Every bank must have a particular portion of their Net Demand and Time Liabilities NDTL in the form of cash gold or other liquid assets by the end of the day. Statutory Liquidity Ratio or SLR is the minimum percentage of deposits that a commercial bank has to maintain in the form of liquid cash gold or other securities.

Determine the bank deposits Next determine the bank deposits borrowed by.

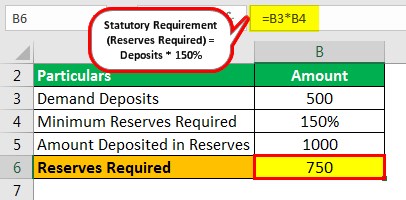

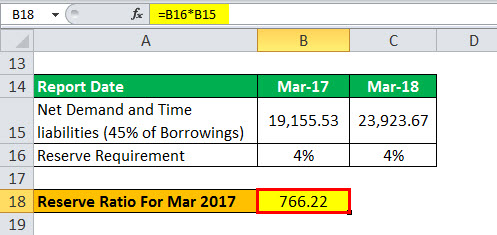

How to calculate statutory reserve ratio. Similar to Credit Reserve Ratio SLR is also fixed as a percentage on the total deposits of bank. First determine the total reserve. Statutory reserves are state-mandated reserve requirements for insurance companies intended to make sure they will be able to pay their claims.

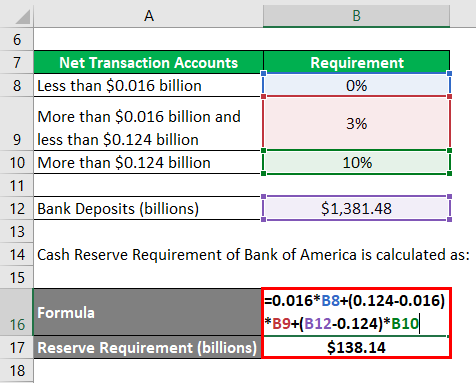

Calculate the total cash reserve. Most reserve requirements are established at the state level. Cash reserve Ratio CRR is the amount of Cash that the banks have to keep with RBI.

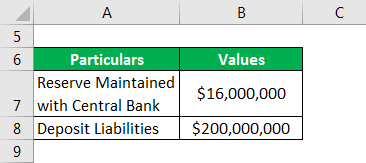

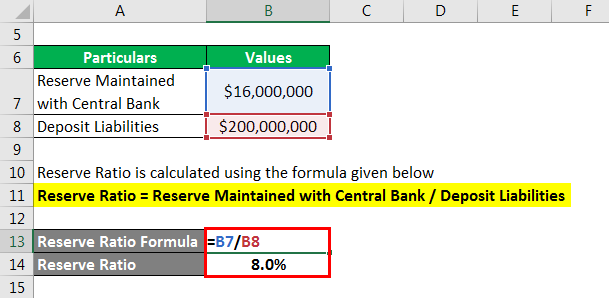

Actuaries and other parties who estimate reserves for health coverages. Determine the reserve amount Firstly determine the reserve amount maintained by the bank with the central bank and it. Calculation of Statutory Reserves.

This Ratio is basically to secure solvency of the bank and to. How to calculate the Statutory Liquidity Ratio SLR. The purpose of the Health Reserves Guidance Manual is to provide guidance regarding the calculation and documentation of health reserves for statutory financial statements as described in the Health Insurance Reserves Model Regulation.

SLR Rate liquid assets demand time liabilities 100. Statutory Liquidity Ratio -Definition. While the required reserve ratio is set by an outside controlling financing board the actual reserve ratio on hand can be calculated by dividing the amount of deposited money retained on hand by the bank by the total amount of deposited money that the bank has.

Like in our above example if the SLR rate is 6 then 12 crore has to be. Standard levels include 8 to 12 of the insurers total revenue but the actual amount. The ratio of these liquid assets to the demand and time liabilities is called the Statutory Liquidity Ratio SLR.

The majority of states prefer the latter approach which uses standardized models and assumptions to prescribe how much funds insurers must reserve to reach the required capital requirement. What are the components of the Statutory Liquidity Ratio. Next determine the total liabilities.

How to calculate reserve ratio. The formula for the money multiplier is Money Multiplier 1 Reserve Ratio. The Reserve Bank of India RBI has the authority to increase this ratio by up to 40.

The calculation of reserve ratio can be done by using the following steps. SLR is the amount that is invested specifically in certain securities of central government or state government. The former approach is also popular as it gives insurers greater latitude to set their statutory reserves.

Not later than thirty 30 days following the close of each calendar quarter during which any of the Reinsured Claims remains outstanding the Reinsurer shall calculate and report to the Company Statutory Reserves for the Reinsured Claims as of the quarter-end or year -end closing date as applicable. It is basically the reserve requirement that banks are. This guidance is intended for.

SLR or statutory liquidity ratio is also fixed by RBI. The money multiplier is the reciprocal of the reserve ratio. There are two approaches used to calculate statutory reserves namely a rule-based method and a principle-based method.

There are three major components of SLR. As you can see changing the reserve ratio which is.

Crr Slr Cash Reserve Ratio Statutory Liquidity Ratio In 2018 Crr And Slr Help Rbi In Maintaining Liquidity Solvency Of Banks An Bank Rate Slr Finance

Reserve Ratio Formula Calculator Example With Excel Template

Image Result For Unearned Premium Reserve Calculation Financial Statements Underwriting Liability Insurance

Cash Reserve Ratio Examples Of Crr With Step By Step Calculation

Reserve Ratio Formula Calculator Example With Excel Template

Apply Fixed Deposit Compare Fd Calculator New Set Of Rules From Rbi For Small Finance And Payment Banks Rbi Finance Fixed New Set Finance Bank Of India

Reading Money Creation Macroeconomics

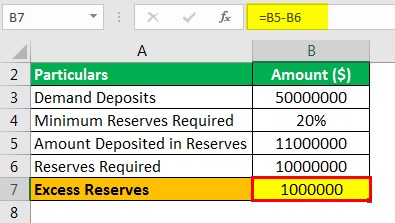

Excess Reserves Formula Example How To Calculate Excess Reserves

Reserve Ratio Formula Calculator Example With Excel Template

Image Result For Unearned Premium Reserve Calculation Accounting Period Accrual Insurance

Education What Effect Does A Change In The Reserve Requirement Ratio Have On The Money Supply

Reserve Ratio Formula Calculator Example With Excel Template

Excess Reserves Formula Example How To Calculate Excess Reserves

Reserve Ratio Formula Calculator Example With Excel Template

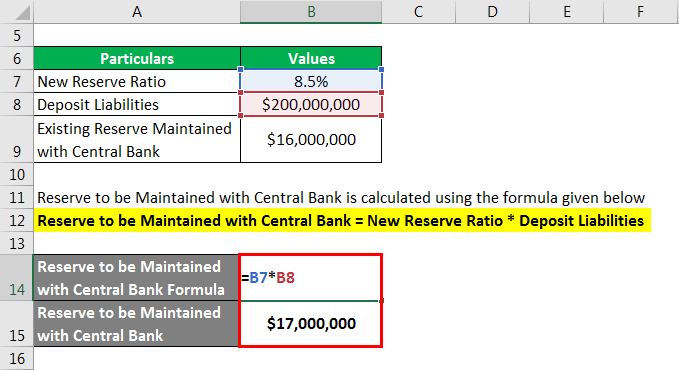

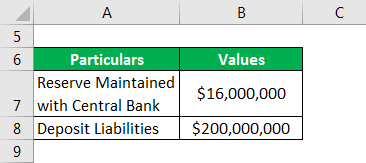

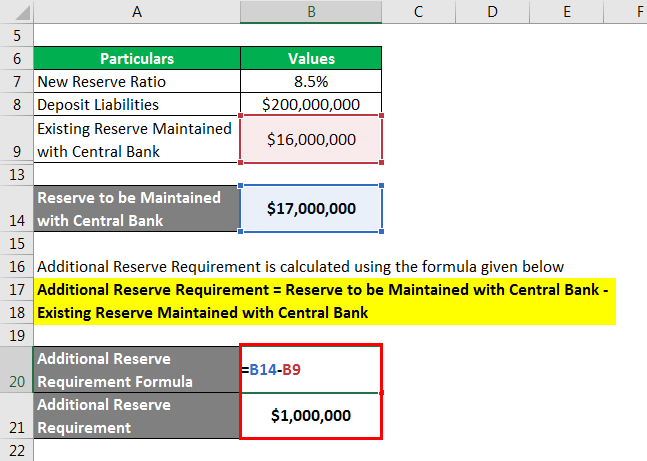

Cash Reserve Ratio Formula Example Calculate Crr

Excess Reserves Formula Example How To Calculate Excess Reserves

:max_bytes(150000):strip_icc()/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)