Private patient hospital cover. Through your private health insurance provider your private health insurance provider will apply the rebate to reduce your private health insurance premiums.

What Tax Changes Did The Affordable Care Act Make Tax Policy Center

This liability will be listed in the myTax estimate and on your notice of assessment as an Excess private health insurance reduction or refund.

Excess private health insurance reduction tax. How you claim your rebate. Having an excess means that you have to pay part of your treatment costs up to the amount of your excess. Your private health insurance statement.

You can receive the rebate or refund as either a direct reduction of the cost of your private health insurance through the year and this is a reduction. The level of rebate you claim for your policy. Those singles with an income of over 84000 in the 2012-13 tax year are now only eligible for up to a 20 rebate on those premiums.

You get a 246 rebate 1 April 2021 to 31 March 2022 on your private health insurance premium if you earn up to 90k a year as a single or 180k for a couple or family. This liability will be listed in the myTax estimate and on your notice of assessment as an Excess private health insurance reduction or refund. The Private Health Insurance Rebate reduces the premium you pay for having private health insurance.

Or if you choose not to claim the rebate this way you can claim it as a refundable tax offset on your tax return lodgement. When you take out private health insurance youre offered an excess with your cover. It is important for MYOB Tax to calculate correctly that you enter the Period 1 statement details in Period 1 likewise with Period 2.

If you get an excess private health insurance reduction or rebate reduced amount on your notice of assessment it is the amount of overpaid private health insurance you have received. The rebate goes directly to the health insurer who then passes on a reduced premium. Adding an excess of as little as 200 can cut premiums by as much as 10.

You can claim your private health insurance rebate as a. This means that in most cases private health insurance is not tax deductible and employees need to pay tax on any insurance premiums as reported in the P11D. You can claim this rebate in two ways.

The rebate can be claimed for premiums paid for a private health insurance policy that provides. This liability will be listed on your notice of assessment as an Excess private health insurance refund or reduction rebate reduced. It is optional for health insurers to provide you with a private health insurance statement.

For example if you have treatment that costs 3000 and you have agreed an excess of 500 youll pay. If you claim too much private health insurance rebate as a premium reduction we recover the amount as a tax liability. Selecting the correct tax claim code will ensure that MYOB Tax will calculate the correct Private health insurance rebate or Excess private health insurance reduction.

As a premium reduction which lowers the price your insurer charges you or As a refundable tax offset which you receive through your tax return. Premium reduction which lowers the policy price charged by your insurer. An excess is the amount you will have to pay when you make a claim on your health insurance policy.

When you lodge your tax return as a refundable tax offset. We are paying private insurance as a family but myself and my wife are charged individually for excess private health insurance premium reduction or refund. In any case my understanding is that youre meant to be honest and acting in good faith when you provide your income to your private health insurance provider or indeed any other provider for tax purposes.

This may result in you receiving a private health insurance tax offset or a liability depending on. To claim a Private Health Insurance Tax Offset or Rebate simply fill in the appropriate section on your tax return and the ATO will calculate your entitlement. Your private health insurance statement.

A statement may only be provided if you request one from your registered health insurer. One of the biggest benefits of setting a Health Insurance excess is that it can reduce the cost of your policy quite considerably. At the end of each tax year youll need to complete and submit a P11D form for each employee which states the benefits theyve received.

Alternatively you may choose not to include the benefit on the employees P11D form and register with HMRC to payroll it instead. Excess private health insurance premium reduction or refund. See for yourself how much of a difference an excess can make on premiums by comparing Private Medical Insurance quotes online here.

Youll also need to complete and submit a P11Db form and pay Class 1A National Insurance on the value of the benefit. Private health insurance rebate. However there are a number of specific circumstances where this is not the case.

If you claim too much private health insurance rebate as a premium reduction we recover the amount as a tax liability. Refundable tax offset through your tax return. Your income for Medicare levy surcharge purposes.

I dont think theres a penalty but I personally dont think the nickel shavings youd get in interest would. For singles earning above 90k the rebate steps down incrementally until it reaches 0 for people earning over 140k or families or couples earning over 280k. Do I need to report healthcare cover to HMRC.

This amount will be shown in the debit column of your notice of assessment. If you or your family dont have private health insurance hospital cover or you choose to cancel your cover you will pay the Medicare levy surcharge if you earn more than 90000 single or 180000 couplesfamilies in 201415 to 2020-21 financial years. Where private health insurance is provided to employees it is considered a benefit in kind.

Excess Private Health Insurance Refund or Reduction Changes in the Tax system have resulted in many people losing part of the 30 Rebate on Private Medical Insurance premiums.

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

The 2020 Changes To California Health Insurance Ehealth

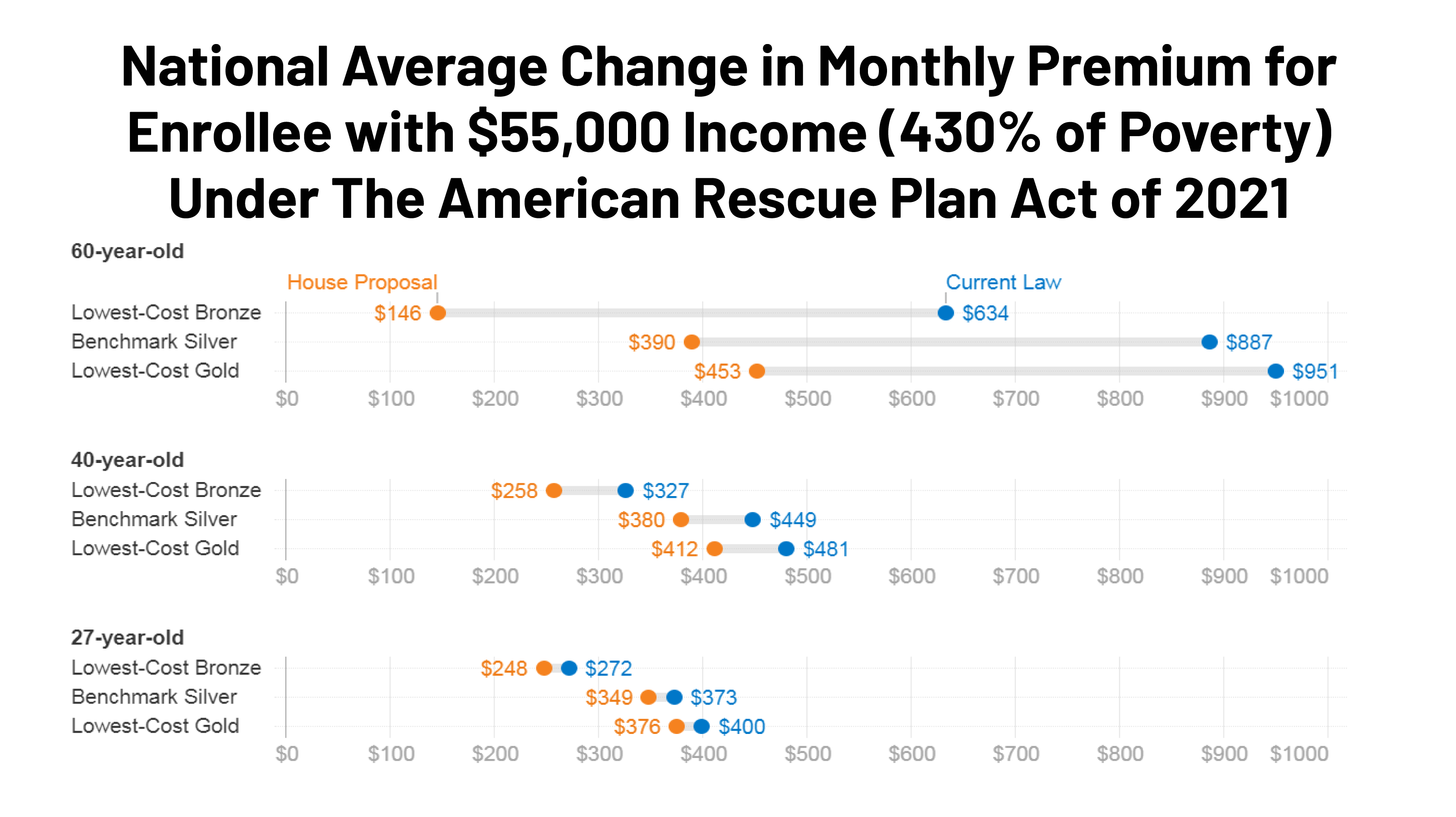

Impact Of Key Provisions Of The American Rescue Plan Act Of 2021 Covid 19 Relief On Marketplace Premiums Kff

Faqs Health Insurance Marketplace And The Aca Kff

What Is Health Insurance Definition What Is Health Health Insurance Health

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Home Heating Tax Credit Utility Bill Payment Tax Credits Michigan

Covered California Ftb 3895 And 1095a Statements 2020

Cbo Scores Better Care Health Insurance Budgeting American Healthcare

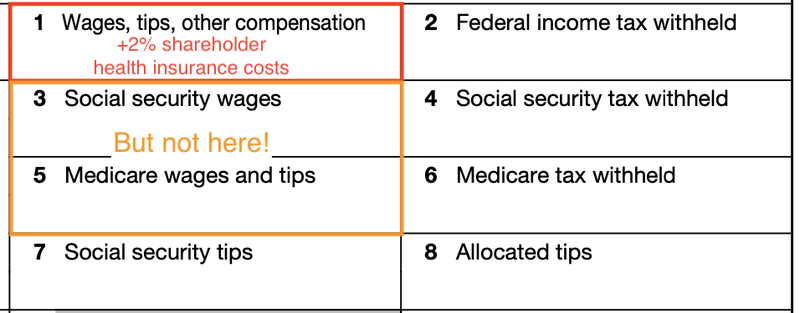

A Beginner S Guide To S Corp Health Insurance The Blueprint

Self Employed Health Insurance Deduction Healthinsurance Org

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Certificate Of Liability Insurance Coi How To Request Sample Insurance Template Liability Insurance Insurance

Tips For Getting Insurance That S Better Or Less Expensive Or Both Shots Health News Npr

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org