To help people become homeowners the government insures lenders if the borrower defaults on the loan. LTV Is Just One Factor Remember your LTV is only one piece of your mortgage application.

Reverse Mortgage Age Chart What Percentage Of Appraised Value Will I Get Reverse Mortgage Loan Advisors 714 271 8524 Reverse Mortgage Mortgage Loans Mortgage

For a home mortgage the maximum loan-to-value ratio is typically 80.

What does 100 percent loan to value mean. As you can see the underwater borrower has a LTV ratio greater than 100 this equates to negative equity which is a major issue from a risk standpoint. Your LTV for your car loan is simply the ratio of your loan amount to the market value of your car. The catch is VA mortgages are only available to.

100 percent Auto Financing and Your Credit Score. 85000 divided by 100000 85. Mortgages with no down payment are usually available only through certain government-sponsored programs.

FHA purchase loans will allow you to have a loan-to-value ratio of up to 965 percent. 95000 divided by 85000 89. It describes the proportion of your home value that your mortgage takes up.

LTVs are usually expressed in percentages. Refinance Options for Borrowers with a Loan to Value Ratio Over 100. Typical down payments range between 10 percent and 20 percent of the selling price of the vehicle.

The loan-to-value percentage is the ratio of the amount the buyer is borrowing on a mortgage loan to how much the home is worth. So it shows the value of your first mortgage in percentage terms against your property value. A high-ratio loan is a loan whereby the loan value is close to the value of the property being used as collateral a loan value that approaches 100 of the value of the property.

Your down payment reduces the loan to value ratio of your loan. VA loan guidelines allow for 100 percent LTV which means that no down payment is required for a VA loan. USDA VA and other specialty loan types may allow for a 100 percent LTV for a purchase loan.

How Does LTV Affect A Mortgage Loan. The loan-to-value ratio is the amount of the mortgage compared with the value of the property. VA loans are available with an LTV ratio of 100 allowing service members to buy a home with zero down or refinance the full value of their home.

These are often referred to as 100 loans loans in which the money lent comprises 100 of a particular homes market value. This term is used by the finance industry. LTVs greater than 100 are also possible early in the repayment period on loans with high closing costs.

How to work out the LTV. The loan-to-value ratio is a measure of risk used by lenders when deciding how large of a loan to approve. It is expressed as a percentage.

When an LTV ratio is greater than 100 a borrower is considered underwater on the loanthat is when the market value of the property is less than the balance owed on the loan. For the record you get 125 by dividing 500 by 400. So if you borrow 20000 to buy a 20000 car your LTV will be 100 100 2000020000.

A loan-to-value ratio LTV is the total dollar value of your loan divided by the actual cash value ACV of your vehicle. The loan-to-value LTV ratio is the percentage of your homes appraised value or purchase price if it is lower that you are borrowing. If you get an 80000 mortgage to buy a.

The loan-to-value percentage or ratio will determine the amount of. What is loan-to-value ratio. Using VA loan programs eligible borrowers can finance up to 100 of a homes value.

Borrowers with an extremely high loan-to-value ratio are considered upside-down on their. Then multiply by 100 to turn the ratio into a percentage. However borrowers are typically still responsible for paying any.

It is usually expressed as a percentage. If you are financing more than 100 percent of the book value a down payment not only bring your total advance back to 100 percent but can also lower your interest rate. To calculate your LTV ratio take your mortgage amount and divide it by the purchase price or appraised value of the home whichever is lower.

If a home is appraised at 100000 and the borrower is asking for a mortgage loan either for a purchase or a refinance of 85000 the LTV would be 85. A home with a purchase price of 100000 appraised at 95000 with a loan amount of 85000 would have an LTV of 89. The math looks like this.

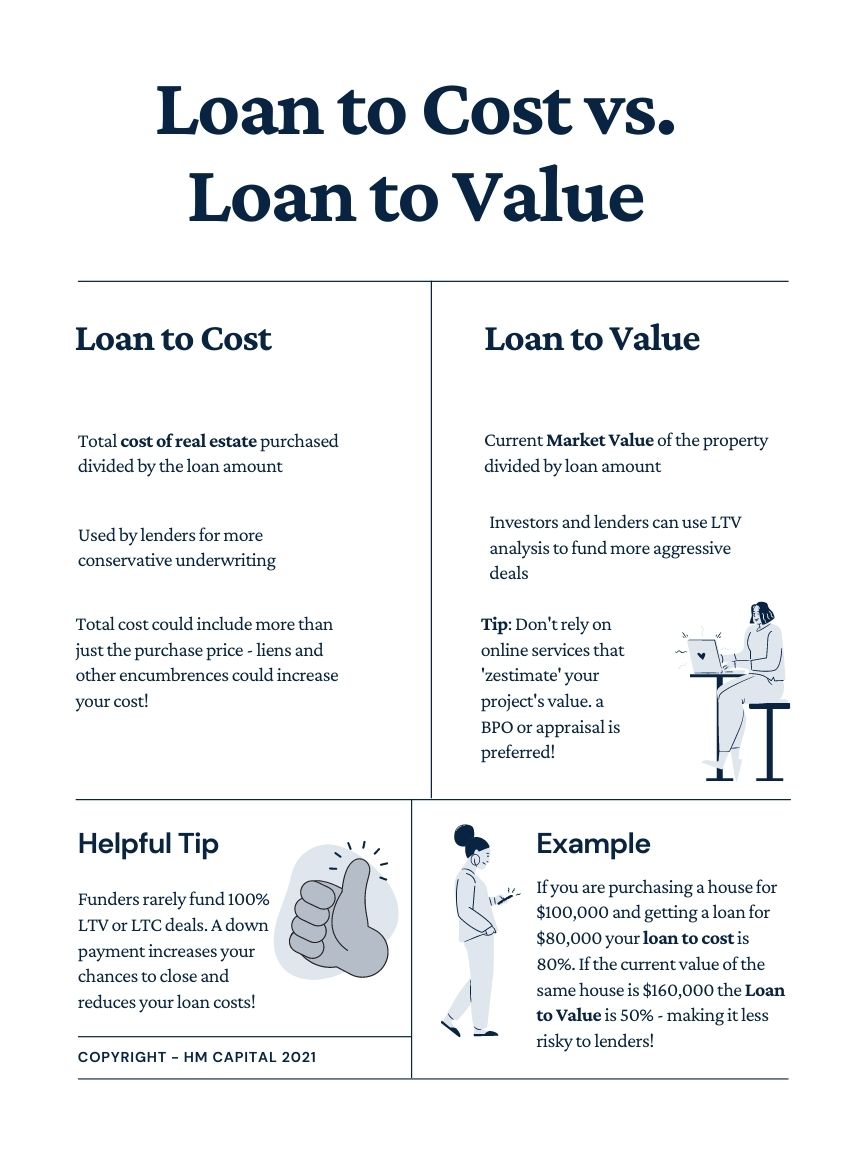

Loan To Cost Vs Loan To Value Definitions

5 Simple Financial Ratios For Stock Picking Price To Earnings Ratio Price To Book Value Ratio Debt To Equit In 2020 Financial Ratio Finance Investing Trade Finance

What Does Loan To Value Ltv Mean

What Does Loan To Value Ltv Mean

What Does Loan To Value Ltv Mean

Loan To Value Ltv Ratio Explained Quicken Loans

Debt To Income Ratio Explained Debt To Income Ratio Debt Income

Kentucky Fannie Mae Homepath Mortgage Loan Fannie Mae Renovation Loans Home Renovation Loan

Rural Development Not What You Think Rural Usda Development

How Macro Trends Shape The Market S Future Infografik Finanzen Geldanlage

Kentucky Usda Rural Housing Loans Kentucky Rural Development Guidelines For Usda Refinance Streamline Development Mortgage Assistance Kentucky

Real Estate Lingo And Acronyms Home Ownership Real Estate School Home Buying

Metro Mortgage Assistance Vs Chfa Loan Options The Mortgage Company 303 300 1850 Regulated By The Divis Mortgage Assistance Mortgage Companies Mortgage Tips

The 5 C S Of Credit And What They Mean For Your Agricultural Land Loan Agamerica Land Loan The Borrowers Loan

Maximum Loan To Value Ratio Definition

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet