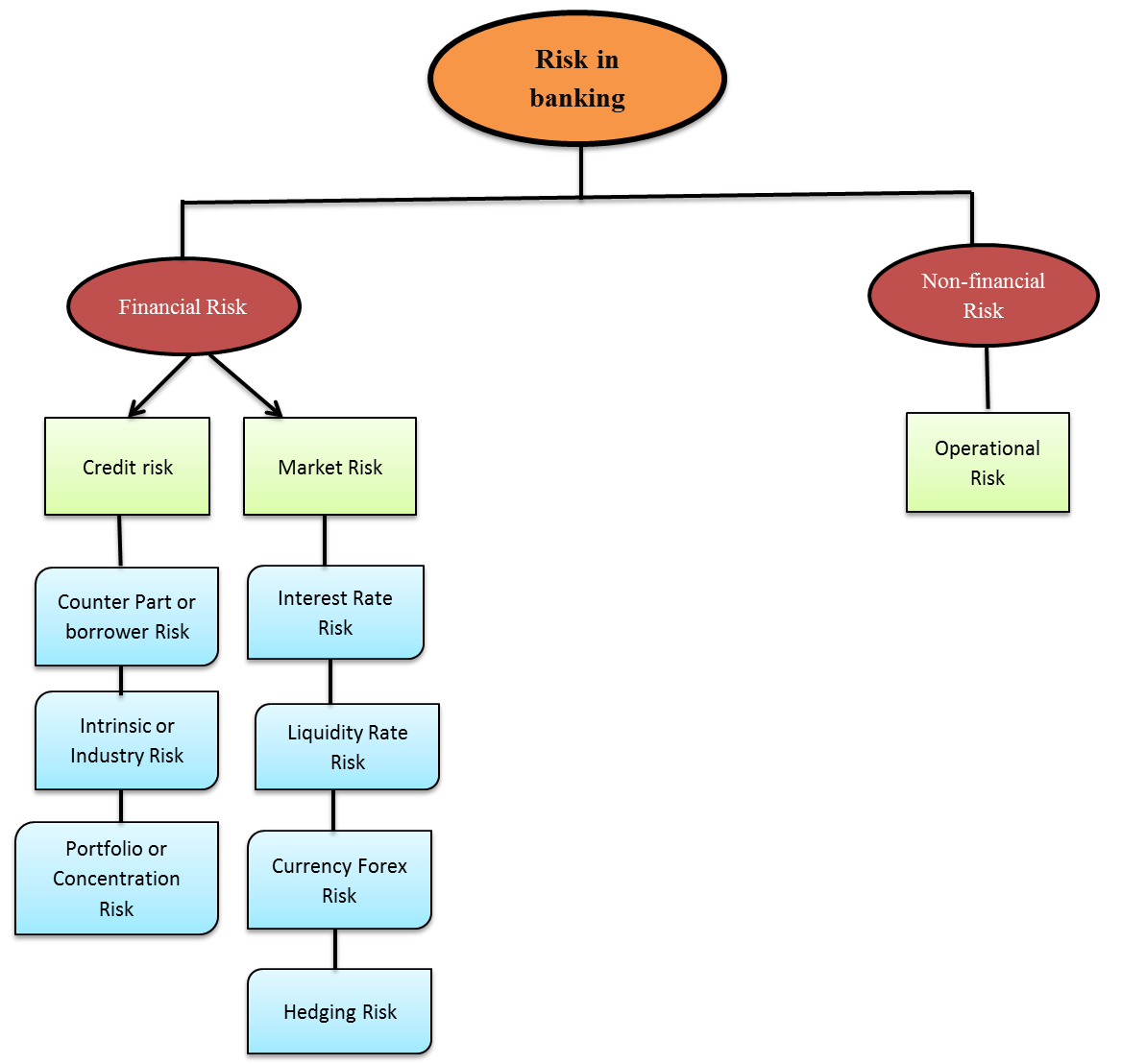

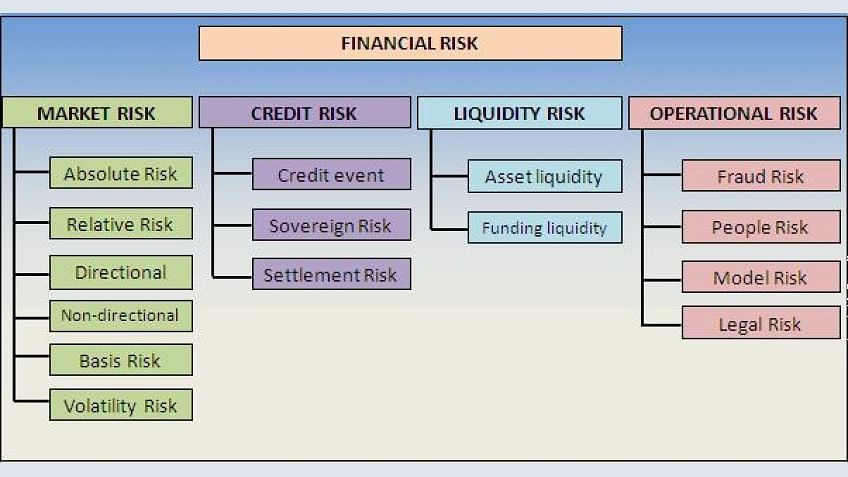

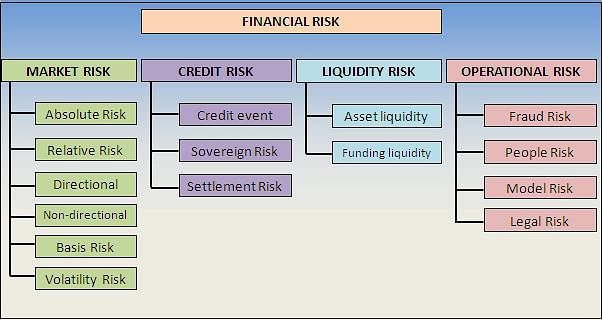

We know based on the definition of risk management that it is the methodology used to mitigate adverse consequences that result from threats and uncertainties. It can be categorized into the following four categories. Through the use of derivatives.

Risk management encompasses the identification analysis and response to risk factors that form part of the life of a business Business Life Cycle The business life cycle is the progression of a business in phases over time and is most commonly divided into five stages. Of the various types of risk your organization might face financial risk has the. It does this in several ways.

Reducing cash flow and earnings volatility. Managing financial risk does not only mean averting a risk but also defining the type of risks that an organization could face or is willing to take. The financial risk most commonly referred to is the possibility that a companys cash flow will prove inadequate to meet.

Addressing financial risks proac-tively may provide an organization with a competitive advantage. Financial risk management is nothing but identifying the potential pitfalls called risks prioritizing them and finding appropriate solutions to mitigate or eradicate these risks. A situation involving exposure to danger and it goes on The possibility that something unpleasant or unwelcome will happen.

Put simply this means developing a strategy to avoid losing money when unexpected events occur. Effective risk management means attempting to control as much as possible future outcomes by acting proactively rather than reactively. Financial risk management not only seeks to forecast potential problem areas but it also works to predict opportunity.

This enables the business to act quickly on what it sees as good investment scenarios and to work to maximize the financial benefit of these opportunities. A financial risk assessment can help you identify the risk level specific to your business prioritize those risks develop ways to avoid them and outline steps to manage them should they happen. There are many financial risks that were faced with nearly every.

Understanding Financial Risk It is common to have a very traditional interpretation when we think of investment risk such as the belief that stocks are seen as a risky investment and bonds less so. Managing financial risk is a high-priority risk for businesses irrespective of the industry they operate in. Financial risk management is a process to deal with the uncertaintiesresulting from financial markets.

But many issues have come to light in the past decade that cause us to think about risk differently. What Is Financial Risk Management. Literally speaking risk management is the process of minimizing or mitigating the risk.

It involves assessing the financial risksfacing an organization and developing management strategies consistentwith internal priorities and policies. This is an expansive field because ultimately anything that involves a company spending or collecting money involves risk. Financial risk management identifies measures and manages risk within the organisations risk appetite and aims to maximise investment returns and earnings for a given level of risk.

Financial Risk Management The process of understanding as well as finding a solution to the risk that a business is facing or could face is known as financial risk management. A first obstacle stands in the way of determining risk. Credit risk liquidity.

Managing the costs of financing costs eg. Financial risk is a constant in every business and the best way to manage those risks varies from industry to industry. Financial risk can also apply to a government that defaults on its bonds.

Financial Risk Management is the process of managing the uncertainty of investment by series of activities in order to determine if the presumed rewards from the investments justify the expected risk and to manage to stay within the risk appetite framework. Financial Risk Explained. Understanding Risk Management Framework RMF Effective risk management plays a crucial role in any companys pursuit of financial stability and superior performance.

In simple terms financial risk management is the process of managing the investments within the pre-set risk levels. It starts with the identification and evaluation of risk followed by optimal use of resources to monitor and minimize the same. With financial risk management you can get yourself prepared for all of the possible unexpected situations of your business that is related to finances.

Risk generally results from uncertainty.

Theme Financial Risk Management Plan Types Of Financial Risks Method Of Managing The Risks Ppt Download

Enterprise Risk Management Framework Rma

Seven Free Computational Finance Case Studies Risk Management Financial Risk Manager Asset Liability Management

Risk Appetite The Cornerstone Of Enterprise Risk Management Pecb

Financial Risk Meaning Type Management By Managers And Individuals

Measuring Risk Essentials Of Financial Risk Management

/knowrisk-56fd587a5f9b586195c69845.jpg)

Identifying And Managing Business Risks Investopedia

What Is Financial Risks And Its Types

5 Steps Of The Risk Management Process

Quantitative Financial Risk Management Pdf Risk Management Management Financial Management

Unit 2 Risk In Banking Business Ppt Download

Risk Management 7 Steps Of Risk Management Process

What Is Financial Risks And Its Types

What Is Financial Risks And Its Types

Financial Risk Types Of Financial Risk Advantages And Disadvantages

What Is Risk Management In Healthcare

Risk Definition Types Adjusment And Measurement

/risk_management-5bfc36abc9e77c005182400f.jpg)

/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)