Income tax loss relief for self-employed On 23 July 2020 the Government announced the introduction of a new once-off income tax relief measure. Small Business COVID-19 Support Grant.

Improve Your Business Performance With Professional Business Accountant Accounting Business Performance Business Advisor

This includes the ability to defer payment of certain taxes up to six months and receive refunds on previous pay as you go instalments.

Covid 19 tax relief for sole traders. Read the ATOs information on COVID-19 call them on 1800 806 218 or speak to your tax professional so that they can work with you to find a solution. Almost 760000 businesses and sole traders have claimed wage subsidies or claimed. The Australian Tax Office ATO will provide relief for certain tax obligations for taxpayers including sole traders affected by the Coronavirus outbreak on a case-by-case basis.

JobSeeker Payment Partner Allowance Widow Allowance Sickness Allowance and Wife Pension. As Abi received the payroll tax relief she has a smaller allowable deduction in her 2020 tax return. Banking deferral and relief.

Under the Coronavirus Aid Relief and Economic Security Act CARES Act as originally enacted March 27 2020 the Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees. Abi operates a hairdressing salon. It is intended to benefit self-employed people who were profitable in 2019 but as a result of the COVID-19 pandemic will make a loss in 2020.

The government is expected to announce relief for sole traders who were left out of its small business stimulus package in the next few days. If you have 2020 YTD trading losses and are eligible for trader tax status TTS as a sole proprietor consider a 475 election on securities and or commodities due. The CARES Act allowed these credits for wages paid after March 12.

Taxpayers can contact the ATO on 1800 806 218 or visit the atogovau for further information. Small businesses or sole traders with a turnover of between AU30000 and AU75000 which experience a. This should give these businesses time to recommence trading and enjoy a period of recovery before the tax is due.

Latest Updates on Coronavirus Tax Relief American Rescue Plan Act of 2021 See this IRS news release for more information on individual tax provisions of the American Rescue Plan Act of 2021 signed into law on March 11 2021. Sole traders will be eligible to receive 1000 per week. To receive the payment eligible businesses and non-for-profits will be required to keep their full-time part-time and long term casual staffing level consistent from July 13 2021.

The state government introduces payroll tax relief for all small businesses to help them cope with the impacts of COVID-19. The Coronavirus Supplement is an ongoing 550 payment delivered fortnightly. Income support has been extended for six months to include sole traders who will become eligible for jobseeker payments and will receive.

For a sole trader or partnership preparing accounts on the cash basis this income will be taxable in the 202021 tax year and the income tax payable by 31 January 2022. JobMaker Hiring Credit scheme The JobMaker Hiring Credit scheme is an incentive for businesses to employ additional young job seekers aged 1635 years. Tax obligations for businesses claiming Covid-19 support.

Small business ombudsman Kate Carnell said. Sole traders who receive any of the below payments will also receive the payment. We have tabled the key components of the 2021 COVID-19 package below.

Relief for certain tax obligations The ATO can provide relief from certain tax obligations for eligible businesses including payment deferrals. Coronavirus COVID-19 support is available to businesses Loans tax relief and cash grants are available Employers might be eligible for financial support to pay wages Self-employed people might. Available to businesses and sole traders with a turnover of more than 75000 per annum but below the NSW Government 2020 21 payroll tax threshold of 1200000 as at 1 July 2020.

The relief is delivered as no payroll tax payable for the quarter April to June 2020. Find government coronavirus COVID-19 financial assistance and support for your business. Taxpayers negatively impacted by COVID-19 can take a withdrawal from an IRA or qualified retirement plan of up to a maximum of 100000.

The legislation also made changes to tax relief for employersContinue to check back for updates.

Portugal Golden Visa Cryptocurrency Guide Gcs

Pin On New Vision Financial Services

John A Sanchez Company Auburn Hills Mi Cpa Firm

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

How To Become Eligible For Trader Tax Status Benefits

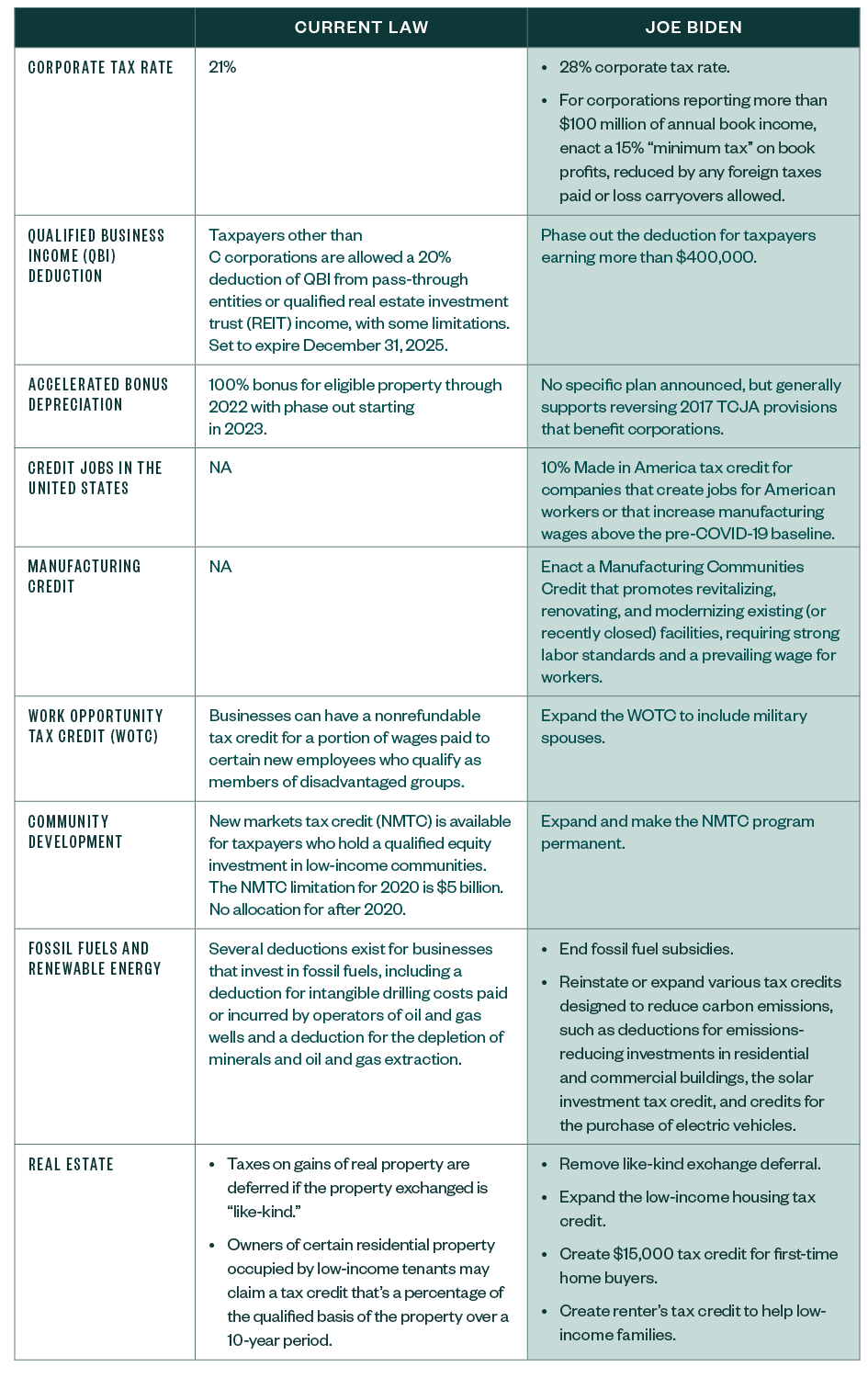

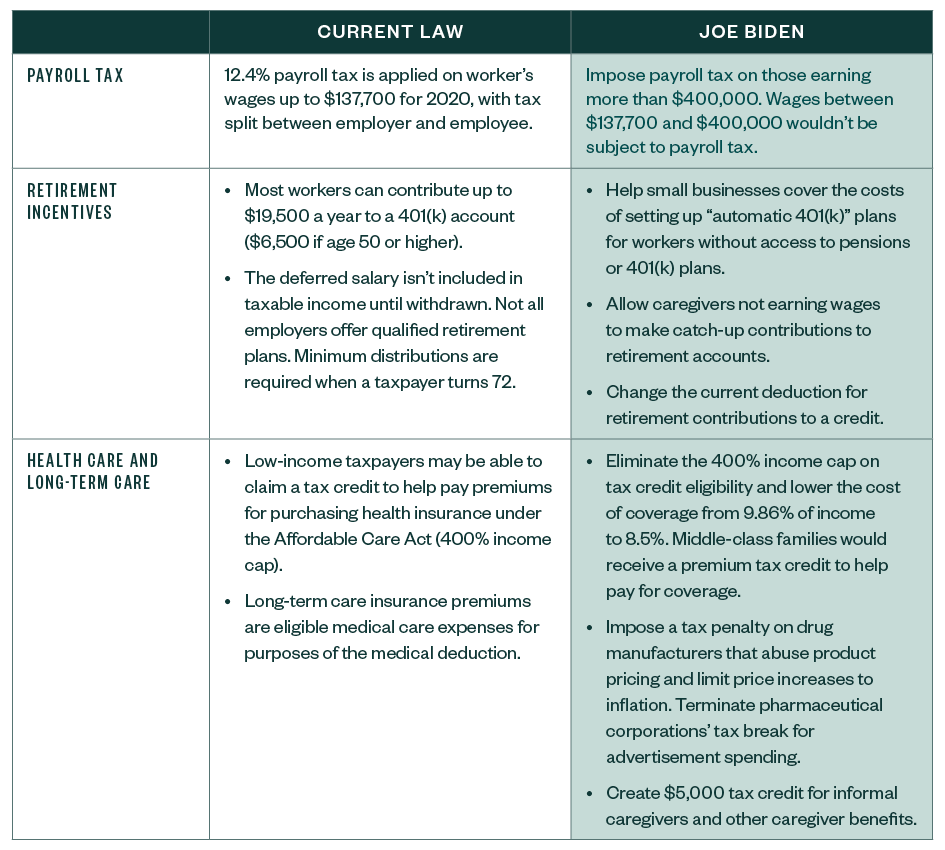

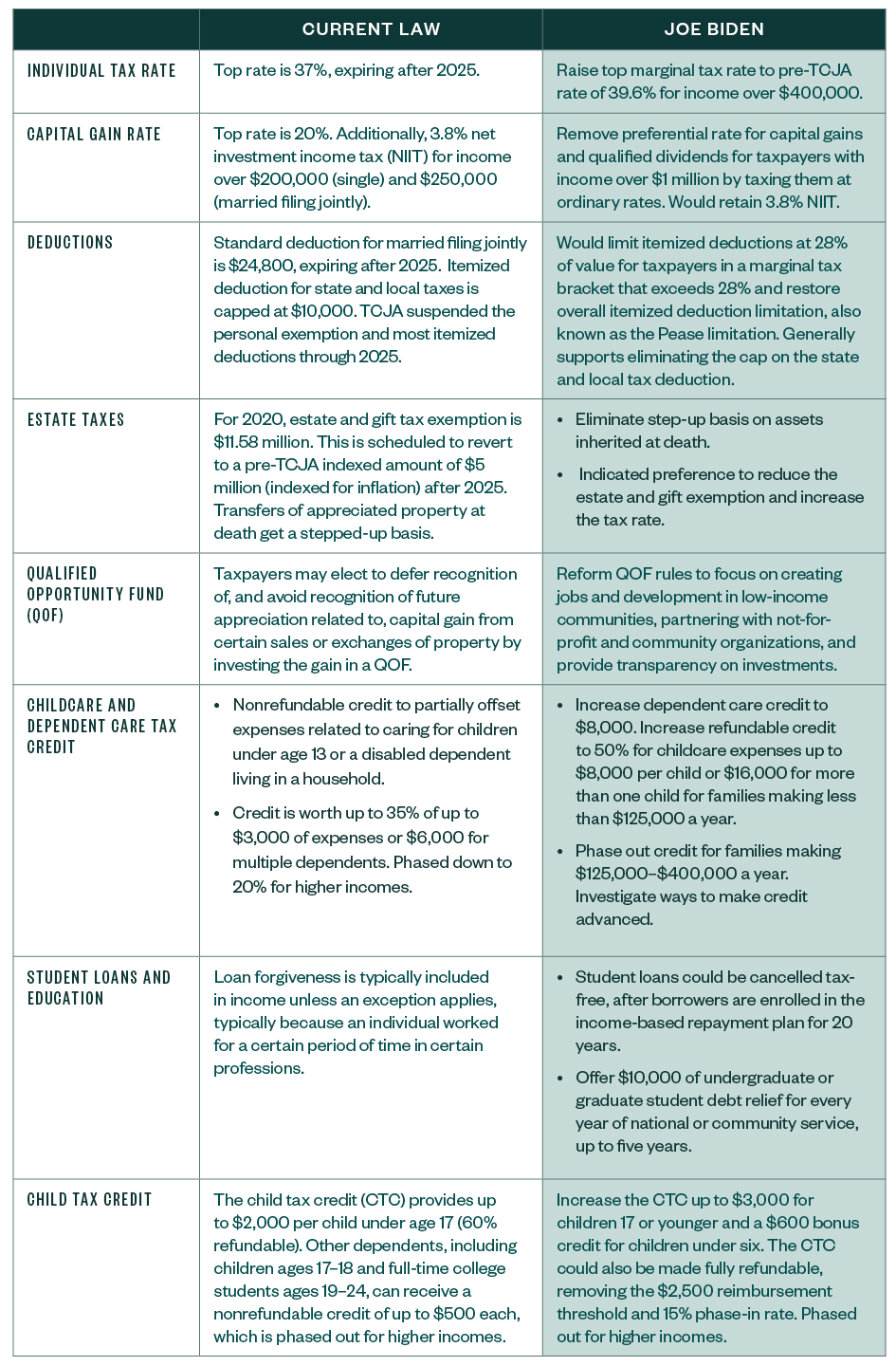

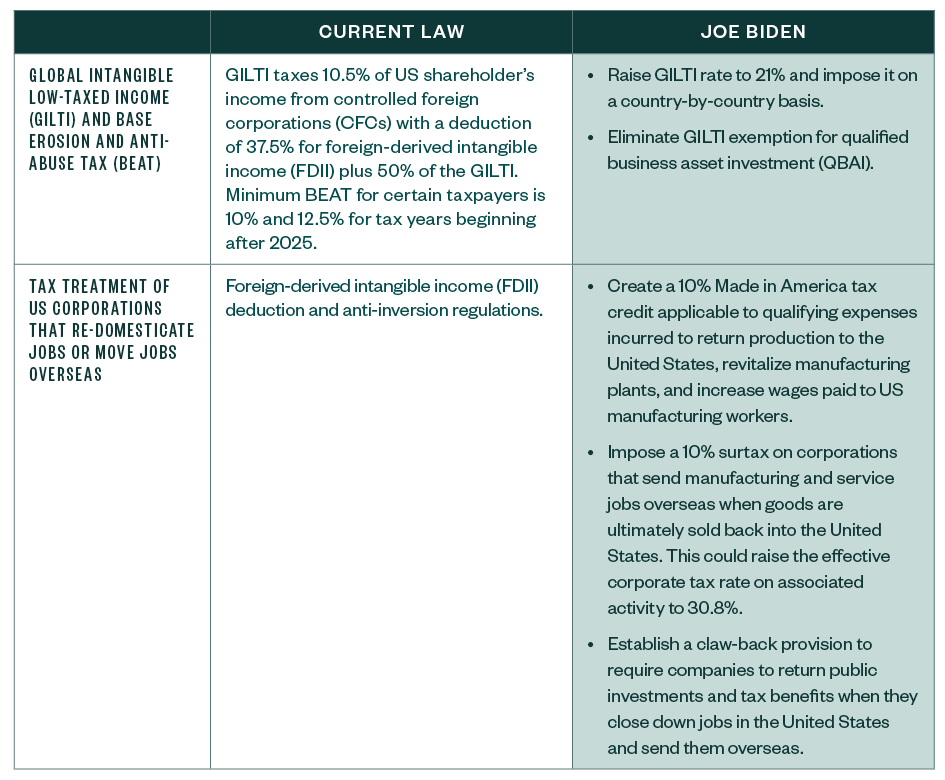

A Review Of Us President Elect Joe Biden S Tax Proposals

Pass Through Taxation What Small Business Owners Need To Know

A Review Of Us President Elect Joe Biden S Tax Proposals

A Review Of Us President Elect Joe Biden S Tax Proposals

Food License In India Food License Food A Food

Professional Identity Card Template With Red With Regard To Photographer Id Card Template Best Templat Id Card Template Card Template Visiting Card Templates

A Review Of Us President Elect Joe Biden S Tax Proposals

Risk Report A Quad 4 Investing Playbook Investing Risk Management Implied Volatility

Pin On Los Angeles Tax Attorney

Cares Act Tax Considerations Insights Skadden Arps Slate Meagher Flom Llp

Tax Returns Clerkenwell Accounting Services Tax Accountant Tax App

Privately Held Company Accounting And Finance Business And Economics Private Finance