Thus the portion of the profit that is kept aside for meeting a few known or unknown losses is known as Reserves. Financial institutions like banks credit unions and insurance companies derive their profits from the loans and investments they make with the funds that have been deposited with them.

Upvote 0 Downvote 0 Reply 0.

What is statutory reserve in corporate accounting. LASAAC has issued guidance entitled The Statutory Basis for Accounting and Disclosing Reserves in Local Authorities in Scotland. In finance reserve accounting refers to how reserves are computed utilized and most importantly accounted for. Unless specifically mentioned these can be utilized without any legal restrictions for the purchase of fixed assets settlement of legal obligations payment of statutory bonuses and long-term debts.

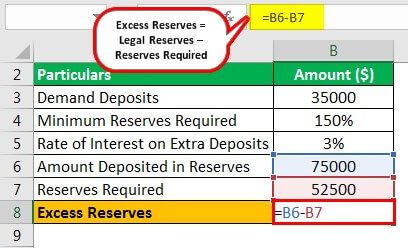

A part of a firms surplus comes from an increase in retained earnings. Statutory Reserve is the amount of money securities or assets that need to be set aside as a legal requirement by insurance companies and financial institutions to cover its claims or obligations which are due in the near future. Form 1A4 Statutory Balance Sheet Form 2A5 - Statutory Income Statement Form 8 Statutory Statements of Capital Surplus Notes to the Statutory Financial Statements Auditors Report Loss Reserve Certificate Actuarial Certificate if required Alternative Capital Schedule General Business.

_____is concerned with accounting for amalgamation. In a balance sheet we often see reserves been categorized into statutory and non-statutory reserves. The purpose of statutory reserves is to help.

In accounting this process is referred to as appropriation. 16UPA 514 HIGHER CORPORATE ACCOUNTING UNIT I 1. That is because they intend to use it for another purpose.

A AS 10 b AS 12 c AS 14 d AS 16. The National Association of Insurance Commissioners NAIC provided the framework for SAP in order to record the financial transactions of insurance companies. Amalgamation is done for ____.

Reserves in Accounting is a part of the profit which is kept aside not to use for a specific purpose but to strengthen the financial position of a concern. In _____ a new company is formed to take over the business of two or more existing companies which go into liquidation. There are various kinds of accounts kept by a company or business such as the cash account and expenditure account.

Statutory reserves are reserves a company is required to set up by law and which are NOT available for the distribution of dividends. As per the companys law no 2 of 2015 UAE Companys law The limited liabilities companies is required to reserve 10 of the annual net income as a statutory reserve which is not subject to distribution or withdraw. Statutory accounts are an important part of running your business so that your shareholders see how your company is performing and they keep your records updated with Companies House.

The name or label of. A reserve is an amount of profits that you set aside until you need money for some purpose. Statutory Accounting on the other hand is specific to insurance companies.

Proprietorship reserves is an account that is set up to alert investors that part of the shareholders equity wont be paid out as cash dividends. The reserve can be ceased when reaches 50 of the capital of the company. Similarly there is also a.

Statutory accounts must include a balance sheet a profit and loss account cashflow statement notes to the accounts and a directors report together with a cover contents and company information. This increases the companys total shareholders equity. The filing under Statutory Accounting is used to determine how insurance companies are performing.

Reserve Accounting represents the accumulated profits of the company which has been earned over the years authorized by the board of directors. AAmalgamation b External reconstruction cAbsorption d Internal reconstruction 3. Statutory reserve is the amount of cash a financial institution must keep on hand by virtue of accepting deposits and premium payments.

Statutory reserves are the funds that state insurance regulators require the insurance companies operating in their state to maintain at any given time. The Statutory Basis of Reserves.

Statutory Reserve Meaning Types What Is Statutory Reserve

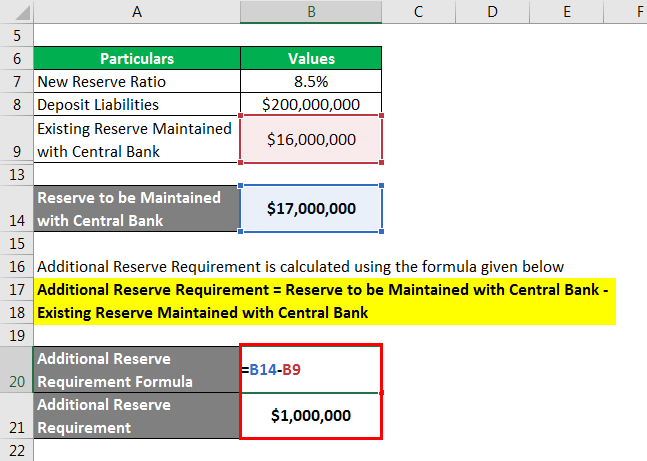

Excess Reserves Formula Example How To Calculate Excess Reserves

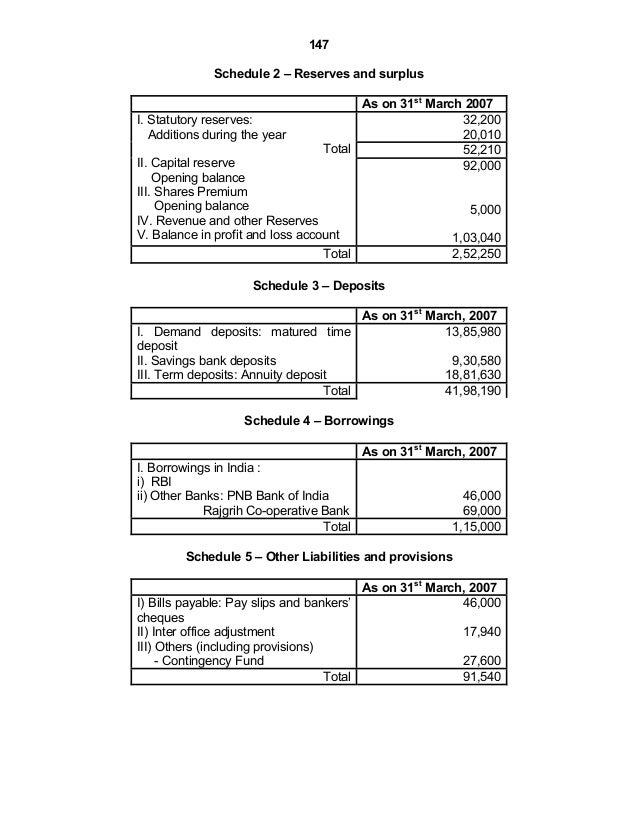

Accounts Of Banking Companies Ppt Download

Accounts Of Banking Companies 1 90mb

The Difference Between Local And Foreign Banks Using International Accounting Standard And Statement Of Accounting Standard Case Of Nigeria Banks Semantic Scholar

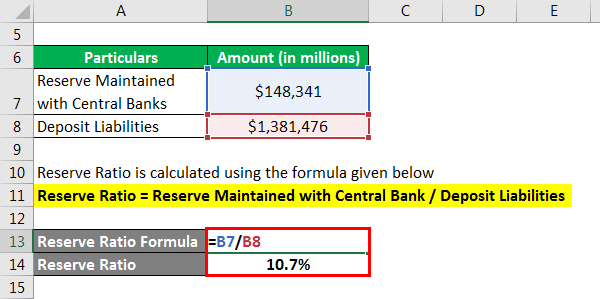

Reserve Ratio Formula Calculator Example With Excel Template

Reserve Ratio Formula Calculator Example With Excel Template

Accounts Of Banking Companies 1 90mb

Understanding Balance Sheet Statement Part 1 Varsity By Zerodha

Statutory Reserve Methods And Purpose Of Statutory Reserve

Reserve Ratio Formula Calculator Example With Excel Template

What Is The Accounting Treatment Of A Reserve Fund Quora

General Reserve General Reserve Vs Retained Profit

Understanding Balance Sheet Statement Part 1 Varsity By Zerodha

What Is The Accounting Treatment Of A Reserve Fund Quora

Meaning Of Statutory Reserves And Key Explanations Sb Accounting