All you do is take your loan amount and divide it by the purchase price or if youre refinancing divide by the appraised value. Mortgage 225000.

Reverse Mortgage Age Chart What Percentage Of Appraised Value Will I Get Reverse Mortgage Loan Advisors 714 271 8524 Reverse Mortgage Mortgage Loans Mortgage

For example a loan to value of a building worth 200000 and a loan of 150000 has an LTV of 75 150000 divided by 200000.

What does 75 loan to value mean. Loan to value ratio - A loan to value ratio is the ratio between your property value and the mortgage your require the loan High vs. This means the borrower does not have to make a down payment at all. For instance the VA home loan program offers 100 financing.

If a lender provides a loan worth half the value of the asset for example the LTV is 50. The propertys lease location and condition your age and credit score. Borrowers with a loan-to-value of 60 or lower will be offered the most preferential rates.

In this scenario the loan-to-value ratio can be up to 100. Property value 300000. The loan-to-value LTV ratio is the percentage of your homes appraised value or purchase price if it is lower that you are borrowing.

To calculate your LTV ratio take your mortgage amount and divide it by the purchase price or appraised value of the home whichever is lower. Generally speaking borrowers with a loan-to-value of 90 or above will be charged the most while borrowers with a loan-to-value of 75 will be charged less. This is best shown by way of an example.

It also shows how much equity a. The loan-to-value ratio or LTV ratio is the amount that you are allowed to borrow to finance your home. The lower your LTV the less risky a mortgage application appears to lenders.

Low loan to value - The higher the loan to value ratio the. Lenders use both to measure risk the higher the percentage the higher the risk to the lender. For example a mortgage with a maximum Loan to Value Ratio of 60 would probably be offered with a lower interest rate.

This is because the more of your own money used to make the purchase the less the lenders money is at risk if you stop paying the mortgage or the property falls in value for any reason. 75 loan-to-value means that the loan is equal to 75 of the value of the asset held as collateral. A loan-to-value LTV ratio is the relative difference between the loan amount and the current market value of a home which helps lenders assess risk before approving a mortgage.

The remaining value is paid as a deposit. If a person takes out a 75 loan and uses an asset worth 100 the loan has a loan-to-value. Up to 90 of the purchase priceproperty value.

The loan to value. The loan-to-value ratio is a simple formula that measures the amount of financing used to buy an asset relative to the value of that asset. Take what you want to borrow or already owe and divide by the value of the property.

Up to 75 of the purchase priceproperty value. Calculating your loan to value ratio is simple. The borrower puts nothing down so the lender covers the entire purchase amount.

Simply put the loan-to-value ratio or LTV ratio as its more commonly known in the industry is the mortgage loan amount divided by the lower of the purchase price or appraised value of the property. Factors that may affect your LTV. It measures the relationship between the loan amount and the market value of the asset securing the loan such as a house or car.

The loan-to-value is the ratio between the value of the loan you take out and the value of the property as a whole expressed as a percentage. Loan-to-value LTV ratio is a number lenders use to determine how much risk theyre taking on with a secured loan. Say you want to buy a house worth 300000 and you have 60000 in your account that you can use as a deposit.

A low LTV may improve your odds at getting a better mortgage. Loan to Value is a critical tool used when lenders measure risk and as a house buyer the Loan to Value. LTV 225000 divided by 300000.

Certain types of loans offer 100 financing. A loan-to-value LTV ratio is a financial term used by lenders to describe the ratio between the value of your home loan and the homes value and represent the first mortgage line as a percentage of the total appraised value of your home. To calculate your LTV divide your loan amount by the homes appraised value or purchase price.

If were talking existing mortgages in the case of refinance loans its the outstanding loan balance divided by the appraised value.

3 Ways To Take Advantage Of Home Equity Achieva Life Home Equity Equity Smart Money

Fsbo Vs Realtor Infographics Fsbo Vs Realtor Real Estate Infographic Infographic

Va Home Loans Facts 2020 Home Loans Loan Facts

Loan To Value Ltv Ratio Explained Quicken Loans

The Us Employment Population Ratio Rose Even As The Labour Participation Rate Fell In February Pay Off Mortgage Early Mortgage Finance Blog

Usedfirst Com Shows Car Shoppers The Best Value Based On Depreciation Used Car Values Car Car Buying

Maximum Loan To Value Ltv Ratio For The Fha Mortgage Program Fhahandbook Com

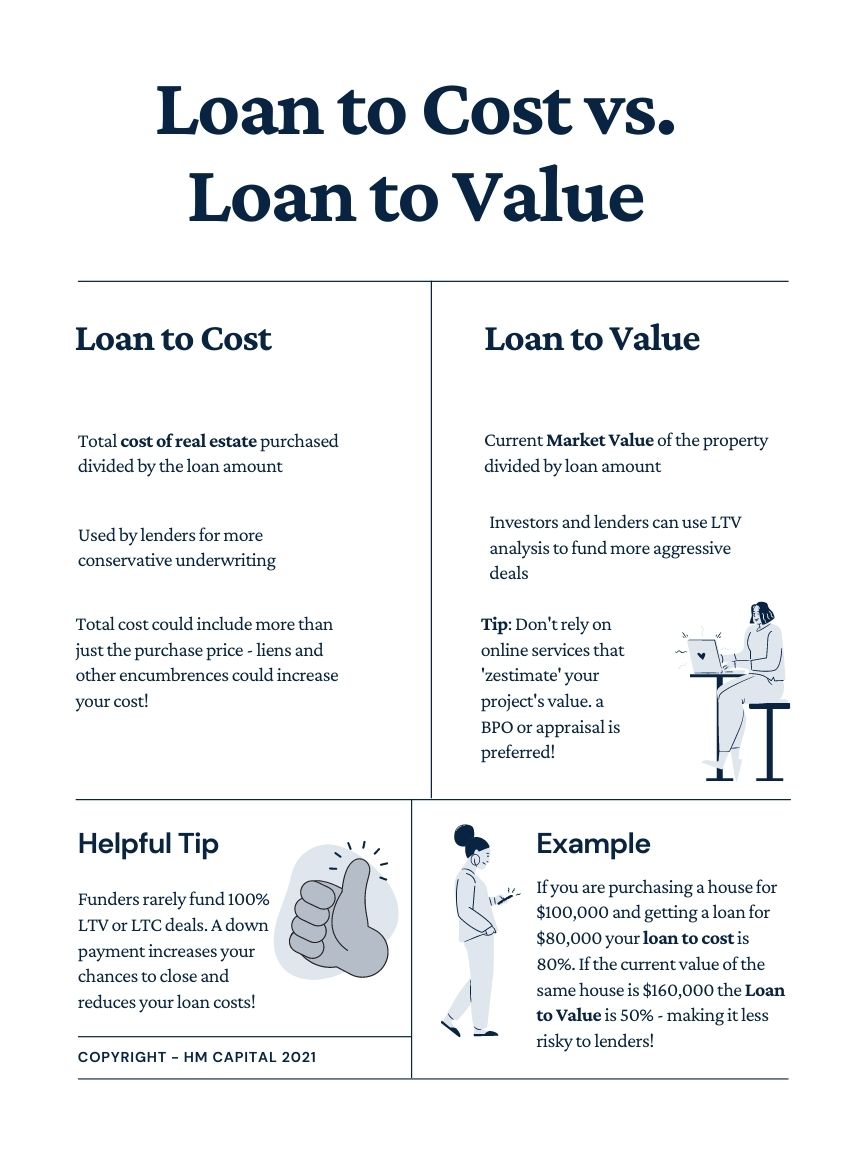

Loan To Cost Vs Loan To Value Definitions

Download The Daily Compounding Loan Calculator From Vertex42 Com Loan Calculator Car Loan Calculator Mortage Loans

What Is Ltv Loan To Value Ratio In Home Loan Abc Of Money

What Does Loan To Value Mean And Why Is It Important

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet

What Is A Good Loan To Value Ltv Ratio Smartasset

Home Improvements That Sell House Fast With Best Value Selling House Property Buyers Real Estate Buying

Debt Free Christmas Debt Free Debt Free Chart

What Is Ltv Loan To Value Ratio In Home Loan Abc Of Money

Who S Getting Scalped And Who Is Doing The Scalping Loan How To Apply This Or That Questions

Kentucky Rural Housing Usda Loans Usda Loan Conventional Loan Fha