How much tax do I have to pay on my COVID-19 payment. Work and Income COVID-19 Wage Subsidy.

Self Employment Understanding Universal Credit

How to Manage Salaries During Covid-19 Five strategies to make decisions that are in the best interests of your employees and your business.

Do i have to pay paye during covid 19. Self-isolation and sick pay When someone cannot come to work because they need to self-isolate and when they must get Statutory Sick Pay SSP. Is an employee entitled to sick leave if sick or if the employee has symptoms associated with Covid-19. Employee entitlements to leave and pay It can be difficult to navigate a complex and rapidly-changing situation such as with COVID-19.

Struggling companies and self-employed workers have been offered financial help by the government to help keep their businesses afloat and staff paid during the coronavirus outbreak. The amount of tax you have to pay is not likely to be a high amount and it will be deducted from your income gradually over time instead of all at once. One of the key challenges is working out employee entitlements to leave when the worker cannot go to the workplace or work from home.

But different rules can apply to some payments eg lump sum payments like bonuses or retirement payouts or to special types of workers. HMRC Time To Pay Arrangement. A qualifying employer that is a tax resident or representative that is registered for employees tax by 1 March 2020 for a limited period of 4 months from 1 April 2020 31 July 2020 will be allowed.

Are employees entitled to payment if they are unable to work because of sickness caused by Covid-19. All time between the start and finish of an employees workday must be paid unless it falls within one of the exceptions stated in 29 CFR. Students and non-EEA nationals can apply for the payment.

Part 785 such as. Which COVID-19 related payments are subject to tax. PAYE is pretty straightforward once youre set up.

If youre currently pursuing a loan rehabilitation program you do not have to continue making rehabilitation payments. You will be entitled to take paid sick leave in terms of section 22 of the Basic Conditions of Employment Act. COVID-19 Wage subsidy and leave support payments - Issues for self-employed and other individuals Self-employed persons and other individuals upon application may be eligible for a wage subsidy including extension resurgence and March 21 paid by the Ministry of Social Development MSD if they have been affected by COVID-19.

The COVID-19 Pandemic Unemployment Payment PUP is a social welfare payment for employees and self-employed people who have lost all their employment due to the COVID-19 public health emergency. There is no need to worry about receiving a big tax bill at the end of the year. HMRC have offered that those facing financial distress because of COVID-19 and with outstanding tax liabilities may be eligible to receive support with their tax affairs through HMRCs Time To Pay service.

Carried leave is still subject to the usual rules around payment in lieu. If you are sick or have symptoms associated with Covid-19 then you must inform your employer self-quarantine and not go to work. It was updated since it was first published to provide that contingent workers who are unable to work due to COVID-19 for example due to sickness self-isolation or the temporary closure of offices should be paid 80 per cent of their pay up to a maximum of 2500 per month.

The 22nd after the end of the quarter if you pay quarterly - for example 22 July for the 6 April to 5 July quarter Pay now If you pay by cheque through the post the deadline is the 19th of the month. Pay-as-you-earn PAYE relief measures Deferral of payment of PAYE for qualifying employers. An employer must facilitate the worker taking their annual leave and not replace it with a financial payment known as.

The COVID-19 Wage Subsidy is only available if there is an escalation to Alert Levels 3 or 4 anywhere in New Zealand for 7 days or more. Modifying employment agreements during COVID-19 response and recovery Find out about options to deal with the impacts of COVID-19 in the workplace. The current Covid-19 crisis has caused a number of employees to stop rendering services as the lockdown means that they cannot come into work or work from.

You can apply for the payment if you are aged between 18 and 66. Returning to work keeping staff and the workplace safe and if someone has COVID-19. Yes if an employee is away from work sick the usual statutory regime or company contractual entitlements relating to sick pay are applicable.

On paper forms but only if your annual PAYE and ESCT employer superannuation contribution tax is less than 50000 or youre a new employer. Yes time spent waiting for and undergoing a temperature check related to COVID-19 during the workday must be paid. The subsidy is available to businesses employers and self-employed workers who have experienced a decline in revenue due to the restrictions of Alert Levels 3 and 4.

That includes wage garnishment and tax and Social Security offsets. Your rights and responsibilities regarding pay and leave during COVID-19 response and recovery. All companies need to consider and prepare for employee absences as a result of coronavirus.

Http Documents1 Worldbank Org Curated En 383541588017733025 Pdf Social Protection And Jobs Responses To Covid 19 A Real Time Review Of Country Measures April 24 2020 Pdf

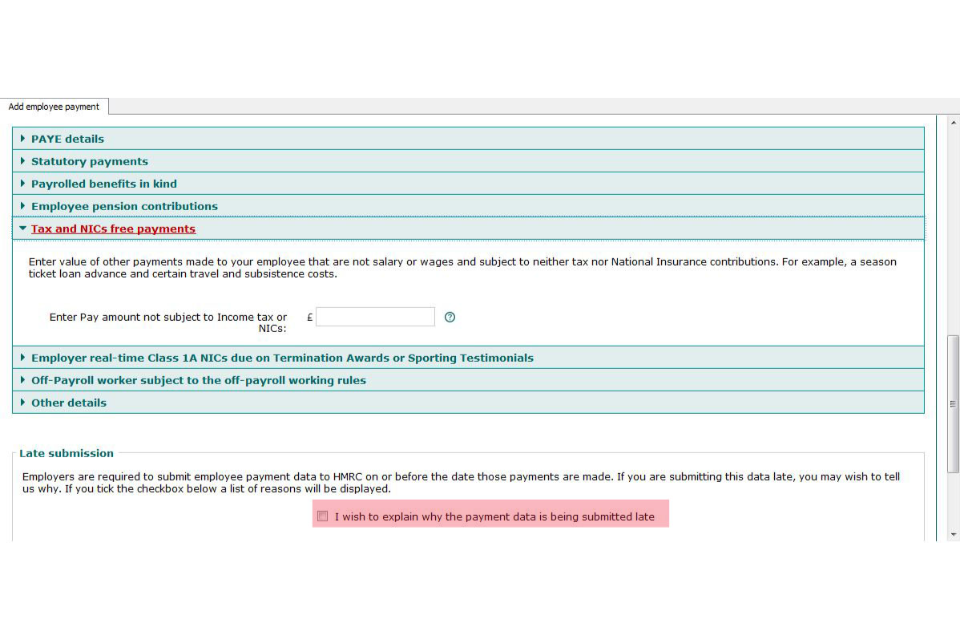

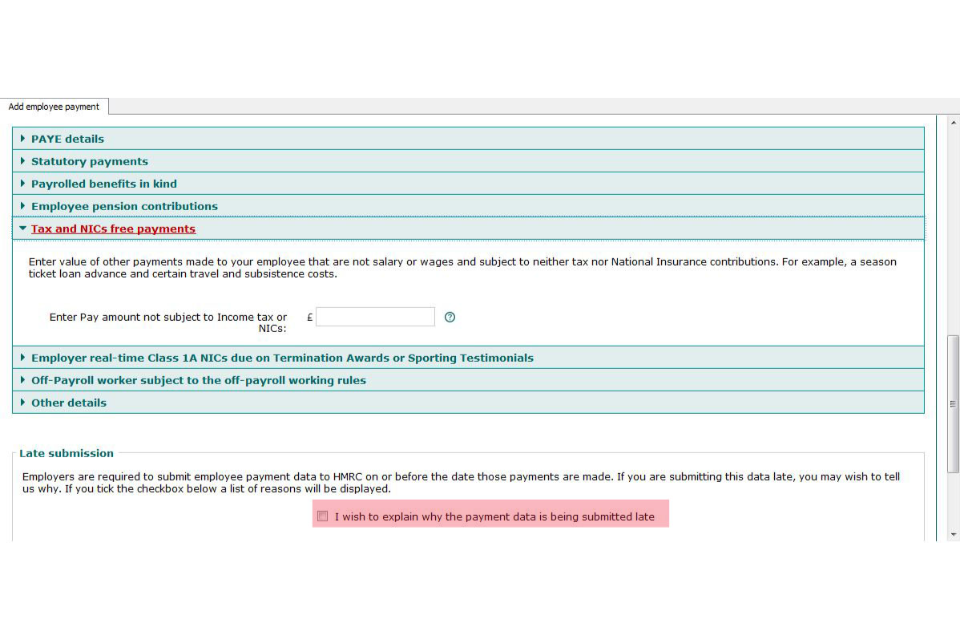

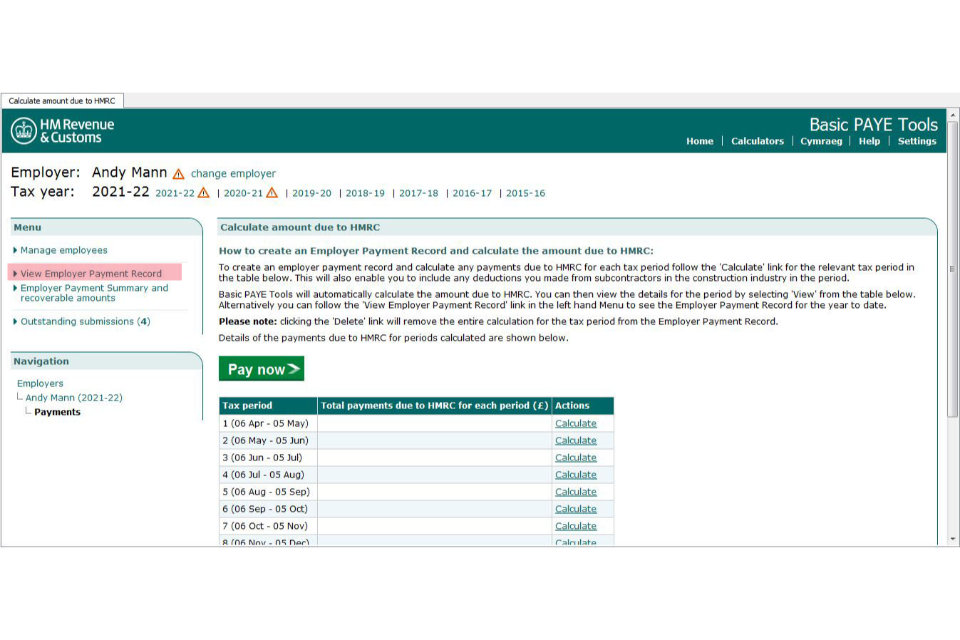

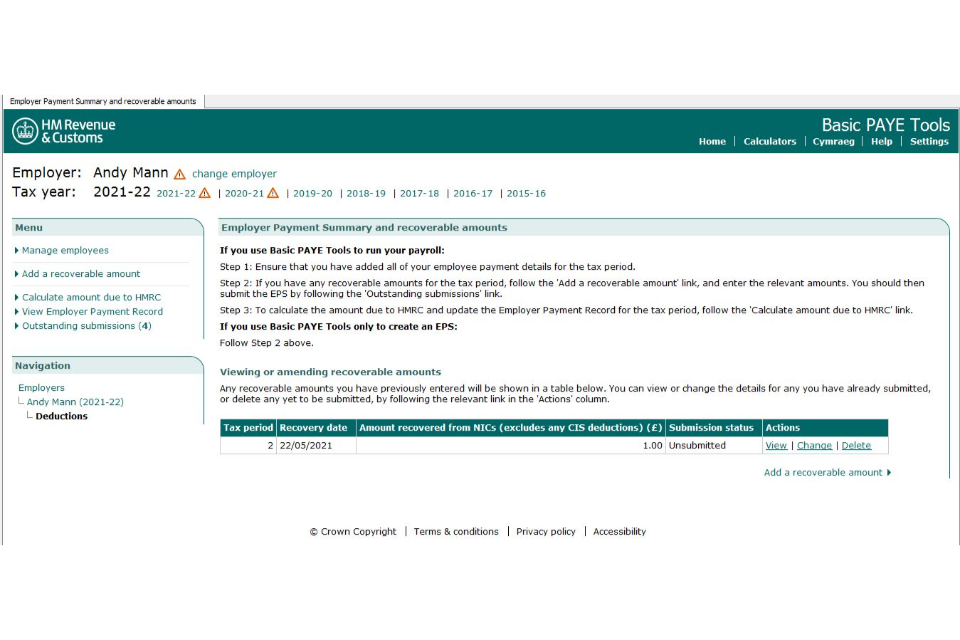

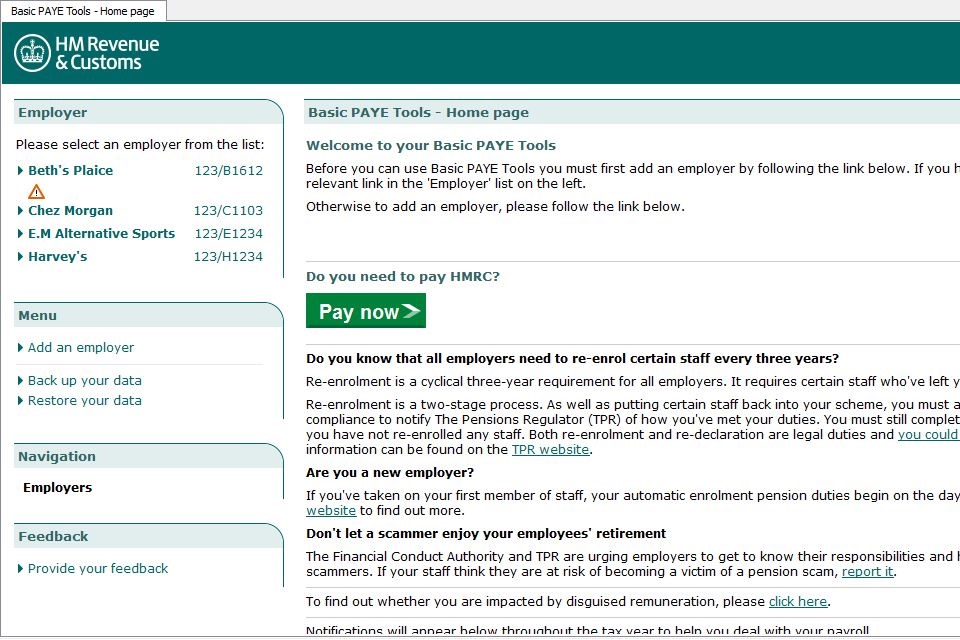

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

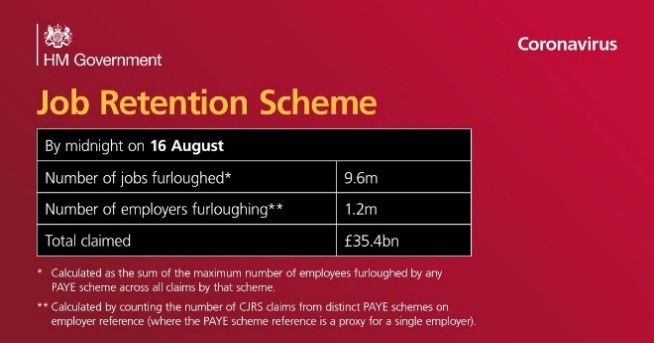

The Data Science Behind Hmrc S Covid 19 Response Hmrc Digital

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

Basic Paye Tools User Guide Gov Uk

Government Support Schemes For Individuals And Businesses Covid 19 Bdo

Https Www Bgateway Com Assets Documents Covid 19 Business Support Summary As At 16 04 20 Pdf

Http Documents1 Worldbank Org Curated En 383541588017733025 Pdf Social Protection And Jobs Responses To Covid 19 A Real Time Review Of Country Measures April 24 2020 Pdf

Basic Paye Tools User Guide Gov Uk

Http Documents1 Worldbank Org Curated En 383541588017733025 Pdf Social Protection And Jobs Responses To Covid 19 A Real Time Review Of Country Measures April 24 2020 Pdf

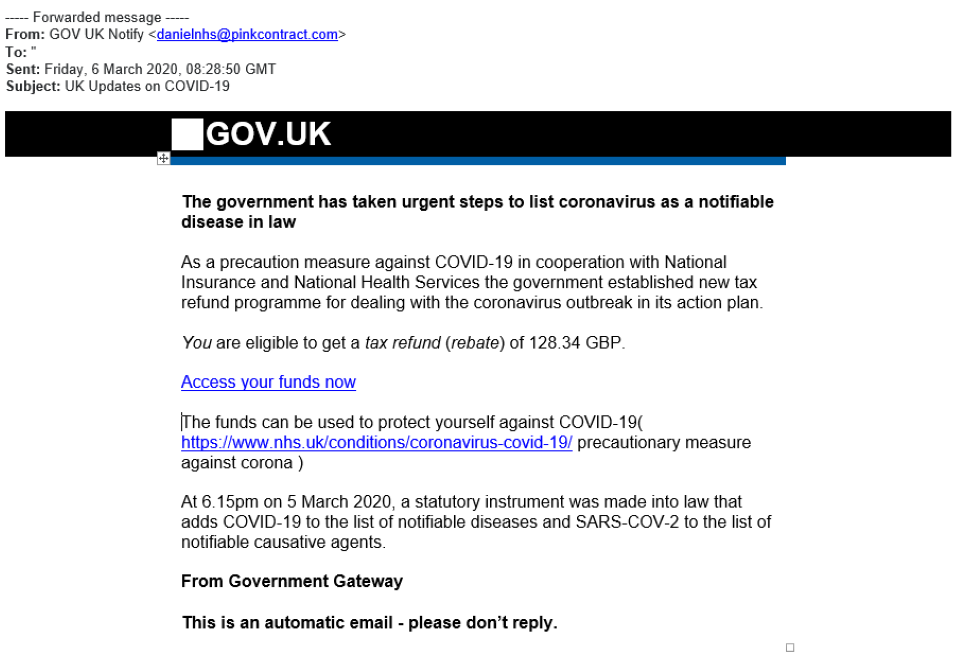

Coronavirus Scams Please Be Vigilant Low Incomes Tax Reform Group

Deferred Vat Payment And How To Cancel Your Direct Debit Alterledger

Hmrc 2020 Uk Tax Deadlines Amid Coronavirus Covid 19 Crisis Celia Alliance

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

When To Pay Vat Which Was Deferred Due To Covid 19 Crowe Uk

Your Income And Coronavirus Covid 19 Policy In Practice

Coronavirus Information For Employers Low Incomes Tax Reform Group