LTV 225000 divided by 300000. If a person takes out a 75 loan and uses an.

Explainer What Is Loan To Value Ratio And Why Is It Important

To calculate your LTV ratio take your mortgage amount and divide it by the purchase price or appraised value of the home whichever is lower.

What does 75 percent loan to value mean. A loan-to-value LTV ratio is the relative difference between the loan amount and the current market value of a home which helps lenders assess risk before approving a mortgage. Its a simple formula but its the basis for most mortgage lending. Mortgage 225000.

It is expressed as a percentage. There are many different factors that lenders consider when evaluating financing for commercial real estate. Since the risk of default is always at the forefront of lending decisions the lender uses the loan-to-value ratio to help measure that risk.

The loan-to-value LTV ratio is the percentage of your homes appraised value or purchase price if it is lower that you are borrowing. Management intensive means that the borrower is going to be actively operating and managing the business. Then multiply by 100 to turn the ratio into a percentage.

This is a simple calculation. A low LTV may improve your odds at getting a better mortgage. Generally speaking borrowers with a loan-to-value of 90 or above will be charged the most while borrowers with a loan-to-value of 75 will be charged less.

The loan-to-value is the ratio between the value of the loan you take out and the value of the property as a whole expressed as a percentage. Because it means that it has a greater equity position in the property and conversely the borrower has less of an equity position. The loan-to-value ratio is the amount of the mortgage compared with the value of the property.

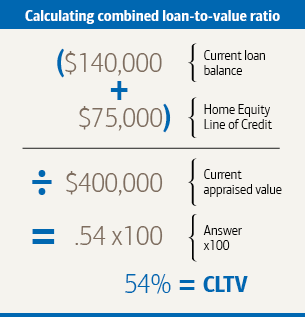

See full answer below. The combined loan to value now becomes 100000 30000 20000 200000 75. Whenever talking about the LTV its a percentage.

Borrowers with a loan-to-value of 60 or lower will be offered the most preferential rates. Loan-to-value is the ratio of how much youre borrowing compared to your homes worth. Loan to Value is one of the most discussed terms in commercial real estate finance.

Take what you want to borrow or already owe and divide by the value of the property. Once you know your LTV you can. Its a simple calculation that can.

And this is bothersome to lenders because it means that the borrower can more easily default on the loan. 80 loan to value is used as a threshold to determine the amount of risk for financial lenders. They might consider LTV ratios in the neighborhood of 75 percent for some investment properties but most wont go higher than 65 percent if the property is management intensive.

80 or less is. Property value 300000. Become a member and unlock.

These combined considerations are especially important if the mortgagee defaults and. So what is Loan to Value. As mentioned the LTV compares the amount of your loan to the actual value of what youre getting a loan forin this case well be discussing cars.

The remaining value is paid as a deposit. What is loan-to-value ratio. A much higher ratio.

Understanding basic mortgage lingo is important in helping you make informed confident decisions throughout the lending process. The loan-to-value LTV ratio is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased. If its a jumbo home loan a cash-out refinance or an investment property the loan-to-value will be a lot more limited potentially capped at just 70-80 LTV depending on all the attributes.

For example if you were buying a property valued at 300000 and you have 35000 available for deposit you would need to borrow the remaining. If you get an 80000 mortgage to buy a. Say you want to buy a house worth 300000 and you have 60000 in your account that you can use as a deposit.

And finally those underwater or upside down borrowers you hear about. For example if your loan amount is 90000 and the value of your vehicle is 100000 then your LTV is ninety percent. The lower your LTV the less risky a mortgage application appears to lenders.

In Real estate the term is commonly used by banks and building societies to represent the ratio of the first mortgage line as a percentage of the. As the name suggests LTV is the maximum amount that the lender will consider loaning to you as a percentage of the value of the property. One of the most important criteria is the lenders maximum Loan to Value LTV ratio.

Its essentially the loan figure in comparison to the value of the property or car expressed in percentage form. 75 loan-to-value means that the loan is equal to 75 of the value of the asset held as collateral. This is best shown by way of an example.

Youll need a loan of 240000 in order to purchase the property and so your. The loan to value ratio is utilised by financiers to assess risk. In this case the higher the ratio the higher the lenders financial risk.

To determine interest rates loan terms and overall risk one common metric thats used is the loan-to-value LTV ratio. They owe more on their mortgage than the property is currently worth.

Reverse Mortgage Age Chart What Percentage Of Appraised Value Will I Get Reverse Mortgage Loan Advisors 714 271 8524 Reverse Mortgage Mortgage Loans Mortgage

What Is Ltv Loan To Value Ratio In Home Loan Abc Of Money

Download The Daily Compounding Loan Calculator From Vertex42 Com Loan Calculator Car Loan Calculator Mortage Loans

How A Loan To Value Ratio Affects Your Mortgage Payment

Maximum Loan To Value Ltv Ratio For The Fha Mortgage Program Fhahandbook Com

Home Improvements That Sell House Fast With Best Value Selling House Property Buyers Home Buying

Loan To Value Ratios Dscr S Joe Banfield

How To Calculate Your Home S Equity Loan To Value Ltv Tips

The Us Employment Population Ratio Rose Even As The Labour Participation Rate Fell In February Mortgage Pay Off Mortgage Early Finance Blog

How To Calculate Your Home S Equity Loan To Value Ltv Tips

What Is Ltv Loan To Value Ratio In Home Loan Abc Of Money

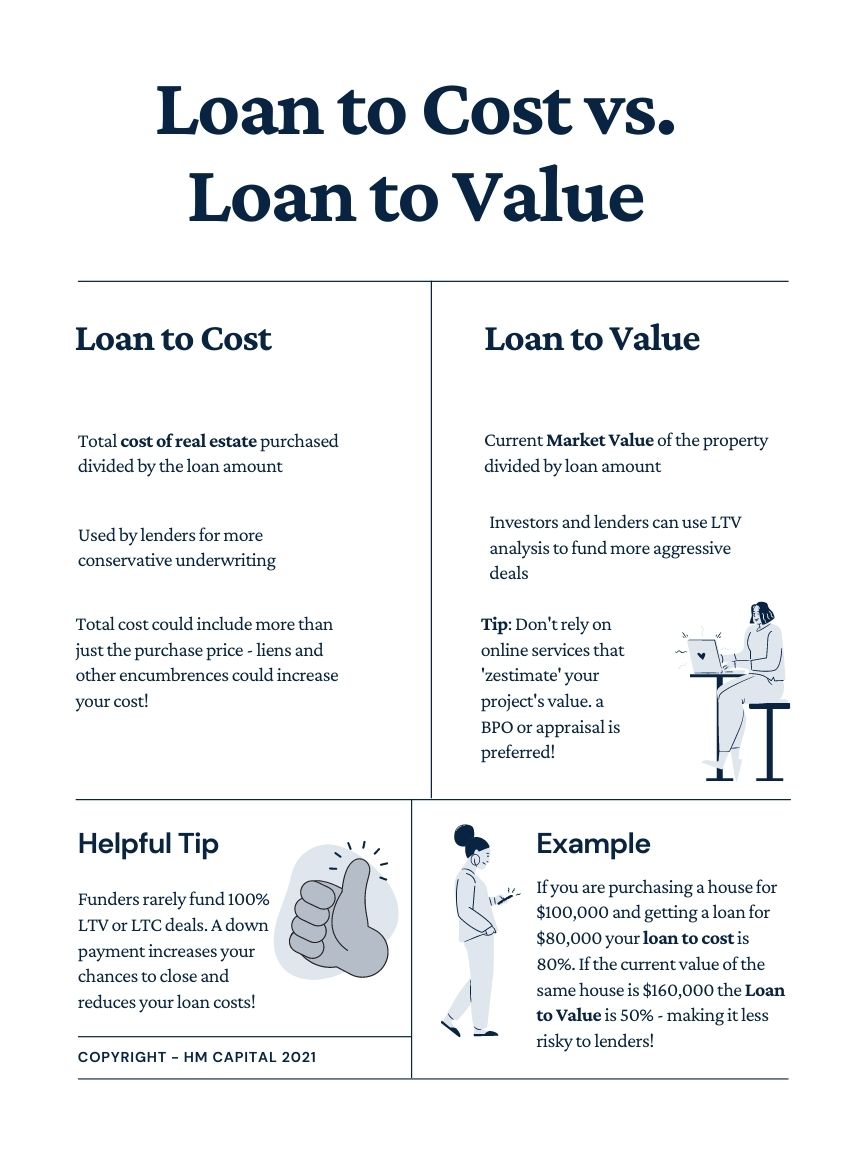

Loan To Cost Vs Loan To Value Definitions

What Is A Good Loan To Value Ltv Ratio Smartasset

Maximum Loan To Value Ltv Ratio For The Fha Mortgage Program Fhahandbook Com

Kentucky Rural Housing Usda Loans Usda Loan Conventional Loan Fha